Pound Sterling Price News and Forecast: GBP/USD appreciates on expectations of a Fed rate cut in September

GBP/USD edges higher to near 1.2700, upside potential seems limited

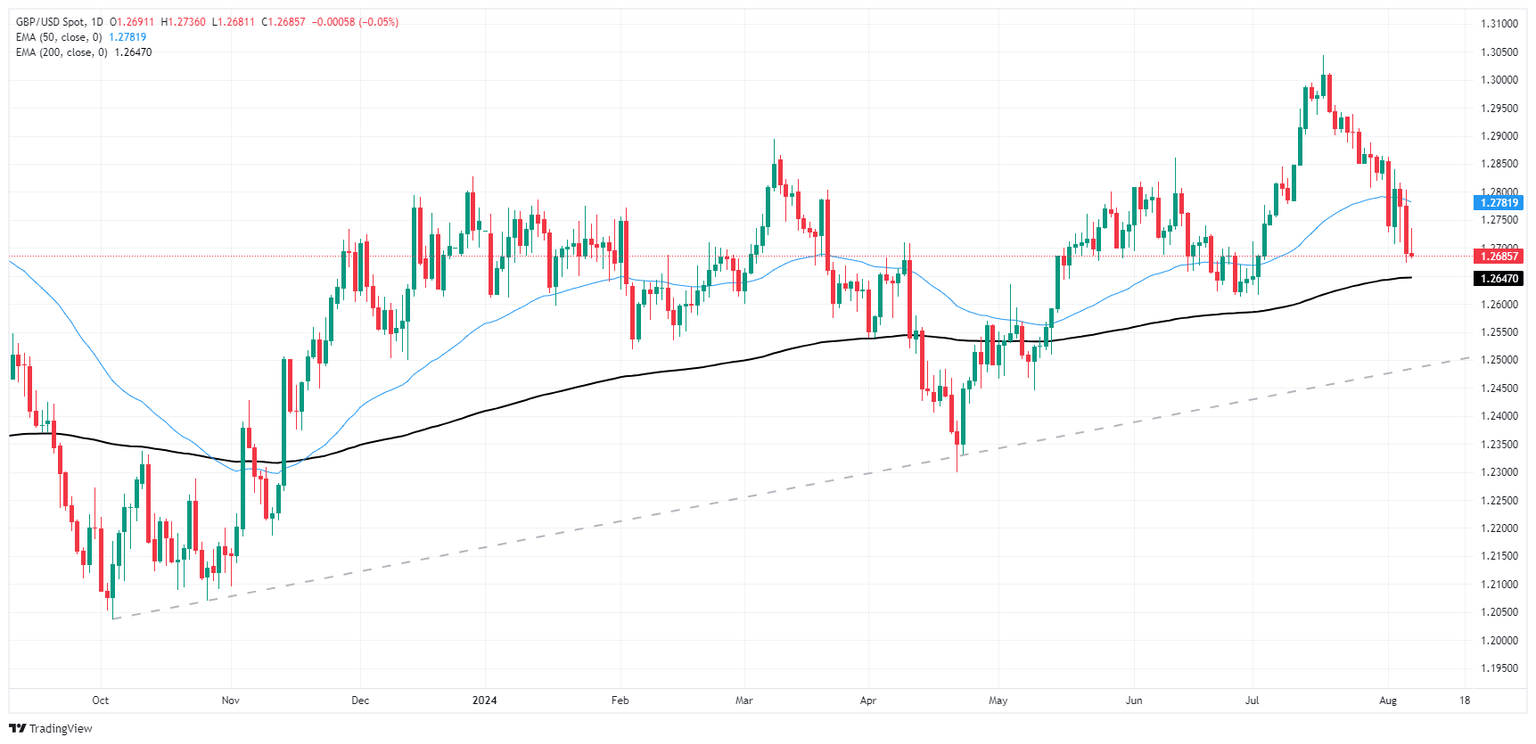

GBP/USD breaks its three-day losing streak, trading around 1.2700 during the Asian session on Thursday. This upside could be attributed to the weaker US Dollar (USD) as the US Federal Reserve (Fed) is widely anticipated to implement a more aggressive rate cut beginning in September.

According to the CME FedWatch tool, there is now a 72.0% probability of a 50-basis point (bps) interest rate cut by the US Federal Reserve (Fed) in September, up from 11.8% a week earlier. The expectation of deeper rate cuts may pressure the US Dollar in the near term. Read more...

GBP/USD struggles to find gains as markets chew on rate cut expectations

GBP/USD tested waters on the high side on Wednesday but settled the day where it started just south of the 1.2700 handle. Markets are struggling to shrug off a broad downside shock kicked off late last week after a raft of US data came in below expectations, reigniting fears of a steep US recession looming over the horizon.

Investors have recovered their balance, but recovery remains a limited affair as Cable treads water. Meaningful economic data remains limited heading through the rest of the week, leaving investors to grapple with hopes for a 50 basis point rate cut from the Federal Reserve (Fed) in September. Read more...

GBP/USD Price Forecast: Rebounds above 1.2700 on risk-on mood

The Pound Sterling bounced off daily/weekly lows and rose above the 1.2700 figure on Wednesday as risk appetite improved after a Bank of Japan (BoJ) official commented the BoJ wouldn’t raise rates amid market instability. Therefore, the GBP/USD trades at 1.2720 after touching a low of 1.2680.

The GBP/USD is neutral to bearishly biased after diving below the 50-day moving average (DMA) at 1.2785. Sellers piercing of the latter sounded buyers’ alarms, which entered below the 1.2700 mark, yet remained in the backfoot as the Greenback strengthened. Read more...

Author

FXStreet Team

FXStreet