Pound Sterling soars against US Dollar after slew of US data release.

- The Pound Sterling jumps to near 1.2660 against the US Dollar after the bulk US data release.

- The FOMC minutes failed to offer meaningful cues about the interest rate path.

- BoE's Lombardelli wants to see evidence of a slowdown in inflation before backing an interest rate cut.

The Pound Sterling (GBP) surges to near 1.2670 against the US Dollar (USD) in Wednesday’s North American session. The GBP/USD pair rallies as the US Dollar plummets after the release of bulk United States economic data. The US Dollar Index (DXY), which gauges the Greenback’s value against six major currencies, dives to near 106.00.

Among a slew of US data, growth in Durable Goods Orders at 0.2% was weaker than expected, Initial Jobless Claims surprisingly came in lower at 213K than the former reading 215K, and the initial estimates for annualized Q3 Gross Domestic Product (GDP) showed that the growth rate was 2.8% in line with preliminary estimates.

The US Dollar was already under pressure this week after US President-elect Donald Trump nominated Scott Bessent, a seasoned hedge fund manager, to fill the position of Treasury Secretary. Market participants expect Bessent to execute Trump-stated trade policies strategically and gradually with the intention of avoiding a lethal trade war.

Investors should brace for more volatility in the US Dollar, with the United States (US) Personal Consumption Expenditure Price Index (PCE) data for October scheduled to be published at 15:00 GMT. Economists expect the core PCE inflation data – which excludes volatile food and energy prices – to have accelerated to 2.8% year-over-year from 2.7% in September, with monthly figures growing steadily by 0.3%.

Investors will pay close attention to the core PCE inflation data as it is the Federal Reserve’s (Fed) preferred inflation measure for decision-making on interest rates. The inflation data will influence market expectations for the Fed's likely interest rate action in the December meeting. According to the CME FedWatch tool, the probability that the Fed will cut interest rates by 25 basis points (bps) to the 4.25%-4.50% range in the December meeting has increased to 65% from 56% a week ago.

Dovish Fed bets have escalated after the release on Tuesday of the Federal Open Market Committee (FOMC) minutes for the policy meeting held on November 7, even though it didn’t offer any meaningful guidance about the interest rate path. Some officials reportedly suggested that the Fed could consider pausing its rate-cutting cycle if inflation remains “elevated”, while others argued that the policy-easing cycle would be needed to accelerate if economic conditions or the labor market deteriorate.

Daily digest market movers: Pound Sterling gains as BoE seems to follow gradual policy-easing cycle

- The Pound Sterling gains against a majority of its peers on Wednesday. The British currency gains as Bank of England (BoE) officials support following a gradual policy-easing approach. BoE Deputy Governor Clare Lombardelli said in a speech at King’s Business School on Monday that she wants to see more evidence of cooling price pressures for backing another interest rate cut. warned about risks of inflation remaining higher than the bank’s forecast where wage growth normalizes at 3.5%-4% and the Consumer Price Index (CPI) around 3% rather than 2%.

- This week, the UK economic calendar has nothing to offer. Therefore, the Pound Sterling will be guided by market expectations for BoE interest rate action in the December meeting. Traders see the BoE to leave interest rates unchanged at 4.75% next month.

- Meanwhile, the outlook of the Pound Sterling remains uncertain amid growing worries over the impact of United States (US) President-elect Donald Trump’s tariffs policies on the United Kingdom (UK) export sector.

- In an interview with Financial Times (FT) on Tuesday, BoE Deputy Governor Lombardelli said, “US trade tariffs would pose a risk to economic growth.” Lombardelli added, “Trade barriers certainly are negative for growth in the short, medium and long term.” However, she refrained from forecasting the likely impact of US tariffs on the economy. “Too early to quantify effects of proposed tariffs,” Lombardelli said.

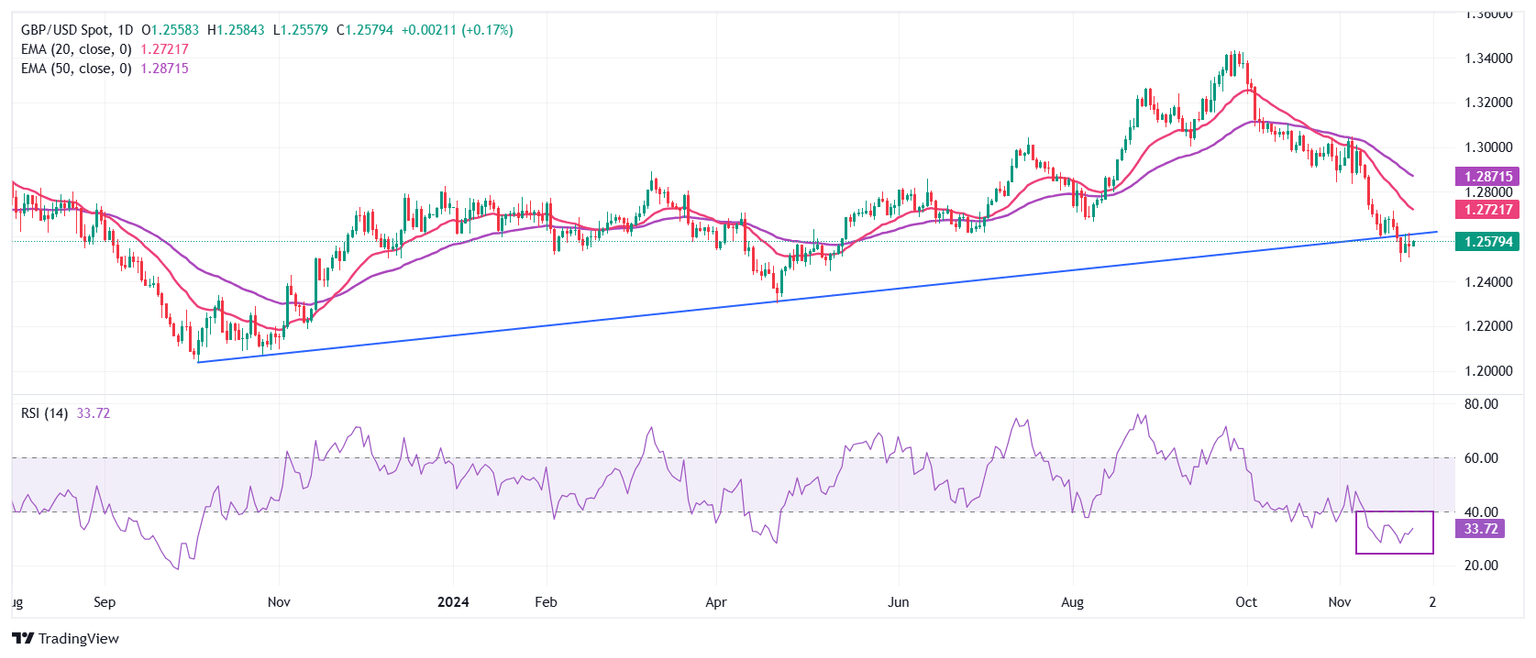

Technical Analysis: Pound Sterling climbs above 1.2600

The Pound Sterling wobbles below the upward-sloping trendline around 1.2600 against the US Dollar, which is plotted from the October 2023 low around 1.2040. The outlook of the GBP/USD pair remains bearish as the 20- and 50-day Exponential Moving Averages (EMAs) at 1.2720 and 1.2870, respectively, are sloping downwards.

The 14-day Relative Strength Index (RSI) oscillates inside the 20.00-40.00 range, suggesting that the downside momentum is intact.

Looking down, the pair is expected to find a cushion near May’s low of 1.2446. On the upside, the November 20 high at around 1.2720 will act as key resistance.

(This story was corrected on November 27 at 09:39 GMT to say that 20- and 50-day EMAs hover at 1.2720 and 1.2870, respectively, not at 1.2735 and 1.2883.)

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.