US Dollar retreats further ahead of the US session as US exports tumble

- US Exports shrink further while imports are nearly flat.

- Ex-Fed member Dudley advocates for a bigger rate cut, while a couple of news articles suggest that a big rate cut is still in play.

- The US Dollar Index is crossing back to the lower band at 100.62 after another rejection.

The US Dollar (USD) trades very soft again on Friday, set to close out the week with another loss. The decline comes on comments from former Federal Reserve Bank of New York President William Dudley, who mentioned there is still a possibility for a 50-basis-point interest-rate cut next week from the Fed. These comments came after two news articles published in The Wall Street Journal and the Financial Times suggested that a 50bps move is still on the cards after markets had largely ruled out such a big move.

Dudley pointed to a slowing US labor market, with risks to jobs greater than those from lingering inflation, supported by the comments from Fed Chairman Jerome Powell in his Jackson Hole speech that he did not want to see more weakness in the labor market, Reuters reports.

On the economic data front, the US Import/Export prices are due, together with the University of Michigan Consumer Sentiment data. However, not much movement is expected unless the Michigan Consumer Sentiment number comes in well below estimates, a scenario that could support further the case for a 50-basis-point rate cut.

Daily digest market movers: Exports sign on the wall?

- At 12:30 GMT, both the Import and Export Price indexes for August were released:

- Monthly Import Prices came in lower at -0.3%, coming from still a positive 0.1% in July. Expectation was for a decline to -0.2%. The Yearly Import Prices went from 1.6% to 0.8%.

- The monthly Export Prices declines more rapidly than expected, to -0.7%, where -0.1% was expected. In july exports still grew by 0.5%. Yearly exports contracted by 0.7%, coming from a positive 1.4% back in July.

- The University of Michigan preliminary findings for September are expected at 14:00 GMT:

- The headline Michigan Consumer Sentiment is expected to increase slightly to 68.0 from 67.9.

- The 5-Year inflation expectation, a closely-followed indicator by the Fed, stood at 3% at the end of July. There is no forecast available for August.

- Asian equities have closed off this Friday in the red, while European equities are jumping higher on expectations that the European Central Bank will cut more than previously foreseen. US futures are rather flat.

- The CME Fedwatch Tool shows only a 57.0% chance aof a 25 basis points (bps) interest rate cut by the Fed on September 18, sharply down from the 87% seen a day ago. Meanwhile, markets have increased the chances of a 50 bps cut to 43.0% on the back of Fed’s Dudley comments and the news articles. For the meeting on November 7, another 25 bps cut (if September is a 25 bps cut) is expected by 24.9%, while there is a 51.4% chance that rates will be 75 bps (25 bps + 50 bps) and a 23.7% probability of rates being 100 (25 bps + 75 bps) basis points lower.

- The US 10-year benchmark rate trades at 3.65%, very close to the 15-month low at 3.60%.

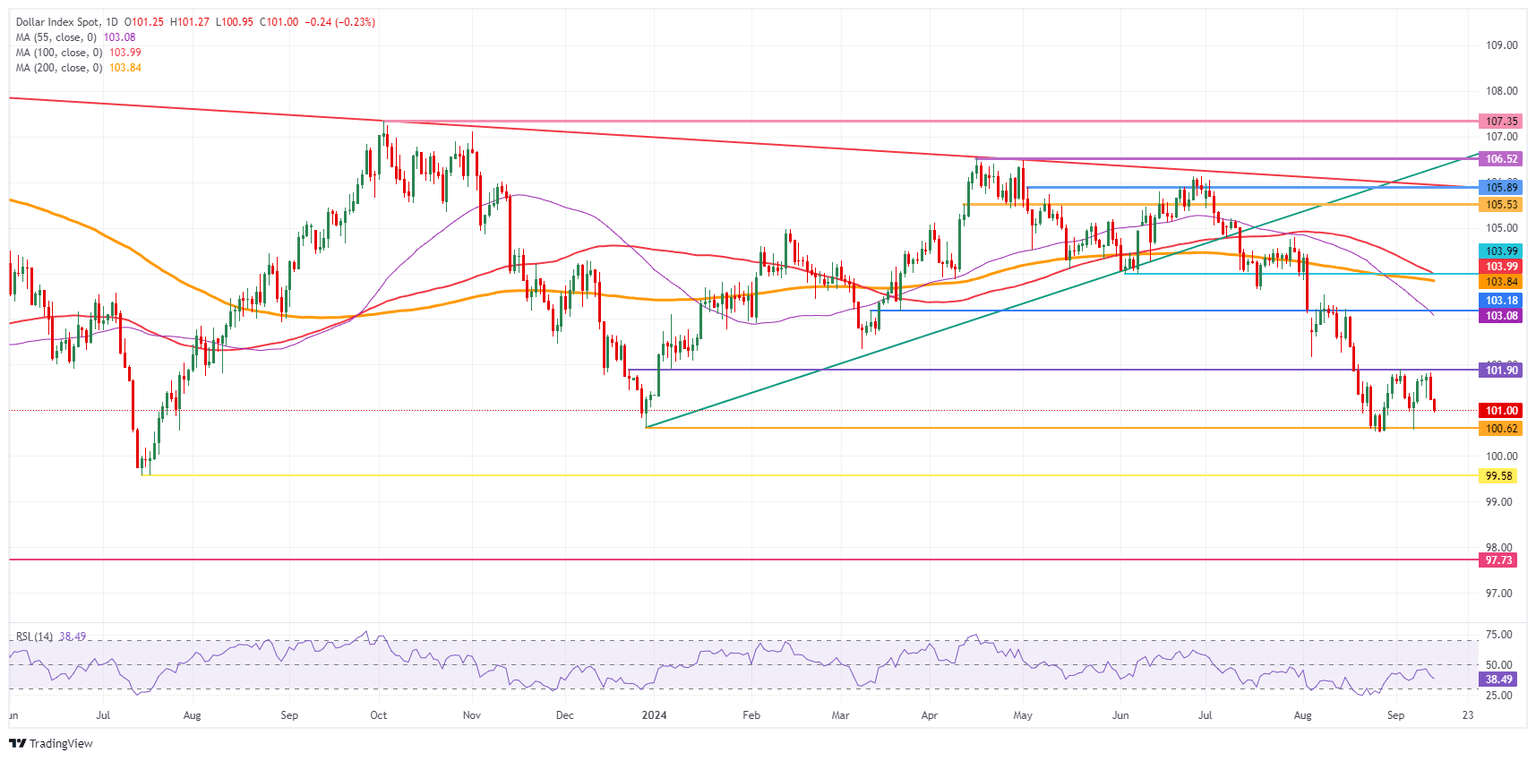

US Dollar Index Technical Analysis: Crossing the river

The US Dollar Index (DXY) came close to snapping the upper band at 101.90 for a breakout on Thursday. That was until Fed Dudley came along and placed the possibility for a 50-basis-point rate cut back in the mind of traders. The DXY is now back down, at a loss for this week, and could be seen testing that lower band at 100.62 for possibly a break lower.

The first resistance at 101.90 is getting ready for a third test after its rejection last week and earlier this week. Further up, a steep 1.2% uprising would be needed to get the index to 103.18. The next tranche up is a very misty one, with the 55-day Simple Moving Average (SMA) at 103.40, followed by the 200-day SMA at 103.89, just ahead of the big 104.00 round level.

On the downside, 100.62 (the low from December 28) holds strong and has already made the DXY rebound four times in recent weeks. Should it break, the low from July 14, 2023, at 99.58, will be the ultimate level to look out for. Once that level gives way, early levels from 2023 are coming in near 97.73.

US Dollar Index: Daily Chart

Interest rates FAQs

Interest rates are charged by financial institutions on loans to borrowers and are paid as interest to savers and depositors. They are influenced by base lending rates, which are set by central banks in response to changes in the economy. Central banks normally have a mandate to ensure price stability, which in most cases means targeting a core inflation rate of around 2%. If inflation falls below target the central bank may cut base lending rates, with a view to stimulating lending and boosting the economy. If inflation rises substantially above 2% it normally results in the central bank raising base lending rates in an attempt to lower inflation.

Higher interest rates generally help strengthen a country’s currency as they make it a more attractive place for global investors to park their money.

Higher interest rates overall weigh on the price of Gold because they increase the opportunity cost of holding Gold instead of investing in an interest-bearing asset or placing cash in the bank. If interest rates are high that usually pushes up the price of the US Dollar (USD), and since Gold is priced in Dollars, this has the effect of lowering the price of Gold.

The Fed funds rate is the overnight rate at which US banks lend to each other. It is the oft-quoted headline rate set by the Federal Reserve at its FOMC meetings. It is set as a range, for example 4.75%-5.00%, though the upper limit (in that case 5.00%) is the quoted figure. Market expectations for future Fed funds rate are tracked by the CME FedWatch tool, which shapes how many financial markets behave in anticipation of future Federal Reserve monetary policy decisions.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.