Pound Sterling stays in positive territory above 1.2650 in the European session

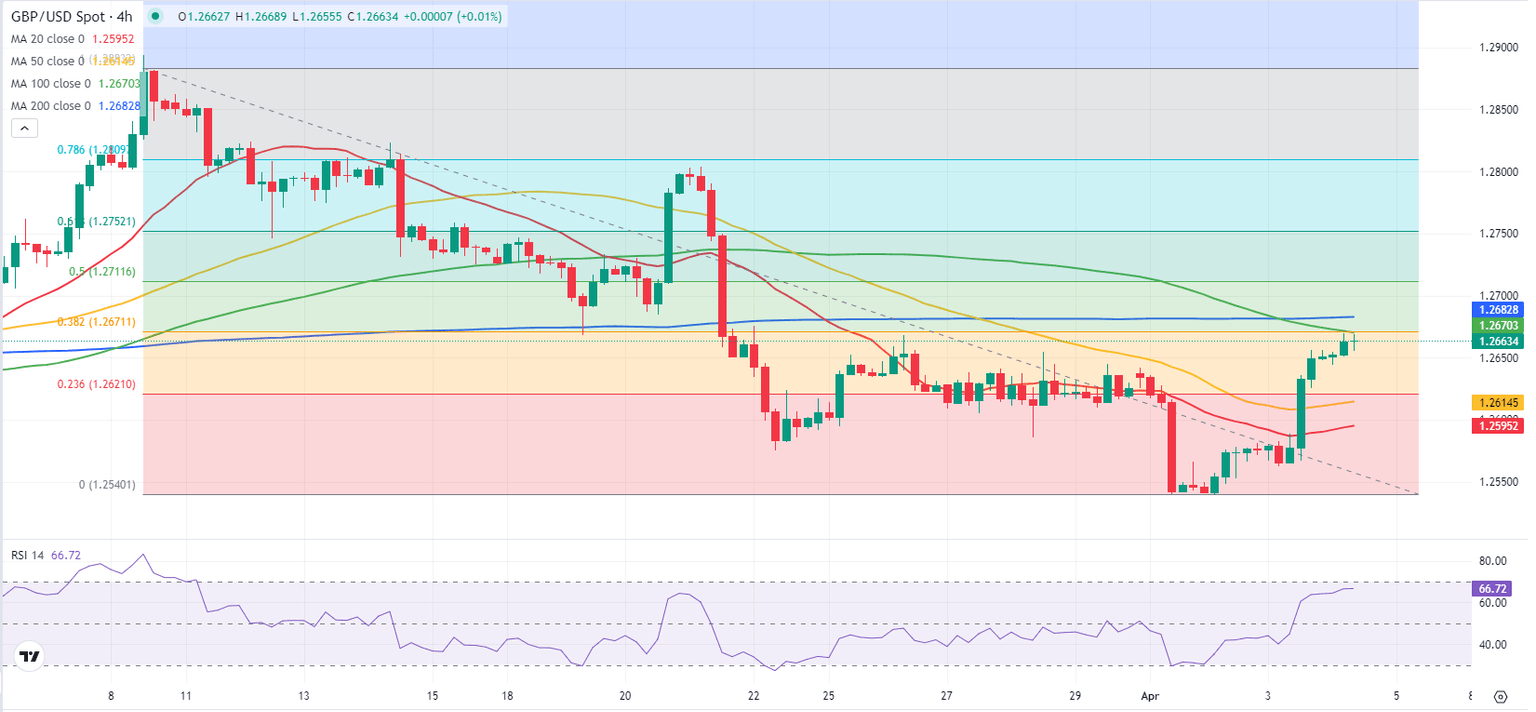

GBP/USD Forecast: Pound Sterling could push higher once it clears 1.2670-1.2680

GBP/USD registered strong daily gains on Wednesday and continued to stretch higher early Thursday. The pair stays in positive territory above 1.2650 in the European session and the technical outlook points to a bullish tilt in the near term.

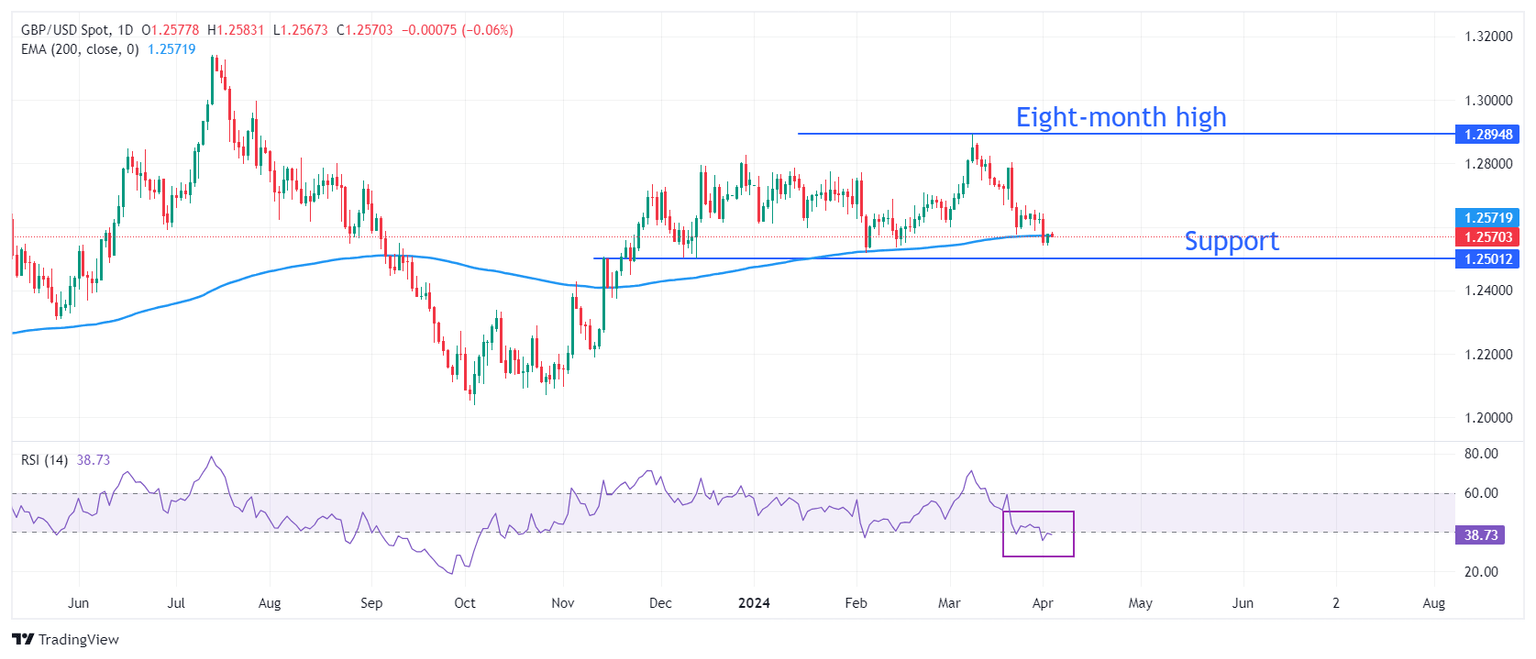

The broad-based selling pressure surrounding the US Dollar (USD) provided a boost to GBP/USD midweek. Once the pair climbed above the 200-day Simple Moving Average (SMA) at 1.2590, technical buyers took action, allowing the pair to extend its rally. Read more...

Pound Sterling holds strength on improved UK economic outlook, weaker US Dollar

The Pound Sterling (GBP) aims to extend its recovery above the one-week high of 1.2660 in Thursday’s London session. The GBP/USD pair exhibits strength as recent economic indicators in the United Kingdom have shown that the economy is on track to return to growth after falling into a technical recession in the second half of 2023. Meanwhile, a weaker US Dollar due to the poor United States Institute of Supply Management (ISM) Services PMI data for March also boosted the Cable.

The UK’s Manufacturing PMI surprisingly expanded in March after contracting for 20 straight months, driven by robust domestic demand. Strong UK factory data propelled business optimism to its highest level since April 2023, with 58% of manufacturers expecting their production level to increase over the coming 12 months. In addition, British house prices rose 1.6% in March, the highest pace since December 2022, suggesting that the real estate sector is holding up despite historically higher interest rates. Read more...

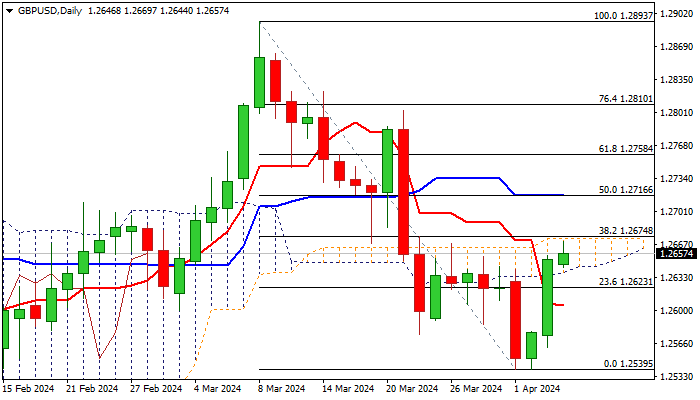

GBP/USD outlook: Slight bullish bias above 200-DMA but thin daily cloud is still significant obstacle

Cable extends recovery from 1.2540 double bottom (Apr 1 / 2 lows) and pressuring significant barrier at 1.2674 (daily cloud top / Fibo 38.2% of 1.2893/1.2539), as bulls regained traction after a false break below pivotal 200DMA support (1.2586).

Near-term action is expected to keep slight bullish bias while holding above 200DMA, though sustained break above 1.2674 pivot is needed to confirm fresh bullish signal, after thin daily cloud capped a number of attempts higher. Read more...

Author

FXStreet Team

FXStreet