Pound Sterling gains against USD as BoE supports gradual rate-cut approach

- The Pound Sterling bounces back strongly against the US Dollar as Donald Trump warns of more tariffs on other North American economies.

- Investors await the FOMC Minutes on Tuesday and the PCE inflation data for October on Wednesday.

- BoE’s Lombardelli supports a gradual policy-easing approach and warns of upside risks to inflation.

The Pound Sterling (GBP) recovers intraday losses and turns positive against the US Dollar (USD) in Tuesday’s North American session after diving near the psychological support of 1.2500 in Asian trading hours. The GBP/USD pair rebounds as the US Dollar surrenders its entire intraday gains after a strong opening.

The US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, had a stellar opening after President-elect Donald Trump warned that he would impose 25% import tariffs on all products from Canada and Mexico. Trump added that there will be an additional 10% tariff on imports from China for pouring illicit drugs into the United States (US) through Mexico.

However, the Greenback has given up more than half of its gains on expectations that Trump nominating Scott Bessent for the role of Treasury Secretary would maintain geopolitical steadiness parallelly fulfilling Trump’s economic agenda. In an interview with the Financial Times (FT) over the weekend, Bessent said that he will focus on enacting tariffs, however, objectives would be “layered in gradually”.

On the monetary policy front, investors await the US Personal Consumption Expenditures Price Index (PCE) data for October, which will be published on Wednesday. Economists expect the inflation data to have accelerated from September readings on an annual basis. The month-on-month headline and core PCE inflation data are estimated to have grown steadily.

The inflation data will significantly influence market expectations for the Federal Reserve’s (Fed) likely interest rate action in the December meeting. The probability of the Fed cutting interest rates by 25 bps to the 4.25%-4.50% range in December is 56%, while the rest favors the central bank opting to leave interest rates steady, according to the CME FedWatch tool.

In Tuesday’s session, investors will focus on the Federal Open Market Committee (FOMC) Minutes of the policy meeting held on November 7, which will be published at 19:00 GMT. In the policy meeting, the Fed cut interest rates by 25 basis points (bps) to the 4.50%-4.75% range.

Daily digest market movers: Pound Sterling consolidates as investors look for fresh BoE interest rate cues

- The Pound Sterling trades broadly sideways against its major peers on Tuesday, with investors looking for fresh cues about the Bank of England’s (BoE) likely interest rate path. Most BoE policymakers, including Governor Andrew Bailey, have supported a gradual policy-easing approach, citing persistent concerns over price pressures.

- BoE Deputy Governor Clare Lombardelli said in a speech at King's Business School on Monday, “I support a gradual removal of monetary policy restriction.” Lombardelli warned about risks of inflation remaining higher than the bank’s forecast, where wage growth normalizes at 3.5%-4% and the Consumer Price Index (CPI) around 3% rather than 2%.

- When asked about the economic performance in the context of weak preliminary S&P Global/CIPS Purchasing Managers Index (PMI) data for November, Lombardelli said, “Flash PMIs for November may suggest some slowing in the United Kingdom (UK) economy, but I don’t take a strong signal from a single release.”

- On the contrary, BoE external policy member Swati Dhingra appears to support a less gradual interest rate cut approach as she doesn't see the UK as an outlier for inflation among advanced economies. Dhingra added that the policy is weighing on investment.

- Currently, traders expect the BoE to leave interest rates unchanged at 4.75% in the December policy meeting.

British Pound PRICE Today

The table below shows the percentage change of British Pound (GBP) against listed major currencies today. British Pound was the strongest against the Canadian Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.31% | -0.31% | -0.57% | 0.81% | 0.03% | -0.22% | -0.07% | |

| EUR | 0.31% | 0.00% | -0.23% | 1.12% | 0.34% | 0.10% | 0.24% | |

| GBP | 0.31% | -0.01% | -0.25% | 1.12% | 0.34% | 0.10% | 0.23% | |

| JPY | 0.57% | 0.23% | 0.25% | 1.38% | 0.59% | 0.34% | 0.49% | |

| CAD | -0.81% | -1.12% | -1.12% | -1.38% | -0.78% | -1.02% | -0.88% | |

| AUD | -0.03% | -0.34% | -0.34% | -0.59% | 0.78% | -0.25% | -0.11% | |

| NZD | 0.22% | -0.10% | -0.10% | -0.34% | 1.02% | 0.25% | 0.14% | |

| CHF | 0.07% | -0.24% | -0.23% | -0.49% | 0.88% | 0.11% | -0.14% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the British Pound from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent GBP (base)/USD (quote).

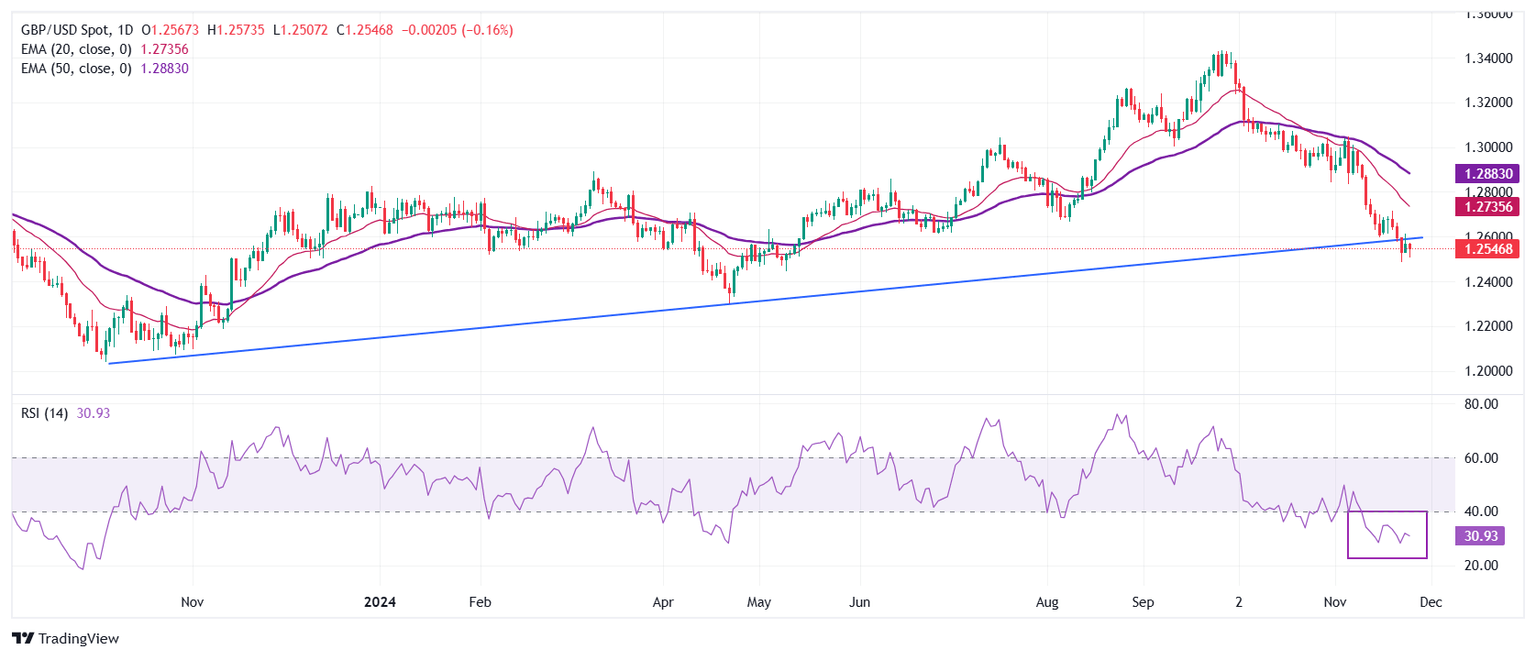

Technical Analysis: Pound Sterling walks on thin rope near 1.2550

The Pound Sterling hovers below the upward-sloping trendline near 1.2550 against the US Dollar, which is plotted from October 2023 low around 1.2040. The outlook of the GBP/USD pair remains bearish as the 20- and 50-day Exponential Moving Averages (EMAs) at 1.2735 and 1.2883, respectively, are sloping downwards.

The 14-day Relative Strength Index (RSI) oscillates inside the 20.00-40.00 range, suggesting that the downside momentum is intact.

Looking down, the pair is expected to find a cushion near May’s low of 1.2446. On the upside, the November 20 high at around 1.2720 will act as key resistance.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.