Silver Price Forecast: XAG/USD rebounds above $31.50 ahead of Fed policy decision

- Silver price recovers slightly after a bloodbath on Wednesday with Fed policy on the horizon.

- The Fed is expected to cut interest rates by 25 bps to 4.50%-4.75%.

- Silver price sees key support near $29.00 if it weakens further.

Silver price (XAG/USD) bounces back above $31.00 in Thursday’s North American session after a sharp nosedive move on Wednesday. The white metal stays vigilant with investors focusing on the Federal Reserve’s (Fed) monetary policy decision, which will be announced at 19:00 GMT.

The Fed is widely anticipated to cut interest rates by 25 basis points (bps) to 4.50%-4.75%, according to the CME FedWatch tool. This would be the second interest rate cut by the Fed this year. The Fed started the policy-easing cycle in September, however, the rate-cut size was 50 bps.

Ahead of the Fed’s policy, the US Dollar Index (DXY), which gauges Greenback’s value against six major currencies, tumbles to near 104.60. The USD index retraces almost half of Wednesday’s rally, which was inspired by Republican Donald Trump’s victory in United States (US) presidential elections. 10-year US Treasury yields drop to near 4.41%.

Investors will pay close attention to the press conference of Fed Chair Jerome Powell’s speech to get cues about the impact of Trump’s victory on inflation and the interest rate outlook. Trump vowed to raise import tariffs and lower corporate taxes, which could boost inflationary pressures and labor demand.

Silver technical analysis

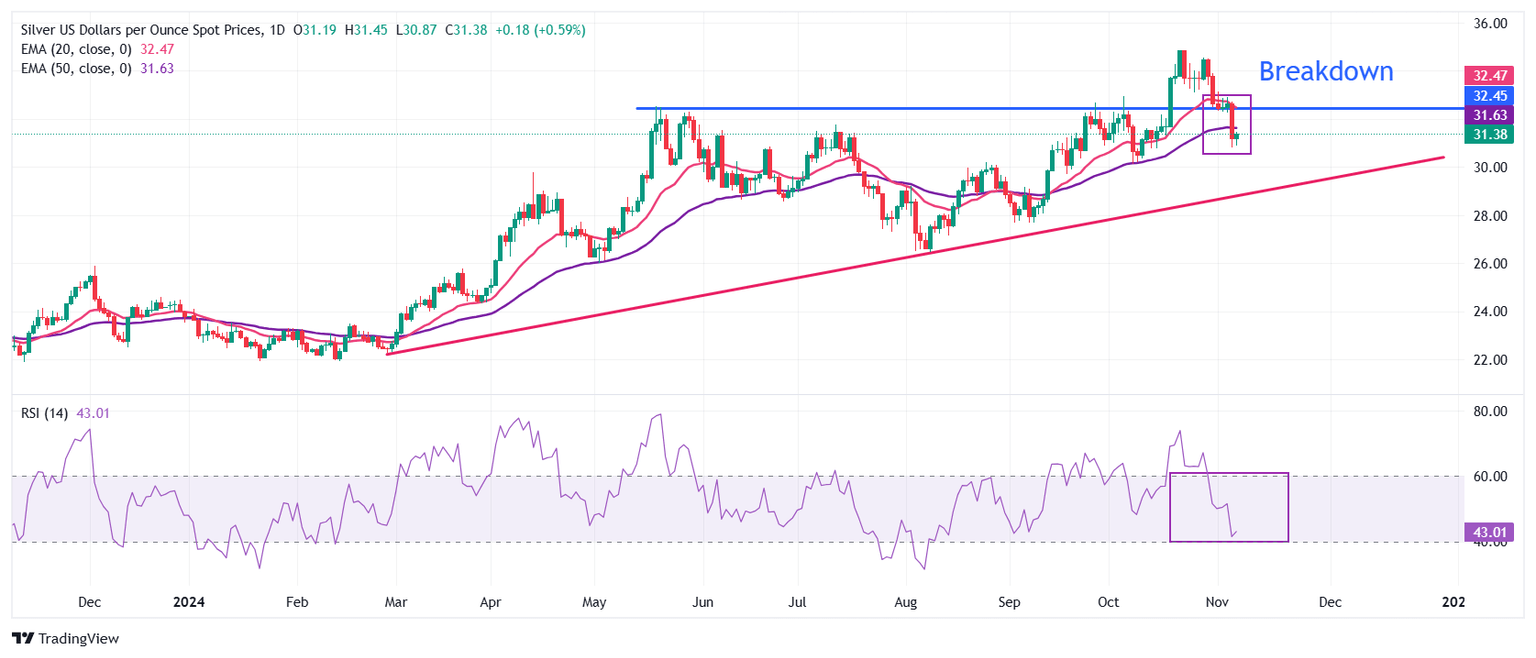

Silver price slides to near $31.00 after breaking below the horizontal support plotted from the May 21 high of $32.50. The near-term trend of the Silver price has turned bearish as it has dropped below the 50-day Exponential Moving Average (EMA), which trades around $31.60.

The asset could find support near the upward-sloping trendline around $29.00, plotted from the February 28 low of $22.30.

The 14-day Relative Strength Index (RSI) dives to near 40.00. Should RSI (14) fall below 40.00, a bearish momentum will be triggered.

Silver daily chart

Silver FAQs

Silver is a precious metal highly traded among investors. It has been historically used as a store of value and a medium of exchange. Although less popular than Gold, traders may turn to Silver to diversify their investment portfolio, for its intrinsic value or as a potential hedge during high-inflation periods. Investors can buy physical Silver, in coins or in bars, or trade it through vehicles such as Exchange Traded Funds, which track its price on international markets.

Silver prices can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can make Silver price escalate due to its safe-haven status, although to a lesser extent than Gold's. As a yieldless asset, Silver tends to rise with lower interest rates. Its moves also depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAG/USD). A strong Dollar tends to keep the price of Silver at bay, whereas a weaker Dollar is likely to propel prices up. Other factors such as investment demand, mining supply – Silver is much more abundant than Gold – and recycling rates can also affect prices.

Silver is widely used in industry, particularly in sectors such as electronics or solar energy, as it has one of the highest electric conductivity of all metals – more than Copper and Gold. A surge in demand can increase prices, while a decline tends to lower them. Dynamics in the US, Chinese and Indian economies can also contribute to price swings: for the US and particularly China, their big industrial sectors use Silver in various processes; in India, consumers’ demand for the precious metal for jewellery also plays a key role in setting prices.

Silver prices tend to follow Gold's moves. When Gold prices rise, Silver typically follows suit, as their status as safe-haven assets is similar. The Gold/Silver ratio, which shows the number of ounces of Silver needed to equal the value of one ounce of Gold, may help to determine the relative valuation between both metals. Some investors may consider a high ratio as an indicator that Silver is undervalued, or Gold is overvalued. On the contrary, a low ratio might suggest that Gold is undervalued relative to Silver.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.