Pound Sterling declines after lower US Jobless Claims

- The Pound Sterling weakens against its major peers after the UK budget announcement.

- Traders pare back BoE interest-rate cut bets due to upwardly revised inflation forecasts.

- In the US, investors expect the NFP report to show lower labor demand in October.

The Pound Sterling (GBP) declines to near 1.2900 against the US Dollar (USD) in Thursday’s New York session, the lowest level in 10 weeks. The GBP/USD pair slumps after the release of the United States (US) Initial Jobless Claims for the week ending October 25, which came in surprisingly lower at 216K against estimates of 230K and the prior release of 228K, another job data that points to improving labor market conditions.

On Wednesday, ADP Employment Change data also showed signals of improving labor demand. The agency showed that private payrolls were significantly higher at 233K against 159K in September.

For more cues on the current status of the job market, investors will pay close attention to the US Nonfarm Payrolls (NFP) data for October, which will be published on Friday. The NFP report is expected to show that the economy added 115K workers, lower than 254K jobs created in September. The Unemployment Rate is expected to remain steady at 4.1%.

Signs of slower job growth would prompt Federal Reserve (Fed) dovish bets, while robust figures would weaken them. According to the CME FedWatch tool, the central bank is expected to cut interest rates by 25 basis points (bps) in both of the policy meetings to be held in November and December.

Meanwhile, the US Personal Consumption Expenditure Price Index (PCE) inflation for September price pressure grew at a slightly faster-than-expected pace. Annual core PCE Price Index, a Fed's preferred inflation gauge that excludes volatile food and energy items, accelerated at a steady pace to 2.7%. Economists expected the underlying inflation data to have grown at a slower pace of 2.6%. Month-on-month core PCE inflation rose expectedly by 0.3%. Its impact is expected to be less likely on market expectations for the Fed interest rate path as officials are confident that the disinflation trend is intact.

Daily digest market movers: Pound Sterling exhibits weakness against US Dollar

- The Pound Sterling underperforms the majority of its peers on Thursday despite traders pared back bets that the Bank of England (BoE) will cut interest rates aggressively after the United Kingdom (UK) Labour government announced its first Autumn Forecast Statement on Wednesday.

- The budget presentation from UK Chancellor of the Exchequer Rachel Reeves was filled with the biggest tax increase in almost three decades to repair the hole in public services, which she referred to as “inheritance from Conservatives”.

- The major highlight of the UK budget was the collection of taxes worth 40 billion pounds through an increase in employers’ contribution to National Insurance (NI), higher duty on alcohol and tobacco, and a sharp increase in Capital Gains Tax. Reeves allocated higher spending to various areas such as the National Health Service (NHS), affordable housing, funding duty freeze on fuel, and setting up green hydrogen projects.

- Meanwhile, the UK’s Office for Business Responsibility (OCR) has upwardly revised inflation forecasts for 2024 to 2.5% from 2.2% projected in March, a revision that also led traders to expect less interest rate cuts by the BoE. The agency also revised inflation forecasts for 2025 significantly higher, to 2.6% from 1.5% previously anticipated.

- Going forward, investors will shift focus to the BoE monetary policy meeting, which will be announced on November 7. The BoE is expected to cut interest rates by 25 basis points (bps) 4.75%, according to an October 22-28 Reuters poll.

Technical Analysis: Pound Sterling falls to near 1.2900

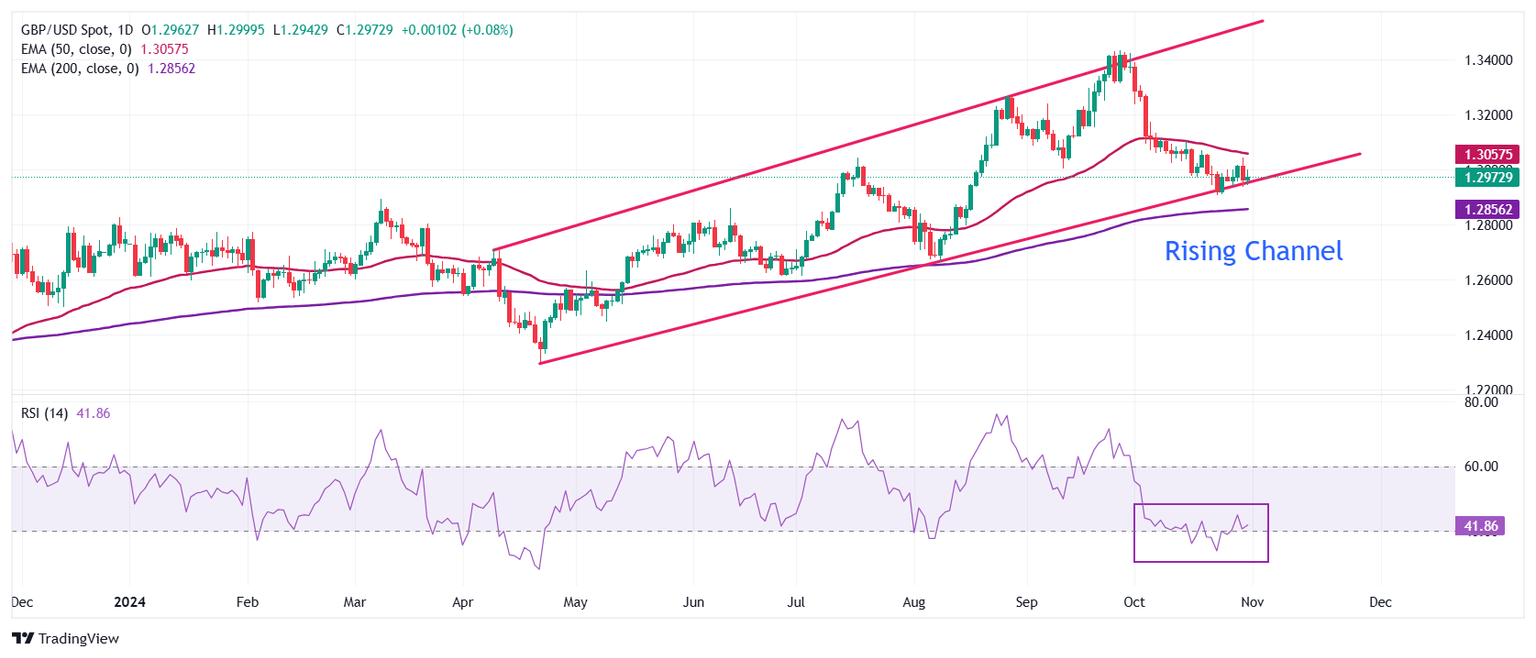

The Pound Sterling slides to near 1.2900 against the US Dollar. The near-term trend of the GBP/USD pair remains uncertain as it stays below the 50-day Exponential Moving Average (EMA), which trades around 1.3060.

The GBP/USD pair struggles to hold the lower boundary of a Rising Channel chart formation around 1.2900 on the daily time frame.

The 14-day Relative Strength Index (RSI) strives to hold above 40.00. A fresh bearish momentum would trigger if the RSI (14) fails to do so.

Looking down, the 200-day EMA near 1.2845 will be a major support zone for Pound Sterling bulls. On the upside, the Cable will face resistance near the 50-day EMA around 1.3060.

Employment FAQs

Labor market conditions are a key element to assess the health of an economy and thus a key driver for currency valuation. High employment, or low unemployment, has positive implications for consumer spending and thus economic growth, boosting the value of the local currency. Moreover, a very tight labor market – a situation in which there is a shortage of workers to fill open positions – can also have implications on inflation levels and thus monetary policy as low labor supply and high demand leads to higher wages.

The pace at which salaries are growing in an economy is key for policymakers. High wage growth means that households have more money to spend, usually leading to price increases in consumer goods. In contrast to more volatile sources of inflation such as energy prices, wage growth is seen as a key component of underlying and persisting inflation as salary increases are unlikely to be undone. Central banks around the world pay close attention to wage growth data when deciding on monetary policy.

The weight that each central bank assigns to labor market conditions depends on its objectives. Some central banks explicitly have mandates related to the labor market beyond controlling inflation levels. The US Federal Reserve (Fed), for example, has the dual mandate of promoting maximum employment and stable prices. Meanwhile, the European Central Bank’s (ECB) sole mandate is to keep inflation under control. Still, and despite whatever mandates they have, labor market conditions are an important factor for policymakers given its significance as a gauge of the health of the economy and their direct relationship to inflation.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.