Pound Sterling Price News and Forecast: GBP/USD 1.2980 aligns as key support

GBP/USD Forecast: 1.2980 aligns as key support for Pound Sterling

GBP/USD preserved its bullish momentum and advanced to its highest level since July 2023 at 1.3052 on Tuesday. The pair edges slightly lower in the European session on Wednesday but stays afloat above 1.3000.

The persistent selling pressure surrounding the US Dollar (USD) fuelled another leg higher in GBP/USD on Tuesday. Although Wall Street's main indexes trades mixed after the opening bell, falling US Treasury bond yields forced the USD to stay on the back foot. Read more...

GBP/USD awaits strong resistance near one-year high

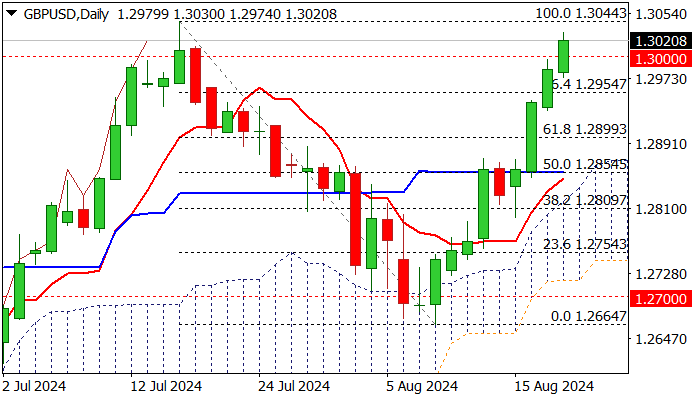

GBP/USD continues last week's rebound off the 200-day SMA and the 50.0% Fibonacci retracement level of the up leg from 1.2300 to 1.3045 at 1.2670, but with some weakness today. The intraday bias looks neutral to negative, as the stochastic is still standing above the 80 level but is losing some steam, while the RSI, although above 50, seems to be making its way down.

If the pair manages to head higher, the one-year high of 1.3045 could serve as a trigger point for steeper bullish action. Further north, cable could run toward the 1.3140 level, a strong barrier from last year. Read more...

GBP/USD outlook: Cable rises above 1.3000 for the first time since mid-July

Cable broke above psychological 1.30 level on Tuesday (last probe above this barrier was on July 17/18). Rally from 1.2664 (Aug 8 low, where rising daily cloud contained previous downtrend and reversed direction) is steep and uninterrupted, holding for the second week.

Daily studies hold strong positive momentum and MA’s in bullish setup, suggesting that bulls hold grip for more gains. July peak at 1.3044 is under pressure, with firm break here to open way towards 2023 high at 1.3141. Read more...

Author

FXStreet Team

FXStreet