Pound Sterling jumps above 1.2900 on soft US Inflation, strong UK GDP growth

- The Pound Sterling performs strongly on faster UK GDP growth and soft US Inflation data.

- The UK economy expanded at a faster pace of 0.4% in May, beating an estimate of 0.2%.

- US annual headline and core inflation decelerated in June.

The Pound Sterling (GBP) surges above the round-level resistance of 1.2900 against the US Dollar (USD) in Thursday’s American session. The GBP/USD pair strengthens as the United States (US) Consumer Price Index (CPI) for June showed that price pressures softened more than expected in June. Annual headline and core CPI, which strips off volatile food and energy prices, decelerated to 3% and 3.3%, respectively. Monthly headline inflation deflated by 0.1%, while economists forecasted growth at a similar pace. The core CPI grew at a slower pace of 0.1% from the estimates and the prior release of 0.2%.

Softer-than-expected US inflation data has boosted expectations of early rate cuts by the Federal Reserve (Fed) and has weighed heavily on the US Dollar. The US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, weakens to June's low near 104.00.

The Cable was already upbeat due to multiple tailwinds, such as weakness in the US Dollar due to firm speculation that the Fed will begin reducing interest rates in September and an upbeat outlook for the British currency amid easing Bank of England’s (BoE) early rate cut bets and strong United Kingdom (UK) Gross Domestic Product (GDP) report for May. The expectations for Fed rate cuts were higher as Fed Chair Jerome Powell signaled some disinflation progress in his semi-annual Congressional testimony comments. Powell refrained from announcing a victory over inflation but assured that policymakers are very focused on the path toward price stability.

Daily digest market movers: Pound Sterling rises strongly on robust UK GDP growth

- The Pound Sterling outperforms its major peers on Thursday as the UK economy grew at a faster pace in May and the maintenance of a hawkish stance by BoE policymakers. UK’s Office for National Statistics (ONS) has reported that the economy expanded strongly by 0.4% from the estimates of 0.2% and a stagnant performance recorded in April.

- The UK ONS also showed that monthly Industrial and Manufacturing Production grew in line with expectations after contracting in April, while annual figures missed estimates. Monthly Industrial and Manufacturing Production rose by 0.2% and 0.4%, respectively. Annually, Industrial and Manufacturing Production grew at a slower pace of 0.4% and 0.6%, respectively. The factory data has returned to a positive trajectory after contracting at a stronger pace in April, suggesting a strong recovery in the domestic and overall demand for factory products.

- Meanwhile, Bank of England (BoE) policymakers have pushed back expectations of rate cuts in August. On Wednesday, BoE policymaker Catherine Mann warned that the decline in annual headline inflation to the 2% target was merely a “touch and go”. Mann added that price pressures could rise again and remain above the required rate for the rest of the year. She indicated that her stance would remain hawkish until she sees a sustained decline in service inflation and wage growth.

- This week, BoE policymaker Jonathan Haskel also maintained hawkish guidance on interest rates due to sticky wage growth. Haskel said: "I would rather hold rates until there is more certainty that underlying inflationary pressures have subsided sustainably", Reuters reported.

Pound Sterling Price Today:

British Pound PRICE Today

The table below shows the percentage change of British Pound (GBP) against listed major currencies today. British Pound was the strongest against the US Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.52% | -0.62% | -1.62% | -0.11% | -0.58% | -0.67% | -0.75% | |

| EUR | 0.52% | -0.10% | -1.11% | 0.43% | -0.06% | -0.13% | -0.21% | |

| GBP | 0.62% | 0.10% | -1.03% | 0.54% | 0.04% | -0.03% | -0.10% | |

| JPY | 1.62% | 1.11% | 1.03% | 1.60% | 1.12% | 1.00% | 0.97% | |

| CAD | 0.11% | -0.43% | -0.54% | -1.60% | -0.51% | -0.60% | -0.63% | |

| AUD | 0.58% | 0.06% | -0.04% | -1.12% | 0.51% | -0.08% | -0.14% | |

| NZD | 0.67% | 0.13% | 0.03% | -1.00% | 0.60% | 0.08% | -0.06% | |

| CHF | 0.75% | 0.21% | 0.10% | -0.97% | 0.63% | 0.14% | 0.06% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the British Pound from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent GBP (base)/USD (quote).

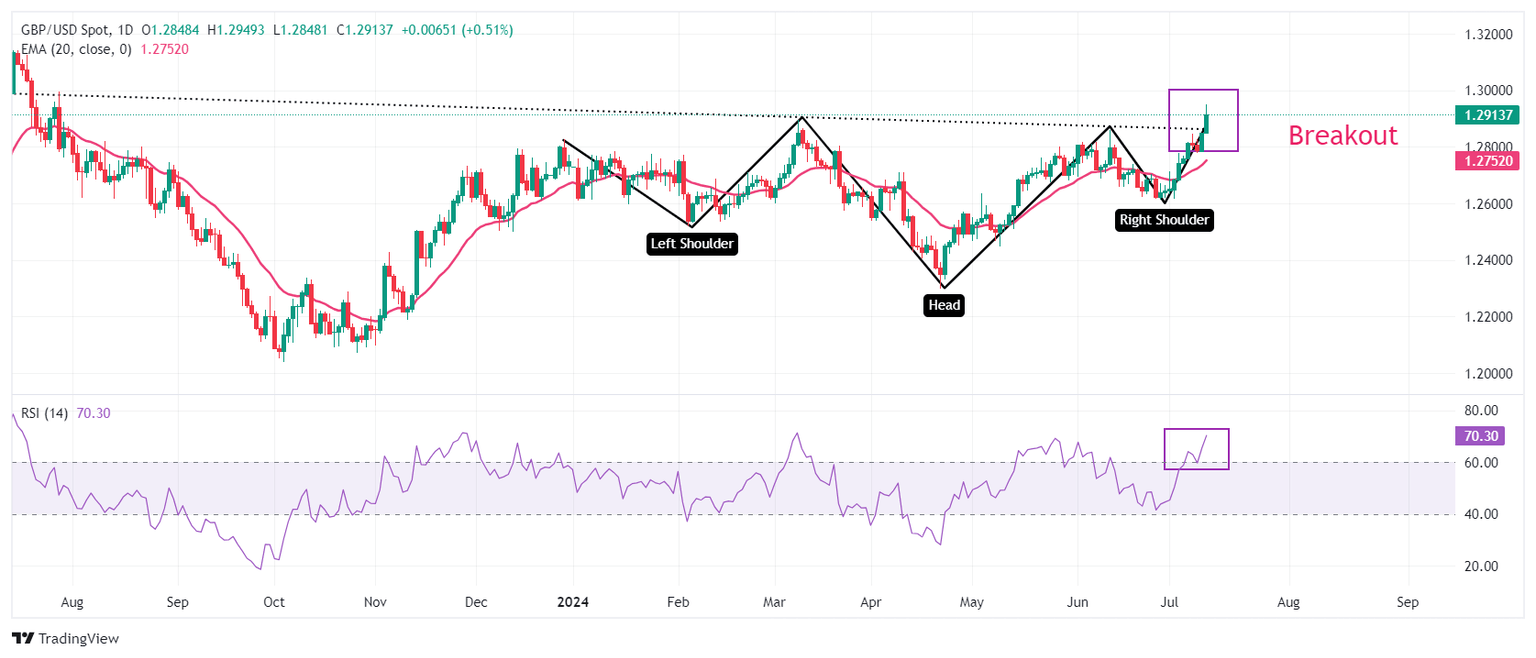

Technical Analysis: Pound Sterling delivers inverted H&S breakout

The Pound Sterling moves higher above the round-level resistance of 1.2900 against the US Dollar. The GBP/USD pair is expected to extend its upside after delivering a breakout of an inverted Head and Shoulder (H&S) formed on a daily timeframe. The neckline of the above-mentioned chart pattern is plotted near 1.2850, and a breakout of the H&S formation results in a bullish reversal.

Advancing 20-day Exponential Moving Average (EMA) near 1.2747 suggests that the near-term trend is bullish.

The 14-day Relative Strength Index (RSI) established into the bullish range of 60.00-80.00, indicating that the momentum has leaned to the upside.

Fed FAQs

Monetary policy in the US is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability and foster full employment. Its primary tool to achieve these goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, it raises interest rates, increasing borrowing costs throughout the economy. This results in a stronger US Dollar (USD) as it makes the US a more attractive place for international investors to park their money. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates to encourage borrowing, which weighs on the Greenback.

The Federal Reserve (Fed) holds eight policy meetings a year, where the Federal Open Market Committee (FOMC) assesses economic conditions and makes monetary policy decisions. The FOMC is attended by twelve Fed officials – the seven members of the Board of Governors, the president of the Federal Reserve Bank of New York, and four of the remaining eleven regional Reserve Bank presidents, who serve one-year terms on a rotating basis.

In extreme situations, the Federal Reserve may resort to a policy named Quantitative Easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used during crises or when inflation is extremely low. It was the Fed’s weapon of choice during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy high grade bonds from financial institutions. QE usually weakens the US Dollar.

Quantitative tightening (QT) is the reverse process of QE, whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing, to purchase new bonds. It is usually positive for the value of the US Dollar.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.