Pound Sterling hits hard by decline in UK Retail Sales, flash PMI

- The Pound Sterling faces a sharp sell-off as UK Retail Sales and flash PMI declined.

- Weak UK Retail Sales and PMI data could boost BoE dovish bets for December.

- Investors await the flash S&P Global PMI data for the US.

The Pound Sterling (GBP) weakens against a majority of its peers, except the Euro (EUR), as the United Kingdom (UK) flash S&P Global/CIPS Purchasing Managers’ Index (PMI) data for November surprisingly declined and the Retail Sales data for October contracted at a faster-than-expected pace.

The agency showed that the Composite PMI, which accounts for manufacturing as well as service business activity, declined unexpectedly for the first time in more than a year. Market experts consider a figure below the 50.0 threshold as a contraction. The index contracted to 49.9, which was expected to expanded at a steady pace to 51.8. The Manufacturing PMI declined at a faster pace to 48.6 from the estimates and the prior release of 49.9. The service sector output managed to hold the 50.0 threshold but was weakest since February.

"The November PMI is indicative of the economy slipping into a modest decline, with GDP dropping at a 0.1% quarterly rate, but the loss of confidence hints at worse to come – including further job losses –unless sentiment revives," Chris Williamson said, Chief Business Economist at S&P Global Market Intelligence.

Retail Sales, a key measure of consumer spending, declined by 0.7% compared with the previous month. In September, sales increased by a marginal 0.1%, downwardly revised from the 0.3% previously reported. Year-on-year, Retail Sales grew by 2.4%, less than the estimates of 3.4% and the former release of 3.2% (downwardly revised from 3.9%).

Weakness in overall private business activity and Retail Sales data are expected to boost expectations of interest-rate cuts by the Bank of England (BoE) in the December meeting. Still, for now, traders expect the BoE to leave interest rates unchanged at 4.75% not only in the December meeting but also in the one to be held in February. This is because UK inflation data came in hotter than expected in October, with services inflation – a closely watched inflation indicator by BoE officials for decision-making on interest rates – rising to 5%.

British Pound PRICE Today

The table below shows the percentage change of British Pound (GBP) against listed major currencies today. British Pound was the strongest against the Euro.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.70% | 0.68% | -0.02% | 0.13% | 0.25% | 0.41% | 0.42% | |

| EUR | -0.70% | -0.02% | -0.72% | -0.56% | -0.45% | -0.29% | -0.28% | |

| GBP | -0.68% | 0.02% | -0.68% | -0.55% | -0.43% | -0.28% | -0.27% | |

| JPY | 0.02% | 0.72% | 0.68% | 0.14% | 0.26% | 0.40% | 0.42% | |

| CAD | -0.13% | 0.56% | 0.55% | -0.14% | 0.11% | 0.27% | 0.28% | |

| AUD | -0.25% | 0.45% | 0.43% | -0.26% | -0.11% | 0.16% | 0.16% | |

| NZD | -0.41% | 0.29% | 0.28% | -0.40% | -0.27% | -0.16% | 0.00% | |

| CHF | -0.42% | 0.28% | 0.27% | -0.42% | -0.28% | -0.16% | -0.00% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the British Pound from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent GBP (base)/USD (quote).

Daily digest market movers: Pound Sterling weakens against US Dollar with US flash PMI in focus

- The Pound Sterling tumbles to near 1.2500 against the US Dollar (USD) in Friday’s North American session, the lowest level seen in more than six months. The GBP/USD pair extends its downfall after weak UK Retail Sales data. However, the Cable was already under pressure as the US Dollar (USD) strengthened due to lower-than-expected United States (US) Initial Jobless Claims for the week ending November 15.

- Individuals claiming jobless benefits for the first time surprisingly came in at 213K, lower than estimates of 220K. Lower jobless claims help to ease concerns about the labor market. However, the report also showed that individuals were taking longer than usual to find new jobs.

- The outlook of the US Dollar has remained firm on expectations that there will be fewer interest rate cuts from the Federal Reserve (Fed) in the current policy-easing cycle. Market expectations for the Fed to adopt a more gradual policy-easing approach have strengthened as investors believe that the economic agenda of President-elect Donald Trump will boost inflationary pressures and economic growth, a scenario that will force the Fed to remain cautious on interest rates.

- On Thursday, Richmond Fed Bank President Thomas Barkin said in an interview with the Financial Times (FT) that the economy is more vulnerable to inflationary shocks as producers are passing on costs to customers more than in the past, Reuters reported. "We're somewhat more vulnerable to cost shocks on the inflation side than we might have been five years ago,” Barkin said.

- In Friday’s US session, investors will focus on the preliminary S&P Global PMI data for November, which will be published at 14:45 GMT. Investors will pay close attention to the PMI data to get fresh cues about the current status of economic health, and the impact of recent Fed rate cuts and Donald Trump’s victory on business sentiment.

Technical Analysis: Pound Sterling sees more downside below 1.2500

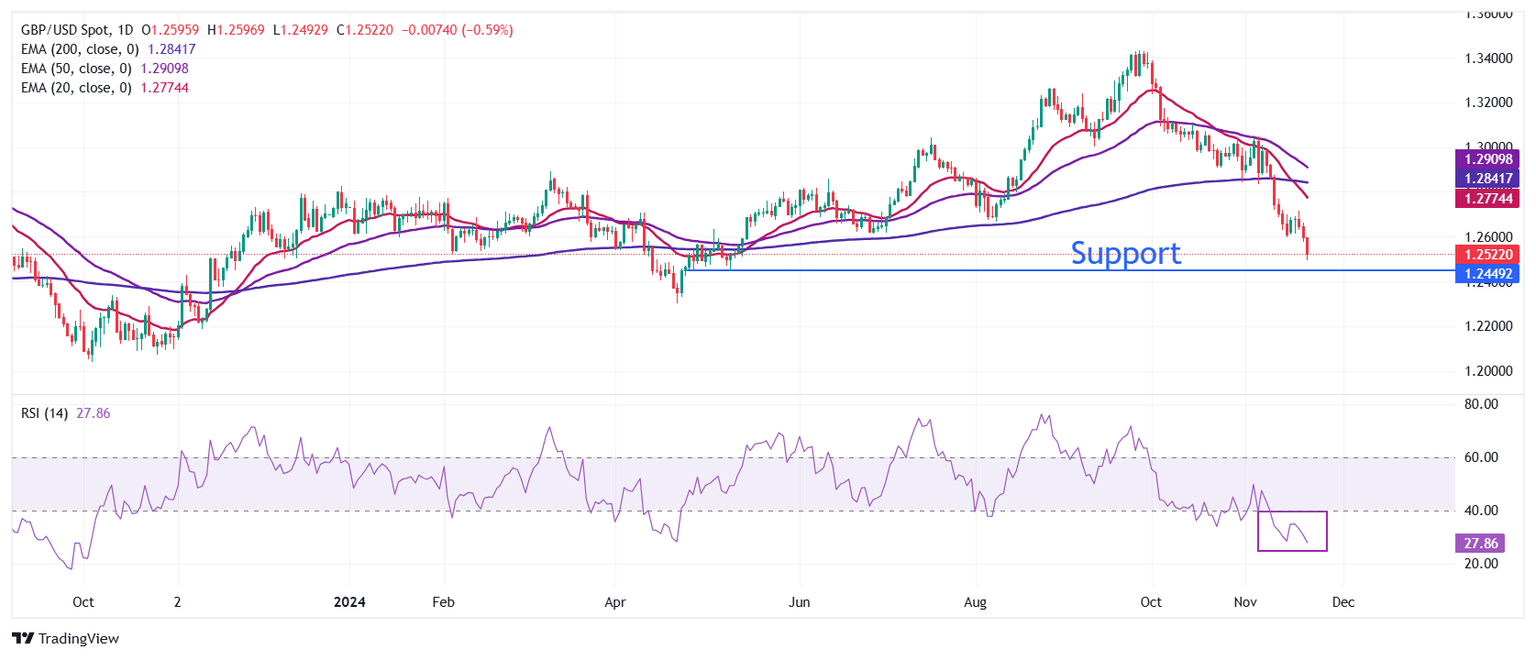

The Pound Sterling slides to near 1.2500 against the US Dollar on Friday, extending losses for a third consecutive trading day. The GBP/USD pair's outlook has turned bearish, given that all short-to-long-term Exponential Moving Averages (EMA) are sloping down.

The 14-day Relative Strength Index (RSI) remains in the 20.00-40.00 range, suggesting that a strong bearish momentum is intact.

Looking down, the pair is expected to find a cushion near May’s low of 1.2446. On the upside, the November 20 high around 1.2720 will act as key resistance.

Economic Indicator

Retail Price Index (MoM)

Retail Price Index released by the National Statistics is a statistical measure of a weighted average of prices of a specified set of goods and services purchased by consumers. It is widely considered as a key measure of inflation that indicates an accurate reflection of the cost of living. Normally, a high reading is seen as positive (or bullish) for the GBP, whereas a low reading is seen as negative (or bearish).

Read more.Last release: Wed Nov 20, 2024 07:00

Frequency: Monthly

Actual: 0.5%

Consensus: 0.5%

Previous: -0.3%

Source: Office for National Statistics

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.