US Dollar steady while stock markets enjoy some mild gains

- The US Dollar is afloat, not really moving in any kind of direction.

- Traders will feast on no less than four Fed speakers on Wednesday.

- The US Dollar index hovers around 105.00 and is looking for direction.

The US Dollar (USD) is seeing a steady and very soft opening for the US session this Wednesday after a very dull European trading session. As such, that should not come as a surprise as the semi-annual testimony from US Federal Reserve (Fed) Chairman Jerome Powell before Congress on Tuesday did not bear any special comments or new angles that markets have not priced in yet. It could have been a tape recorder replaying the latest Fed rate decision, with the bottom line remaining the same: Powell wants to keep rates steady for longer as he is afraid to start cutting too soon.

On the economic front, no real data springs out, though it will instead be the side events that will draw up all the attention. With a 10-year Note auction, it is an ideal moment to see how the benchmark tenor will be behaving and how the appetite for American debt is now in the bond market. Add in there no less than three Fed members, besides Fed Chairman Powell, who is heading to Congress again this Wednesday, and it looks to be a rather Fed-driven day.

Daily digest market movers: Equities happy

- At 11:00 GMT, the weekly Mortgage Applications data for the week ending on July 5 has been released by the Mortgage Bankers Association (MBA). Last week, a slight decrease of 2.6% was noted, with another decline by 0.2% for this week.

- May’s Wholesale Inventories data came in at 0.6%, as expected.

- At 17:00 GMT, the US Treasury will allocate a 10-year Note in the market.

- Several Fed speakers are lined up on Wednesday:

- At 14:00 GMT, Federal Reserve Chair Jerome Powell testifies before Congress, providing a broad overview of the economy and monetary policy.

- Federal Reserve Governor Michelle Bowman and Federal Reserve Bank of Chicago President Austan Goolsbee will give the opening remarks at the Fed Listens in Chicago, United States, at 18:30 GMT.

- Federal Reserve Governor Lisa Cook delivers a speech titled ‘Global Inflation and Monetary Policy Challenges’ at the 2024 Australian Conference of Economists in Adelaide, Australia, at 22:30 GMT.

- Equity markets in a good mood with all European and US equities in the green.

- The CME Fedwatch Tool is broadly backing a rate cut in September despite recent comments from Fed officials. The odds now stand at 70.0% for a 25-basis-point cut. A rate pause stands at a 26.7% chance, while a 50-basis-point rate cut has a slim 3.3% possibility.

- The US 10-year benchmark rate trades at 4.28%, near its weekly low.

US Dollar Index Technical Analysis: Thursday fireworks

The US Dollar Index (DXY) is yet again looking for direction with no substantial moves, even after Fed Chairman Powell's comments on Tuesday. Fatigue is creeping into the Dollar, with markets looking for any different message Powell might deliver. The continuous message that interest rates should remain steady, that they are data-dependent, and that cutting borrowing costs too early might be counterproductive is starting to push investors out of the Greenback.

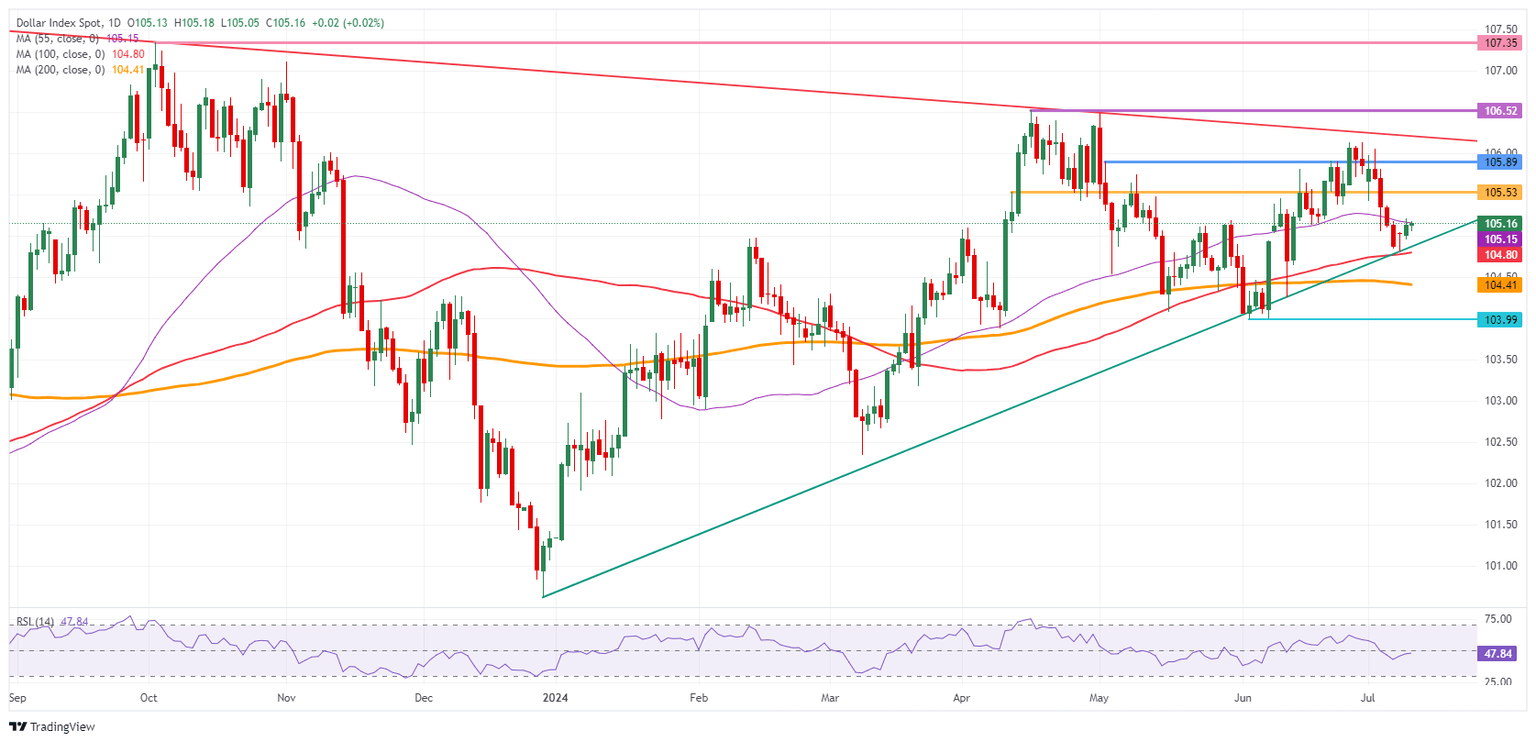

On the upside, the 55-day Simple Moving Average (SMA) at 105.16 remains the first resistance. Should that level be reclaimed again, 105.53 and 105.89 are the following nearby pivotal levels. The red descending trend line in the chart below at around 106.23 and April’s peak at 106.52 could come into play should the Greenback rally substantially.

On the downside, the risk of a nosedive move is increasing, with only the double support at 104.80, which is the confluence of the 100-day SMA and the green ascending trend line from December 2023, still in place. Should that double layer give way, the 200-day SMA at 104.41 is the gatekeeper that should catch the DXY and avoid further declines. Further down, the correction could head to 104.00 as an initial stage.

US Dollar Index: Daily Chart

Inflation FAQs

Inflation measures the rise in the price of a representative basket of goods and services. Headline inflation is usually expressed as a percentage change on a month-on-month (MoM) and year-on-year (YoY) basis. Core inflation excludes more volatile elements such as food and fuel which can fluctuate because of geopolitical and seasonal factors. Core inflation is the figure economists focus on and is the level targeted by central banks, which are mandated to keep inflation at a manageable level, usually around 2%.

The Consumer Price Index (CPI) measures the change in prices of a basket of goods and services over a period of time. It is usually expressed as a percentage change on a month-on-month (MoM) and year-on-year (YoY) basis. Core CPI is the figure targeted by central banks as it excludes volatile food and fuel inputs. When Core CPI rises above 2% it usually results in higher interest rates and vice versa when it falls below 2%. Since higher interest rates are positive for a currency, higher inflation usually results in a stronger currency. The opposite is true when inflation falls.

Although it may seem counter-intuitive, high inflation in a country pushes up the value of its currency and vice versa for lower inflation. This is because the central bank will normally raise interest rates to combat the higher inflation, which attract more global capital inflows from investors looking for a lucrative place to park their money.

Formerly, Gold was the asset investors turned to in times of high inflation because it preserved its value, and whilst investors will often still buy Gold for its safe-haven properties in times of extreme market turmoil, this is not the case most of the time. This is because when inflation is high, central banks will put up interest rates to combat it. Higher interest rates are negative for Gold because they increase the opportunity-cost of holding Gold vis-a-vis an interest-bearing asset or placing the money in a cash deposit account. On the flipside, lower inflation tends to be positive for Gold as it brings interest rates down, making the bright metal a more viable investment alternative.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.