Pound Sterling rises above 1.3000 against US Dollar with Jackshon Hole in focus

- The Pound Sterling rises to a fresh monthly high near 1.3000 against the US Dollar ahead of key economic data for both the UK and the US.

- Fed Chairman Powell may signal in Jackson Hole whether the central bank will cut interest rates by 25 or 50 basis points (bps) in September.

- BoE’s Governor Bailey could uncover uncertainty over subsequent interest-rate cuts.

The Pound Sterling (GBP) posts a fresh monthly high near the psychological resistance of 1.3000 against the US Dollar (USD) in Tuesday’s North American session. The GBP/USD pair demonstrates sheer strength as the outlook of the US Dollar is bleak amid firm speculation that the Federal Reserve (Fed) will start reducing interest rates in September.

The US Dollar Index (DXY) – which tracks the Greenback’s value against six major currencies – edges higher to near 102.00, but it remains close to a fresh more-than-seven-month low.

Sluggishness in the United States (US) economic data of July suggested that the economy is not overheated anymore. The labor market has cooled down, and inflationary pressures remain on track to return to the desired rate of 2%.

This week, the major triggers for the US Dollar will be the release of the Federal Open Market Committee (FOMC) minutes and Fed Chair Jerome Powell’s commentary at the Jackson Hole (JH) Symposium, which are scheduled for Wednesday and August 22-24, respectively. Investors will look through the FOMC minutes and the JH Symposium to know whether the Fed will pivot to policy normalization aggressively or gradually.

A Reuters poll carried out between August 14 and 19 shows that 54% of the respondents think that the Fed will cut interest rates in each of its remaining meetings this year.

On the economic data front, investors await the US preliminary S&P Global PMI data for August, which will be published on Thursday. The flash Composite PMI is estimated to come in at 53.7, down from the prior release of 54.3, suggesting that the economy expanded at a slower pace.

Daily digest market movers: Pound Sterling gains on expectations of BoE’s gradual rate-cut approach

- The Pound Sterling exhibits a strong performance against its major peers in New York trading hours on Tuesday. The British currency trades firm on expectations that the policy-easing cycle from the Bank of England (BoE) will be slower than that of other central banks.

- Despite a sharp slowdown in price pressures in the UK’s service sector, a closely watched inflation gauge by BoE policymakers, the drop is still insufficient to compel officials to cut interest rates aggressively. Services inflation decelerated to 5.2% in July from 5.7% in June. However, easing services inflation has opened doors for BoE sequential interest rate cuts. Currently, markets have attached a 37% probability of such action, Reuters reported.

- For meaningful cues on the interest-rate path, investors will focus on the BoE Governor Andrew Bailey’s speech at the JH Symposium on Friday. Investors will keenly focus on what he says about the wage growth outlook and how far inflationary pressures could increase if they reaccelerate.

- Before Bailey’s speech, investors will look at the UK preliminary S&P PMI data for August, which will be published on Thursday. Economists expect the flash Manufacturing PMI to steady at 52.1, while activity in the service sector is seen improving to 52.8 from the prior release of 52.5.

Pound Sterling Price Today:

British Pound PRICE Today

The table below shows the percentage change of British Pound (GBP) against listed major currencies today. British Pound was the strongest against the Australian Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.01% | -0.14% | -0.25% | -0.13% | 0.04% | -0.67% | -0.39% | |

| EUR | 0.00% | -0.13% | -0.23% | -0.11% | 0.07% | -0.36% | -0.38% | |

| GBP | 0.14% | 0.13% | -0.10% | 0.03% | 0.21% | -0.23% | -0.28% | |

| JPY | 0.25% | 0.23% | 0.10% | 0.12% | 0.28% | -0.15% | -0.19% | |

| CAD | 0.13% | 0.11% | -0.03% | -0.12% | 0.16% | -0.25% | -0.31% | |

| AUD | -0.04% | -0.07% | -0.21% | -0.28% | -0.16% | -0.42% | -0.48% | |

| NZD | 0.67% | 0.36% | 0.23% | 0.15% | 0.25% | 0.42% | -0.06% | |

| CHF | 0.39% | 0.38% | 0.28% | 0.19% | 0.31% | 0.48% | 0.06% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the British Pound from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent GBP (base)/USD (quote).

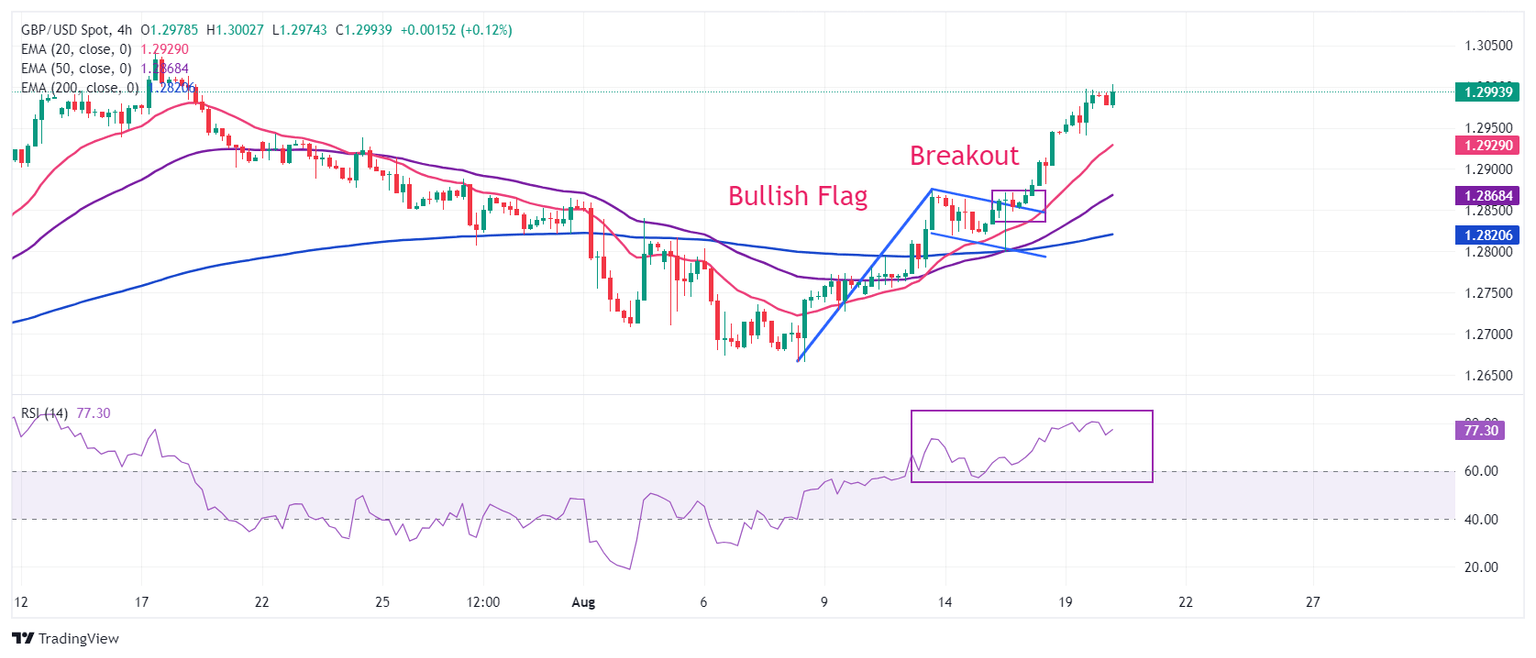

Technical Analysis: Pound Sterling seeks stabilization above 1.3000

The Pound Sterling continues its winning spell for the fourth trading session on Thursday. The GBP/USD pair gains to near 1.3000 after a Bullish Flag breakout in the 4-hour timeframe. The Bullish Flag formation is characterized by lower volume in which inventory is transferred from retail participants to institutional investors. A decisive breakout of the Flag pattern results in the continuation of the ongoing trend, which in this case is up.

All short-to-long term Exponential Moving Averages (EMAs) are sloping higher, suggesting the uptrend is well supported.

The 14-period Relative Strength Index (RSI) oscillates in the bullish range of 60.00-80.00, suggesting a strong upside momentum.

Interest rates FAQs

Interest rates are charged by financial institutions on loans to borrowers and are paid as interest to savers and depositors. They are influenced by base lending rates, which are set by central banks in response to changes in the economy. Central banks normally have a mandate to ensure price stability, which in most cases means targeting a core inflation rate of around 2%. If inflation falls below target the central bank may cut base lending rates, with a view to stimulating lending and boosting the economy. If inflation rises substantially above 2% it normally results in the central bank raising base lending rates in an attempt to lower inflation.

Higher interest rates generally help strengthen a country’s currency as they make it a more attractive place for global investors to park their money.

Higher interest rates overall weigh on the price of Gold because they increase the opportunity cost of holding Gold instead of investing in an interest-bearing asset or placing cash in the bank. If interest rates are high that usually pushes up the price of the US Dollar (USD), and since Gold is priced in Dollars, this has the effect of lowering the price of Gold.

The Fed funds rate is the overnight rate at which US banks lend to each other. It is the oft-quoted headline rate set by the Federal Reserve at its FOMC meetings. It is set as a range, for example 4.75%-5.00%, though the upper limit (in that case 5.00%) is the quoted figure. Market expectations for future Fed funds rate are tracked by the CME FedWatch tool, which shapes how many financial markets behave in anticipation of future Federal Reserve monetary policy decisions.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.