Pound Sterling slides below 1.3100 after strong US job data

- The Pound Sterling slumps to near 1.3070 against the US Dollar after upbeat US NFP report for September.

- The probability of the Fed cutting interest rates by 50 bps in November has waned.

- BoE’s Bailey emphasized the need to cut interest rates aggressively.

The Pound Sterling (GBP) slides below the round-level support of 1.3100 against the US Dollar (USD) in Friday’s New York session. The GBP/USD pair extends its losing spree for the fourth trading session as market expectations for the Federal Reserve (Fed) to reduce interest rates by 50 basis points (bps) again have waned after the release of the upbeat United States (US) Nonfarm Payrolls (NFP) report for September.

The CME FedWatch tool shows that the probability of the Fed cutting interest rates further by 75 basis points (bps) by year-end has almost waned after the US NFP data release.

The official Employment report shows that the job growth remained robust in September as 254K job-seekers were hired against the estimates of 140K and the prior release of 159K, upwardly revsied from 142K. The Unemployment Rate fell to 4.1% from expectations and the prior release of 4.2%.

Meanwhile, the Average Hourly Earnings data, a key measure of wage inflation that influences consumer spending, grew by 4% in September, faster than the estimates of 3.8% and the former reading of 3.9% year-over-year. Monthly Average Hourly Earnings rose at a faster-than-expected pace of 0.4%.

US Dollar PRICE Today

The table below shows the percentage change of US Dollar (USD) against listed major currencies today. US Dollar was the strongest against the Japanese Yen.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.54% | 0.12% | 0.96% | 0.12% | 0.52% | 0.73% | 0.74% | |

| EUR | -0.54% | -0.41% | 0.54% | -0.40% | 0.00% | 0.20% | 0.17% | |

| GBP | -0.12% | 0.41% | 0.95% | 0.01% | 0.40% | 0.60% | 0.57% | |

| JPY | -0.96% | -0.54% | -0.95% | -0.90% | -0.51% | -0.32% | -0.33% | |

| CAD | -0.12% | 0.40% | -0.01% | 0.90% | 0.39% | 0.63% | 0.56% | |

| AUD | -0.52% | 0.00% | -0.40% | 0.51% | -0.39% | 0.21% | 0.21% | |

| NZD | -0.73% | -0.20% | -0.60% | 0.32% | -0.63% | -0.21% | -0.05% | |

| CHF | -0.74% | -0.17% | -0.57% | 0.33% | -0.56% | -0.21% | 0.05% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).

Daily digest market movers: Pound Sterling weakens on Middle East conflicts

- The Pound Sterling outperforms against its major peers, except North American currencies, on Friday. However, it is expected to face pressure due to tensions between Iran and Israel having converted into a full-fledged war after the assassination of Hezbollah leader Hassan Nasrallah. Oil prices have rallied amid tensions in the Middle East. Historically, a sharp rise in energy prices weighs on the currencies of those economies that rely heavily on imported oil, as it results in higher foreign outflows for them.

- Besides that, BoE Governor Andrew Bailey’s commentary on the interest rate outlook on Thursday has also dampened Sterling’s outlook. The comments from Baily in an interview with the Guardian newspaper appeared dovish as he stressed the need to cut interest rates aggressively if price pressures continue to ease. Bailey said the BoE could become "a bit more activist" and "a bit more aggressive" in its approach to lowering rates if there was further welcome news on inflation for the central bank, Reuters reported.

- In the European session, the comments from BoE Chief Economist Huw Pill also indicated that he is confident about further cuts in bank rate. However, he cautioned about risks of cutting rates either too far or too fast.

- On the economic front, the revised S&P Global/CIPS Construction PMI estimate has come in significantly higher at 57.2 unexpectedly. The Construction PMI, which gauges activities in the construction sector, was expected to have expanded at a slower pace to 53.1 from the preliminary estimates of 53.6

Technical Analysis: Pound Sterling extends downside below 1.3100

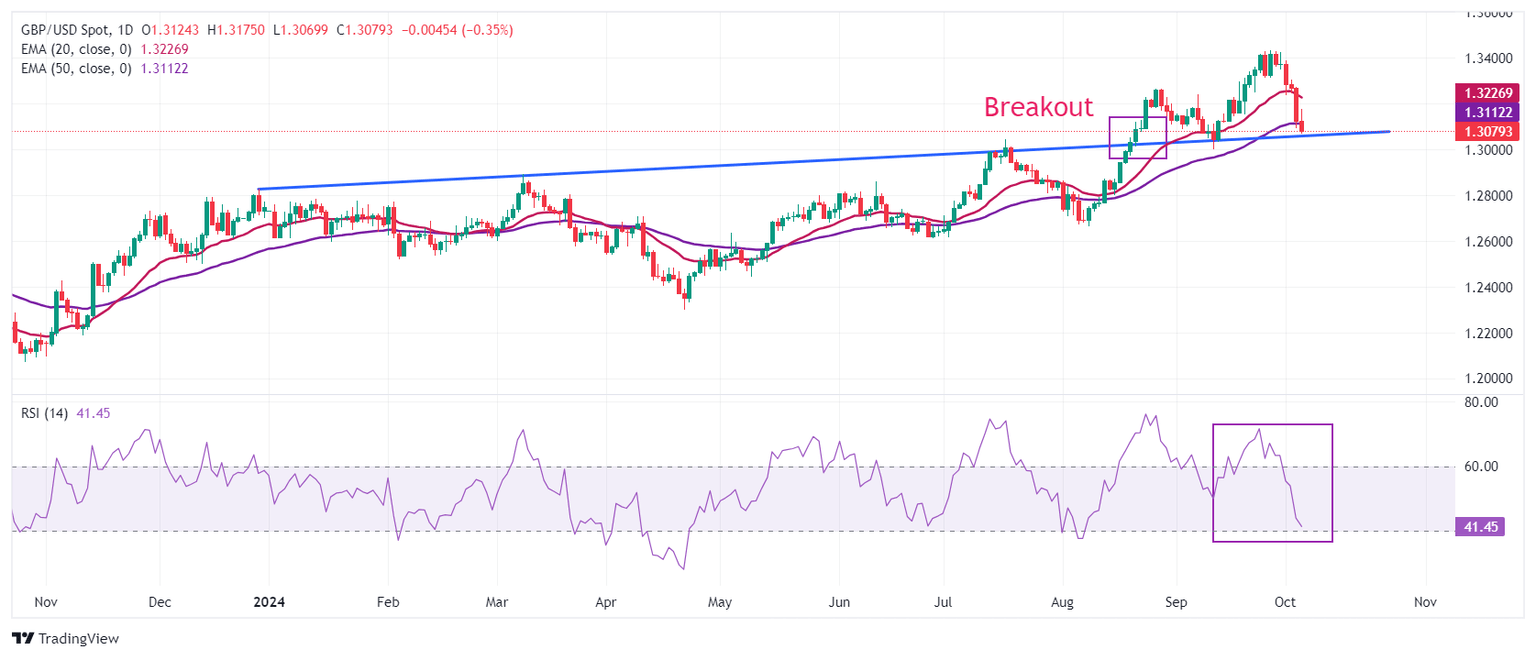

The Pound Sterling falls below the 50-day Exponential Moving Average (EMA), which stands around 1.3115, against the US Dollar. The GBP/USD extends its correction to near 1.3070 after the release of the US official employment data.

The 14-day Relative Strength Index (RSI) declines to near 40.00, suggesting a weakening of momentum.

The Cable has declined to near the trendline around 1.3060, plotted from the December 28, 2023, high of 1.2828. Earlier, the pair delivered a sharp upside move after a breakout of this line on August 21. Looking up, the 20-day EMA near 1.3234 will be a major barricade for Pound Sterling bulls. On the downside, the Pound Sterling bulls would find support near the psychological figure of 1.3000.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.