Pound Sterling gains on steady UK PMI growth, Fed-BoE policy in spotlight

- The Pound Sterling climbs to near 1.2670 against the US Dollar as the UK Composite PMI showed steady growth.

- This week, investors will focus on monetary policy decisions from the Fed and the BoE as well as UK employment and inflation data.

- Traders price in an interest-rate reduction from the Fed while the BoE is expected to leave them unchanged.

The Pound Sterling (GBP) jumps sharply to near 1.2670 against the US Dollar (USD) in Monday’s North American session after the release of the flash United Kingdom (UK) S&P Global/ CIPS Purchasing Managers’ Index (PMI) data. The PMI report showed that the overall business activity expanded at a steady pace to 50.5. The impact of a surprise faster-than-expected decline in the manufacturing sector activity was offset by a robust expansion in the service sector output.

The Manufacturing PMI declined at a faster pace to 47.3 from 48.0 in November. Economists expected the economic data to have improved to 48.1. The Service sector activity expanded at a faster pace to 51.4, from the estimates of 51.0 and the former release of 50.8. Though the data showed that the overall growth was steady, survey respondents were concerned over the business outlook due to fragile consumer confidence, tighter corporate budgets, and cutbacks to non-essential spending. The report also showed the total staffing numbers fell for the third month in a row. Some firms also noted that forthcoming increases in employers’ National Insurance contributions had encouraged cutbacks to working hours and longer-term efforts to restructure workforces.

A recent survey by the UK Recruitment and Employment Confederation (REC) also showed that an increase in employers’ contribution to National Insurance (NI) from 13.8% to 15% has led to dissatisfaction among employers.

Meanwhile, investors also await the United States (US) flash PMI data for October, which will be published at 14:45 GMT. The report is expected to show cooler growth in overall business activity due to a slowdown in both the manufacturing and services sectors. Investors will look for cues about the impact of Donald Trump's election as President on demand and inflation expectations.

Daily digest market movers: Pound Sterling remains firm against US Dollar

- The Pound Sterling outperforms the US Dollar even though the latter rebounds, with the US Dollar Index (DXY) hovering around 107.00. Investors brace for a high level of volatility from the GBP/USD pair this week, as the Federal Reserve (Fed) and the Bank of England (BoE) are set for their last monetary policy meetings of the year on Wednesday and Thursday, respectively.

- Divergent moves are expected from both the central banks as the Fed is widely anticipated to cut its key borrowing rates by 25 basis points (bps) to 4.25%-4.50%, while the BoE is expected to leave them unchanged at 4.75%. Still, as the main interest-rate decisions from both the central banks have already been priced in by market participants, investors will be majorly focusing on the policy outlook for 2025.

- According to current market expectations, traders expect three interest rate cuts from both central banks in 2025.

- This week, the Pound Sterling will also be influenced by the United Kingdom (UK) employment data for the three months ending October and the Consumer Price Index (CPI) data for November, which will be released on Tuesday and Wednesday, respectively. Any sharp deviation in the labor market and inflation numbers from estimates could influence market speculation about the BoE's interest rate action on Thursday and policy outlook expectations for 2025.

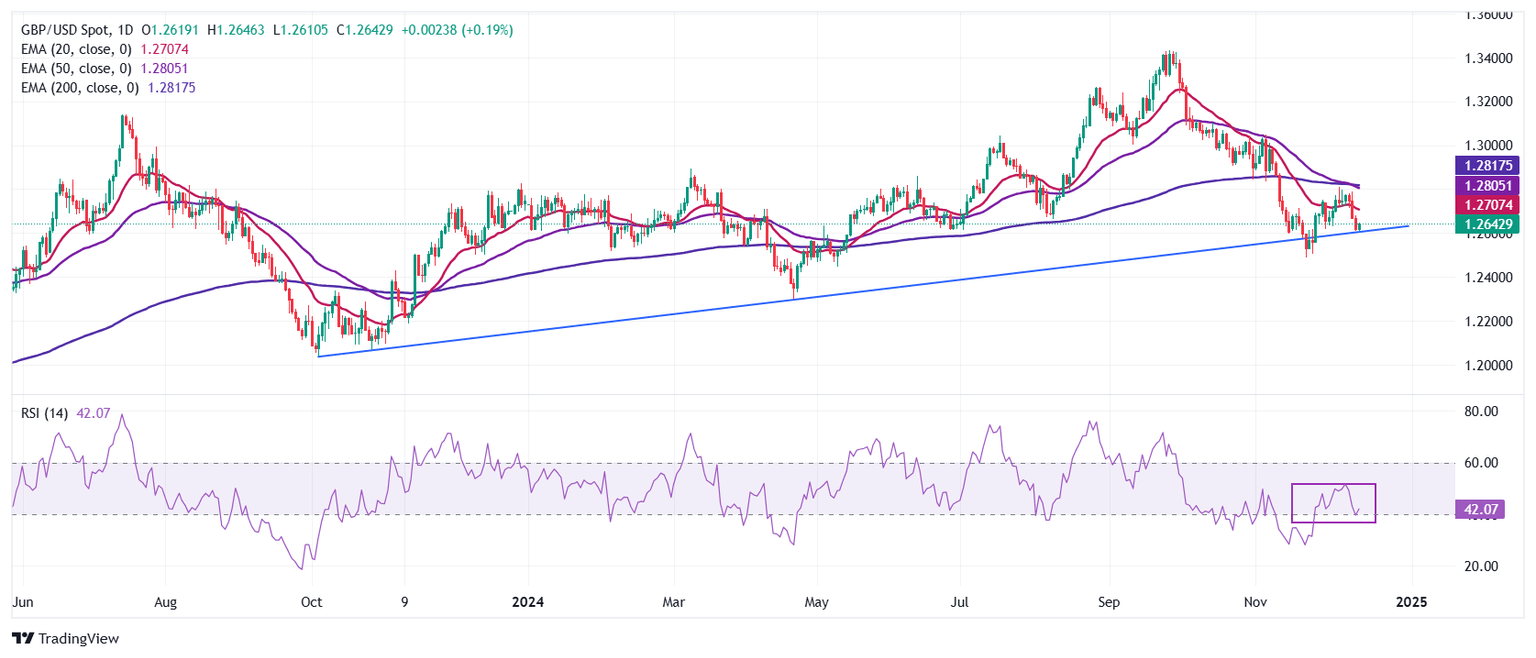

Technical Analysis: Pound Sterling remains below key EMAs

The Pound Sterling rises to near 1.2645 against the US Dollar on Monday after a three-day losing streak. The outlook of the GBP/USD pair remains bearish as all short-to-long Exponential Moving Averages (EMAs) are sloping lower.

Still, the upward-sloping trendline drawn from the October 2023 low around 1.2035 continues to provide support to Pound Sterling bulls near 1.2600.

The 14-day Relative Strength Index (RSI) hovers near 40.00. Should the RSI drop below 40.00, a bearish momentum will set off.

Looking down, the pair is expected to find a cushion near the psychological support of 1.2500. On the upside, the December 6 high of 1.2810 will act as key resistance.

BoE FAQs

The Bank of England (BoE) decides monetary policy for the United Kingdom. Its primary goal is to achieve ‘price stability’, or a steady inflation rate of 2%. Its tool for achieving this is via the adjustment of base lending rates. The BoE sets the rate at which it lends to commercial banks and banks lend to each other, determining the level of interest rates in the economy overall. This also impacts the value of the Pound Sterling (GBP).

When inflation is above the Bank of England’s target it responds by raising interest rates, making it more expensive for people and businesses to access credit. This is positive for the Pound Sterling because higher interest rates make the UK a more attractive place for global investors to park their money. When inflation falls below target, it is a sign economic growth is slowing, and the BoE will consider lowering interest rates to cheapen credit in the hope businesses will borrow to invest in growth-generating projects – a negative for the Pound Sterling.

In extreme situations, the Bank of England can enact a policy called Quantitative Easing (QE). QE is the process by which the BoE substantially increases the flow of credit in a stuck financial system. QE is a last resort policy when lowering interest rates will not achieve the necessary result. The process of QE involves the BoE printing money to buy assets – usually government or AAA-rated corporate bonds – from banks and other financial institutions. QE usually results in a weaker Pound Sterling.

Quantitative tightening (QT) is the reverse of QE, enacted when the economy is strengthening and inflation starts rising. Whilst in QE the Bank of England (BoE) purchases government and corporate bonds from financial institutions to encourage them to lend; in QT, the BoE stops buying more bonds, and stops reinvesting the principal maturing on the bonds it already holds. It is usually positive for the Pound Sterling.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.