Silver Price Forecast: XAG/USD rises to near $31.30 ahead of US NFP data

- Silver price moves higher to near $31.30, exhibiting a strong performance ahead of the US NFP data for December.

- The FOMC minutes signaled that policymakers are worried about a slowdown in the US disinflation trend.

- US President-elect Donald Trump-led volatility keeps the outlook of precious metals intact.

Silver price (XAG/USD) gains to near $31.30 in Friday’s European session. The white metal gains ahead of the United States (US) Nonfarm Payroll (NFP) data for December, which will be published at 13:30 GMT. The labor market data will influence market expectations about whether the Federal Reserve (Fed) will continue with its cautious stance on further policy-easing.

The NFP report is expected to show that the US economy added fresh 160K workers in December, lower than 227K in November. The Unemployment Rate is estimated to have remained steady at 4.2%.

Investors will also pay close attention to the Average Hourly Earnings data for December. Being a wage growth measure that drives consumer spending, the Average Hourly Earnings data will provide cues about the inflation outlook. Month-on-month Average Hourly Earnings is expected to have risen at a slower pace of 0.3% from the former release of 0.4%, with annual figures growing steadily by 4%.

The Federal Open Market Committee (FOMC) minutes for the December policy meeting showed that officials were worried about a slowdown in the progress in inflation towards the Fed’s target of 2%.

Broadly, the Silver price has performed strongly for more than a week as market sentiment remains cautious due to uncertainty over the likely global trade war. Investors remain cautious due to incoming protectionist policies from President-elect Donald Trump, which are expected to promote the business outlook of the US. Historically, Silver performs better in a heightened uncertain environment.

Ahead of the US NFP report, the US Dollar Index (DXY), which gauges Greenback’s value against six major currencies, flattens around 109.15. 10-year US Treasury yields rise to near 4.7%.

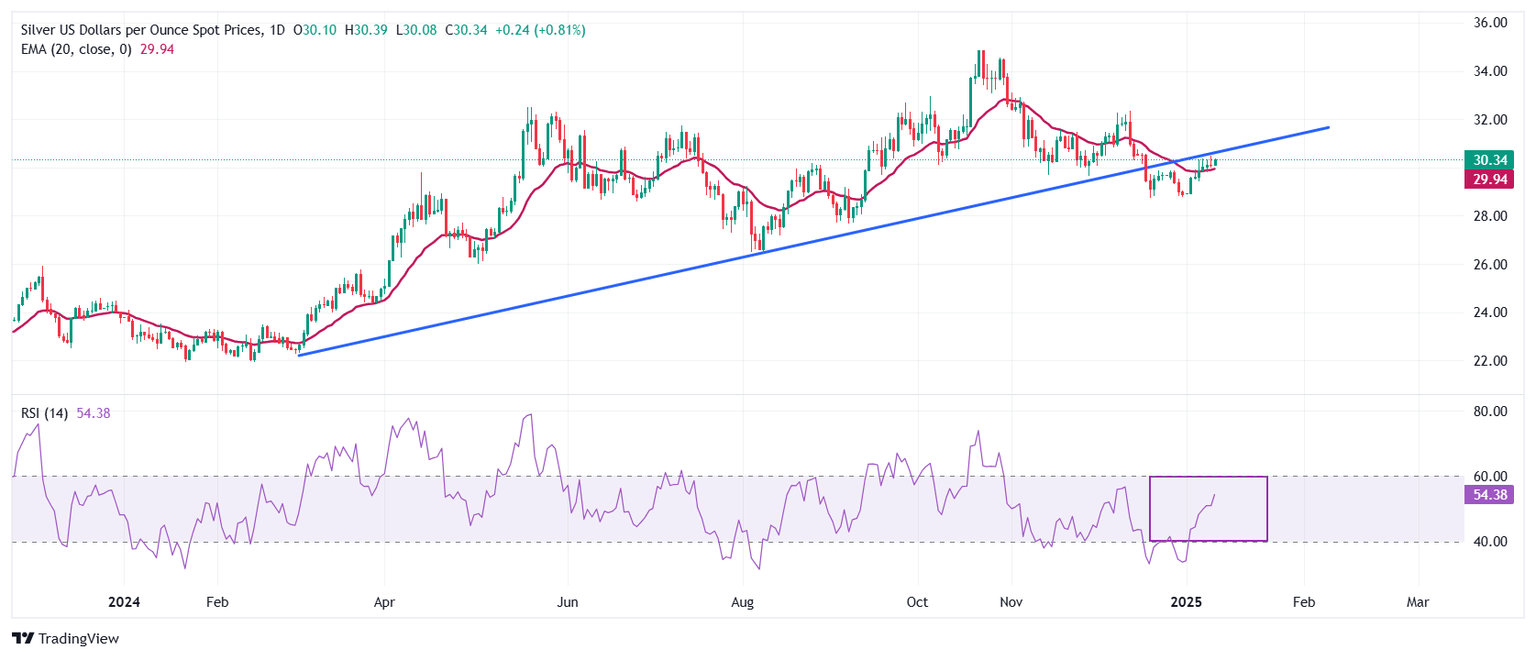

Silver technical analysis

Silver price continues to face selling pressure near the upward-sloping trendline around $30.50, which is plotted from the February 29 low of $22.30 on a daily timeframe. The white metal oscillates around the 20-day Exponential Moving Average (EMA), which trades near $30.00.

The 14-day Relative Strength Index (RSI) moves higher above 50.00. A fresh bullish momentum would come into action if it decisively breaks above 60.00.

Looking down, the September low of $27.75 would act as key support for the Silver price. On the upside, the December 12 high of $32.33 would be the barrier.

Silver daily chart

Silver FAQs

Silver is a precious metal highly traded among investors. It has been historically used as a store of value and a medium of exchange. Although less popular than Gold, traders may turn to Silver to diversify their investment portfolio, for its intrinsic value or as a potential hedge during high-inflation periods. Investors can buy physical Silver, in coins or in bars, or trade it through vehicles such as Exchange Traded Funds, which track its price on international markets.

Silver prices can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can make Silver price escalate due to its safe-haven status, although to a lesser extent than Gold's. As a yieldless asset, Silver tends to rise with lower interest rates. Its moves also depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAG/USD). A strong Dollar tends to keep the price of Silver at bay, whereas a weaker Dollar is likely to propel prices up. Other factors such as investment demand, mining supply – Silver is much more abundant than Gold – and recycling rates can also affect prices.

Silver is widely used in industry, particularly in sectors such as electronics or solar energy, as it has one of the highest electric conductivity of all metals – more than Copper and Gold. A surge in demand can increase prices, while a decline tends to lower them. Dynamics in the US, Chinese and Indian economies can also contribute to price swings: for the US and particularly China, their big industrial sectors use Silver in various processes; in India, consumers’ demand for the precious metal for jewellery also plays a key role in setting prices.

Silver prices tend to follow Gold's moves. When Gold prices rise, Silver typically follows suit, as their status as safe-haven assets is similar. The Gold/Silver ratio, which shows the number of ounces of Silver needed to equal the value of one ounce of Gold, may help to determine the relative valuation between both metals. Some investors may consider a high ratio as an indicator that Silver is undervalued, or Gold is overvalued. On the contrary, a low ratio might suggest that Gold is undervalued relative to Silver.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.