US Dollar on the back foot after Challenger Job Cuts and Jobless Claims print

- The US Dollar in negative territory in the US session with Challenger Job Cuts and Jobless Claims ticking up ahead of Friday's NFP.

- In France Marine Le Pen uses momentum to try and push through here agenda ahead of President Emmanual Macron's speech.

- The US Dollar Index (DXY) failed to close above the pivotal 106.50 level and undergoes harsh rejection.

The US Dollar (USD) is selling off this Thursday ahead of Friday's US Nonfarm Payrolls print in the US Jobs Report for December. The depreciation of the Greenback got triggered with on one had very bearish data from the weekly Initial Jobless Claims and the November Challenger Job Cut data where both elements pointed to a pickup in layoffs. Meanwhile in France the Far Right party with Marine Le Pen is using the momentum to try and push forward here fiscal agenda ahead of President Emannuel Macron's speech later this Thursday.

On the economic data front, all US data has been released. Adding up all things together for this week with the numbers from the Institute for Supply Management, the S&P Global Purchase Managers Index numbers and the Jobless data, traders are not seeing a pretty picture for Friday's Nonfarm Payrolls report. Risks are that another downbeat print could mean more US Dollar weakness to come to close off this week.

Daily digest market movers: NFP expectations lowered

- The Challenger Job Cuts report for November came in more bearish than the October one. The November number came in at 57,727.00 layoffs against the 55,597.00 layoffs seen in October.

- Paul Atkins has been nominated to become the Chair of the US Securities and Exchange Commission (SEC) by President-elect Donald Trump. Bitcoin (BTC) got fired up on the back of that news and broke above $100,000 for the first time. Paul Atkins is known for being a Bitcoin enthusiast.

- Weekly Jobless Claims data for the week ending November 29 was a big beat of expectations, coming in at 224,000, over the 215,000 expected and higher from 213,000 last week.

- Equities trade very mixed this Thursday. Despite the French political turmoil, European stocks are up near 0.50%. US equities keep struggling after the US Opening Bell.

- The CME FedWatch Tool is pricing in another 25 basis points (bps) rate cut by the Fed at the December 18 meeting by 74.0%. A 26.0% chance is for rates to remain unchanged. The Fed Minutes and recent comments from several Fed officials have helped the rate cut odds for December to move higher.

- The US 10-year benchmark rate trades at 4.21%, roughly in the middle of this week’s range between 4.16% and 4.28%.

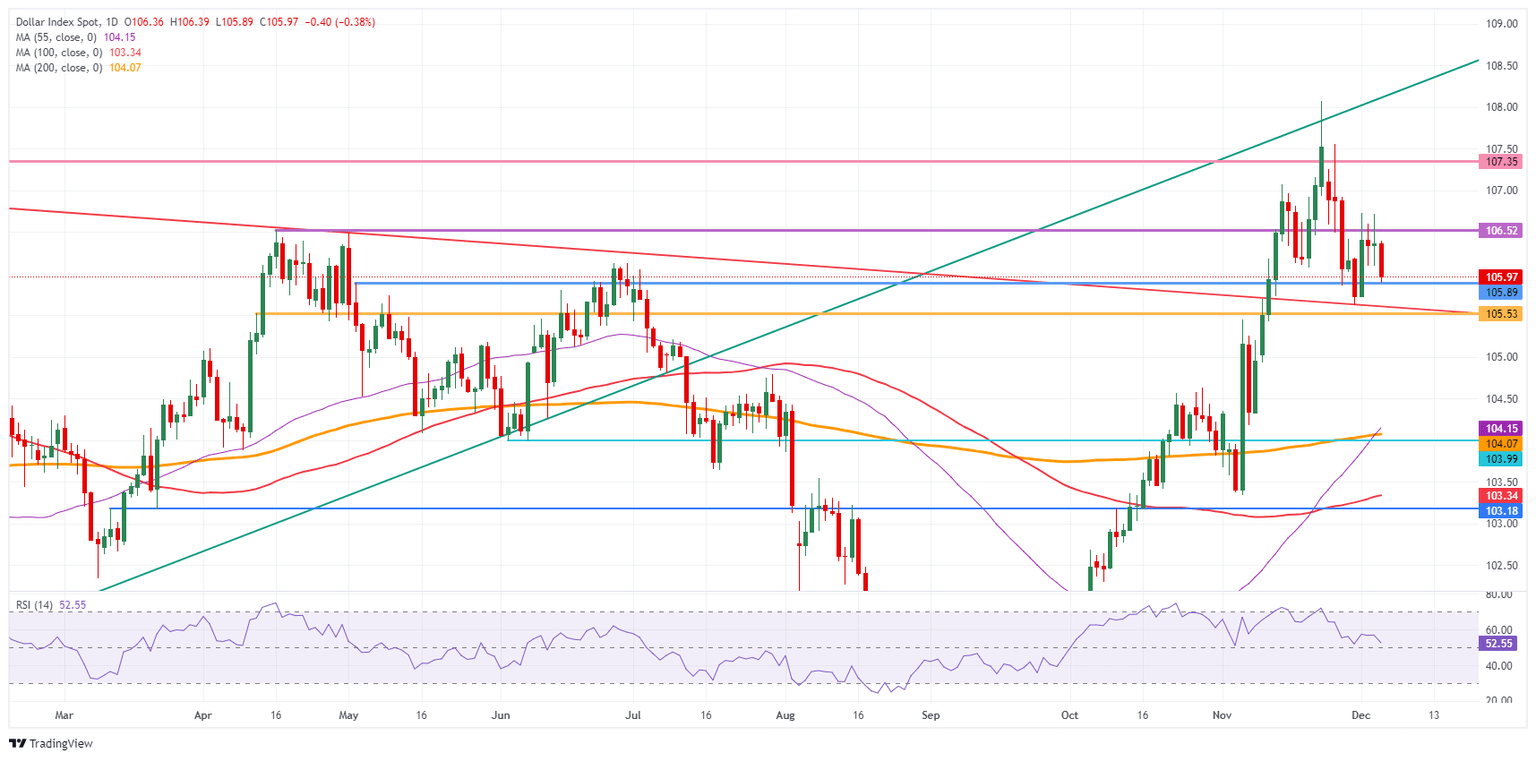

US Dollar Index Technical Analysis: Friday could get ugly

The US Dollar Index (DXY) is turning into a snooze fest, not set to wake up before the US Jobs report on Friday. With some lighter US data, only headline risk could take place in an otherwise calm Thursday. With the tight range in the US Dollar Index, the nearby levels at 106.52 and 105.53 remain pivotal to watch.

On the upside, 106.52 (April 16 high) still remains the first resistance to look at after failing to close above it this week after several attempts. Should the US Dollar bulls reclaim that level, 107.00 (round level) and 107.35 (October 3, 2023, high) are back on target for a retest.

Looking down, the pivotal level at 105.53 (April 11 high) comes into play before heading into the 104-region. Should the DXY fall all the way towards 104.00, the big figure and the 200-day Simple Moving Average at 104.03 should catch any falling knife formation.

US Dollar Index: Daily Chart

Interest rates FAQs

Interest rates are charged by financial institutions on loans to borrowers and are paid as interest to savers and depositors. They are influenced by base lending rates, which are set by central banks in response to changes in the economy. Central banks normally have a mandate to ensure price stability, which in most cases means targeting a core inflation rate of around 2%. If inflation falls below target the central bank may cut base lending rates, with a view to stimulating lending and boosting the economy. If inflation rises substantially above 2% it normally results in the central bank raising base lending rates in an attempt to lower inflation.

Higher interest rates generally help strengthen a country’s currency as they make it a more attractive place for global investors to park their money.

Higher interest rates overall weigh on the price of Gold because they increase the opportunity cost of holding Gold instead of investing in an interest-bearing asset or placing cash in the bank. If interest rates are high that usually pushes up the price of the US Dollar (USD), and since Gold is priced in Dollars, this has the effect of lowering the price of Gold.

The Fed funds rate is the overnight rate at which US banks lend to each other. It is the oft-quoted headline rate set by the Federal Reserve at its FOMC meetings. It is set as a range, for example 4.75%-5.00%, though the upper limit (in that case 5.00%) is the quoted figure. Market expectations for future Fed funds rate are tracked by the CME FedWatch tool, which shapes how many financial markets behave in anticipation of future Federal Reserve monetary policy decisions.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.