Silver Price Forecast: XAG/USD stays firm above $29 amid firm Fed rate-cut hopes

- Silver price holds the crucial support of $29.00 as Fed rate-cut bets surge.

- The expectations for Fed rate-cut increase as progress in the US disinflation process has resumed.

- Investors shift focus to the preliminary US S&P Global PMIs for June.

Silver price (XAG/USD) gains ground above the crucial support of $29.00 in Wednesday’s New York session. The white metal finds buyers amid growing speculation that the Federal Reserve (Fed) will start reducing interest rates from the September meeting.

The expectations for the Fed to begin unwinding its restrictive monetary policy framework rise due to a higher-than-expected United States (US) decline in the Consumer Price Index (CPI) and slower than forecasted growth in Retail Sales data for May. May’s data showed that progress in the disinflation process has resumed, and consumers cut heavily on discretionary spending as high inflation and interest rates by the Federal Reserve (Fed) have reduced the purchasing power of households.

Meanwhile, the market sentiment remains quiet as US markets are closed on Wednesday on account of Juneteenth. The US Dollar Index (DXY) edges down to near 105.20.

This week, investors will focus on the preliminary US S&P Global PMIs data for June, which will be published on Friday. The agency is expected to show a decline in the Composite PMI due to weakness in manufacturing as well as the service sector.

Silver technical analysis

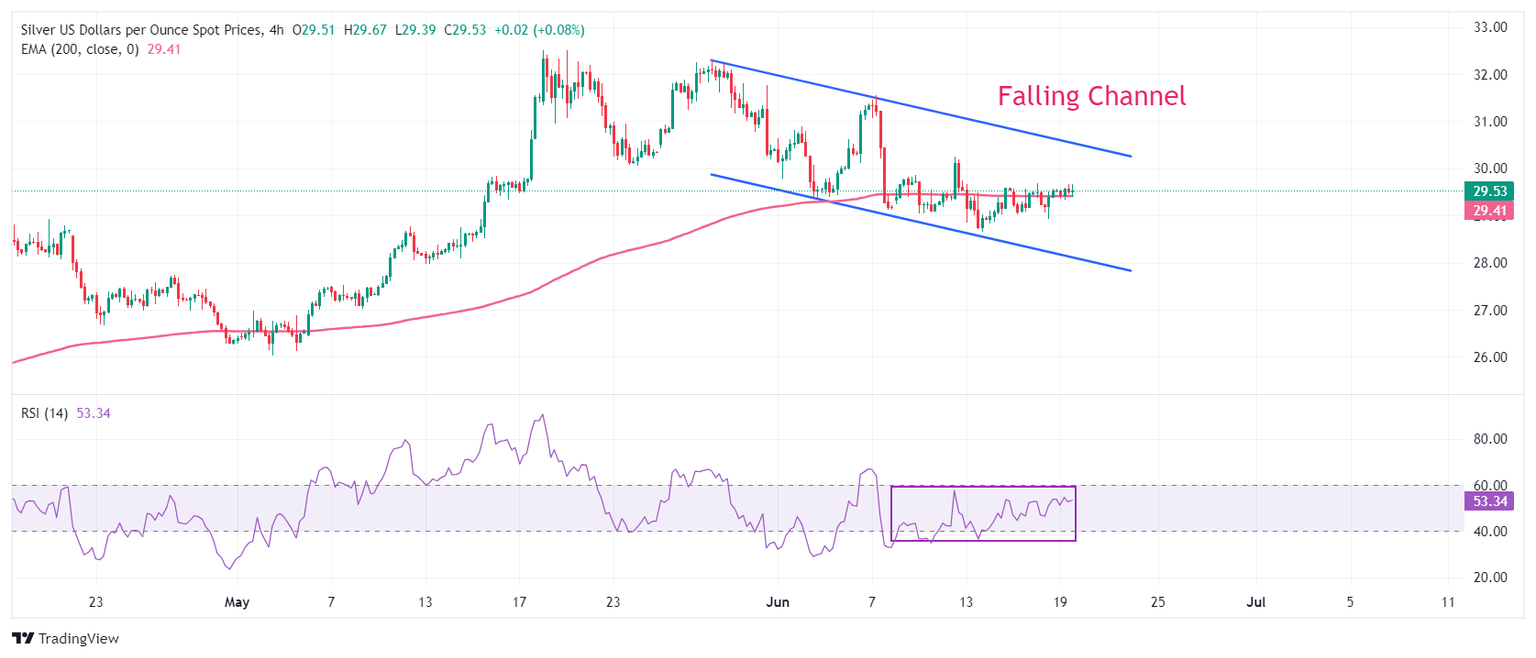

Silver price trades in a Falling Channel chart pattern in which each pullback is considered a selling opportunity by market participants. The asset trades close to the 200-period Exponential Moving Average (EMA), which trades around $29.40, suggesting a consolidating ahead.

The 14-period Relative Strength Index (RSI) oscillates in the 40.00-60.00 range, indicating indecisiveness among market participants.

Silver four-hour chart

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.