Pound Sterling Price News and Forecast: GBP/USD ticks lower on Thursday

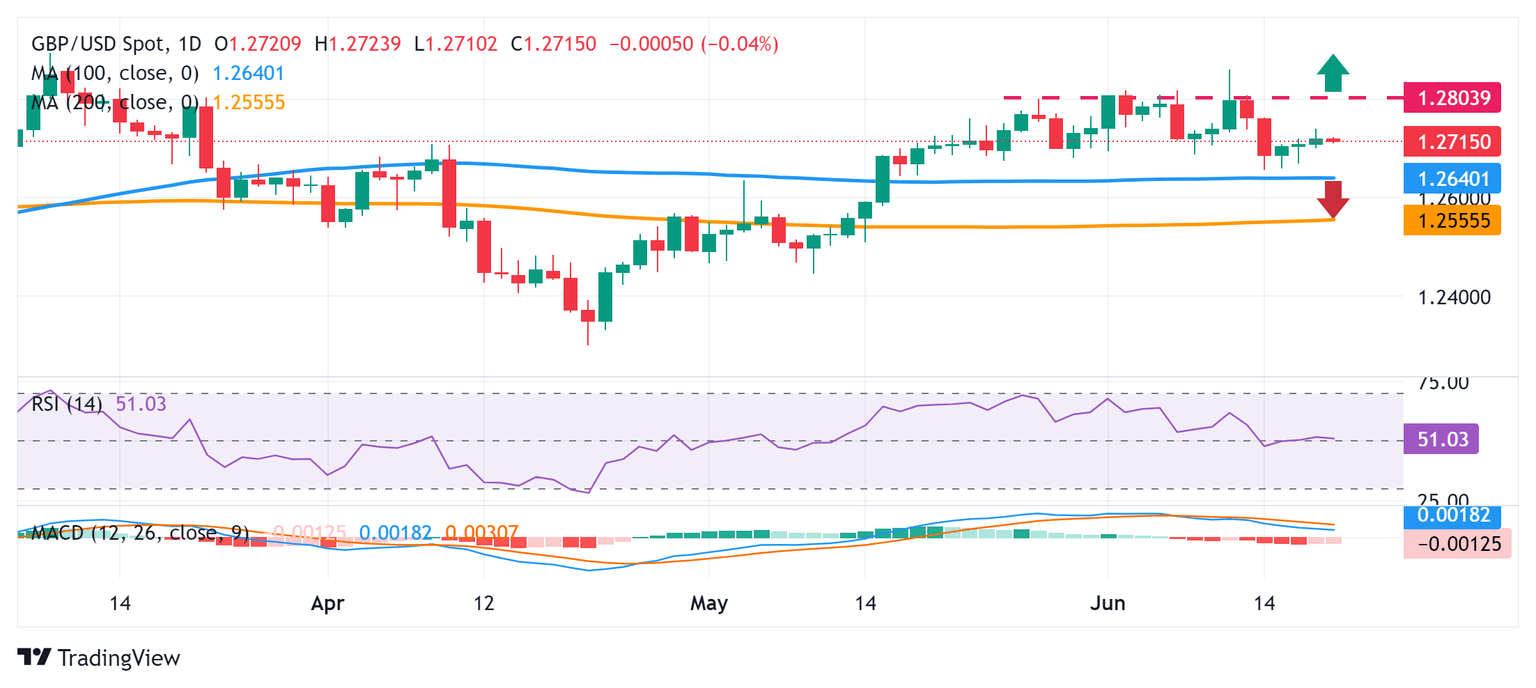

GBP/USD Price Analysis: Consolidates above 1.2700 mark as traders await BoE policy update

The GBP/USD pair trades with a mild negative bias during the Asian session on Thursday and moves further away from the weekly low, around the 1.2740 area touched the previous day. Spot prices, however, hold above the 1.2700 mark as traders await the crucial Bank of England (BoE) monetary policy decision before placing fresh directional bets.

Heading into the key central bank event risk, the US Dollar (USD) attracts some buyers in the wake of a goodish pickup in the US Treasury bond yields and turns out to be a key factor acting as a heading for the GBP/USD pair. However, expectations that the Federal Reserve (Fed) will cut interest rates twice this year keep a lid on any meaningful gains for the Greenback. Furthermore, reduced bets that the BoE will ease monetary policy in the coming months in the wake of higher-than-expected services sector inflation in May should underpin the British Pound (GBP) and lend support to the currency pair. Read more...

GBP/USD finds a foothold ahead of BoE’s upcoming rate call

GBP/USD elbowed its way firmly above 1.2700 in quiet Wednesday trading as GBP traders gear up for Thursday’s latest outing from the Bank of England (BoE), which is expected to keep rates on hold at 5.25% even as UK economic data continues to miss the mark, but not badly enough to spark institutional fears of an outright recession.

Wednesday markets were throttled after US markets shuttered in observation of the midweek Juneteenth holiday, keeping broad-market volumes on the low side and giving US Dollar counterparties a chance to grind out slim gains. American markets will return to the action on Thursday, just in time for a fresh print in week-on-week US Initial Jobless Claims for the week ended June 14. Median market forecasts are expecting new US jobless benefits seekers to ease slightly to 235K from the previous 242K, but still hold above the four-week running average of 227K. Read more...

Author

FXStreet Team

FXStreet