Pound Sterling Price News and Forecast: GBP/USD larger bulls likely to take a breather before resuming

GBP/USD outlook: Larger bulls likely to take a breather before resuming

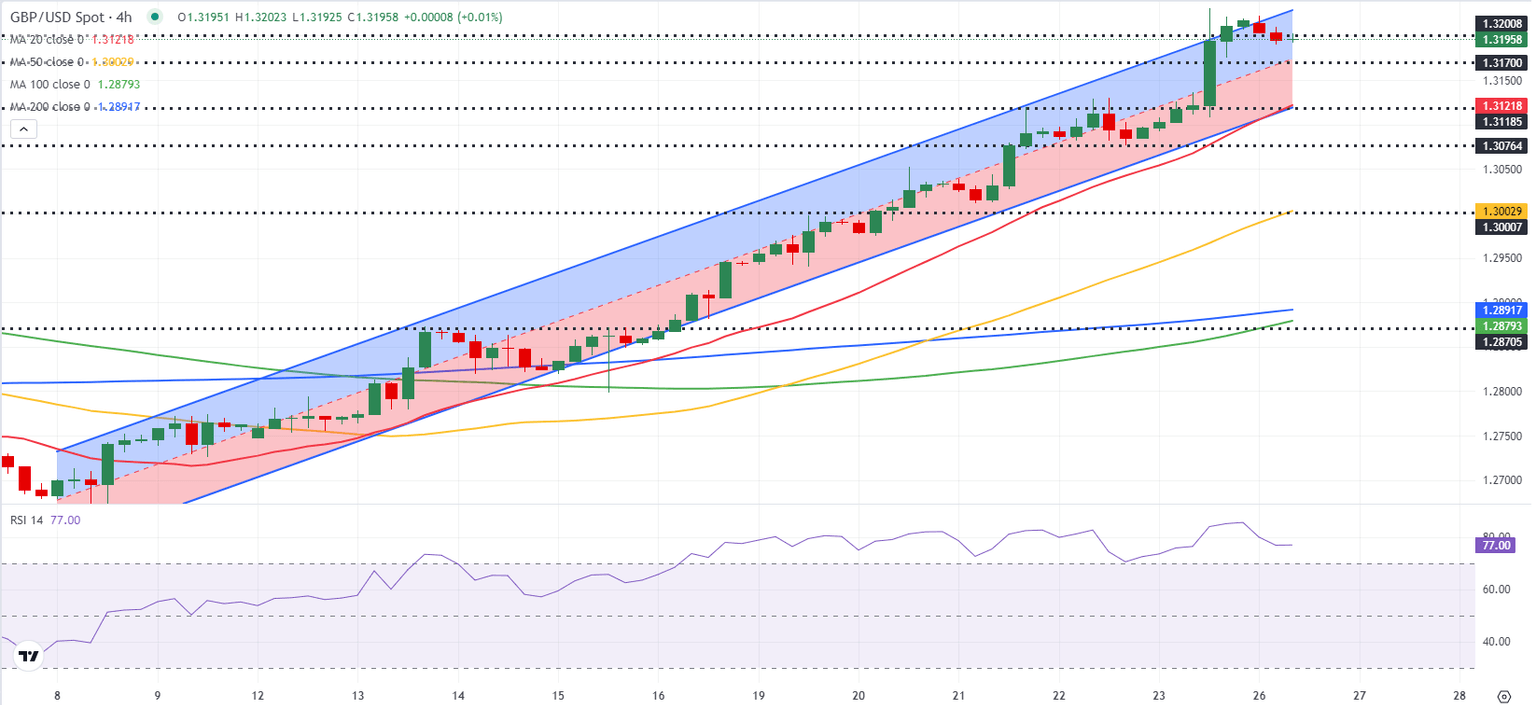

Cable eases from new highest levels since March 2022 on Monday, suggesting that bulls may take breather after 3.6% advance in past two weeks and strong bullish acceleration last Friday (almost 1% daily gain).

Strongly overbought daily studies prompt traders to collect profit, though correction is likely to be limited as the uptrend is strong. Higher base at 1.3080 marks initial support, while extended dips should be contained by solid supports at 1.3000 zone (38.2% of 1.2664/1.3229 / 10DMA / psychological) and mark a healthy correction, before fresh push higher and potential attack at 1.3328 (Fibo 76.4% of 1.4249/1.0348). Read more...

GBP/USD Forecast: Pound Sterling could extend correction below 1.3170

GBP/USD gained 1% on Friday and rose more than 2% for the week, fuelled by the heavy selling pressure surrounding the US Dollar (USD). After touching its highest level since March 2020 at 1.3230, the pair seems to have entered a consolidation phase below 1.3200 at the beginning of the week.

Following Thursday's recovery attempt, the USD Index, which tracks the USD's valuation against a basket of six major currencies, turned south on Friday. Read more...

GBP/USD Weekly Forecast: Pound Sterling risks correction, eyes turn to US PCE inflation

The Pound Sterling (GBP) clinched a second consecutive weekly gain against the US Dollar (USD), as the GBP/USD pair reached its highest level since March 2022, above 1.3200.

GBP/USD witnessed another blockbuster week, devoid of high-impact economic events from the United Kingdom (UK). The underlying positive tone around the major was mainly driven by the sustained weakness in the US Dollar against its major rivals. Read more...

Author

FXStreet Team

FXStreet

-638602644661099029.png&w=1536&q=95)