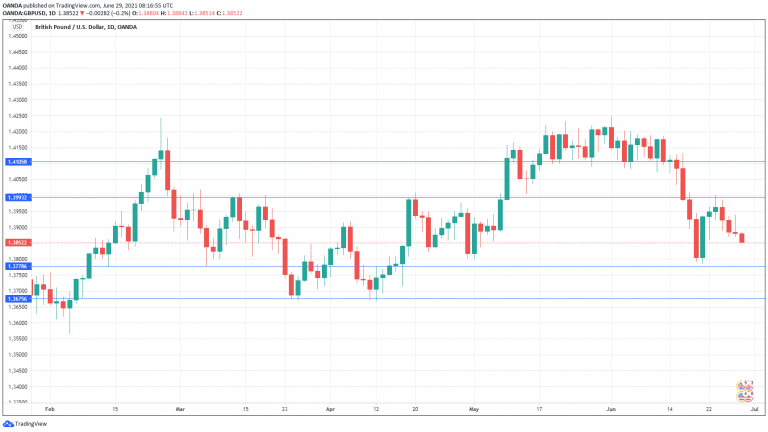

Pound Sterling Price News and Forecast: GBP/USD poised to extend slide sub-1.3800

Sterling dips on COVID-19 jittters

The currency markets are in a holding pattern, as investors cast an eye to Friday, when the US releases Nonfarm Payrolls. The dollar index has managed a slight gain on Tuesday, rising 0.21% to 92.06. The British pound dropped below the 1.39 line overnight. With concerns growing over the resurgence of Covid in Europe, the UK, and Asia, risk appetite has fallen, which has pushed the US dollar slightly higher. If pandemic blues worsen, the greenback could add further gains. Read more...

GBP/USD Forecast: Poised to extend slide sub-1.3800

The GBP/USD pair returned to its bearish path on Tuesday, ending the day in the 1.3840 price zone after bottoming for the day at 1.3813. The slide was linked to the dollar’s demand rather than UK news. Anyway, coronavirus and Brexit-related headlines keep affecting Sterling. UK Prime Minister Boris Johnson’s spokesman said that the government expects to agree with the EU an extension to the grace period on custom checks on chilled meats heading to Northern Ireland soon. Read more...

GBP/USD trims losses and climbs to the 1.3850 area

US Dollar lost momentum during the American session, DXY pullback to 92.00. GBP/USD negative for the day, off lows. The GBP/USD pair bottomed at 1.3813 and then rebounded, trimming losses. It is trading near the 1.3850 area, still in negative ground for the day but off lows. The recovery of the cable was favored by a pull back of the dollar across the board. Read more...

Author

FXStreet Team

FXStreet