Pound Sterling retreats as BoE seems to cut interest rates next month

- The Pound Sterling falls back against the majority of its peers ahead of BoE Bailey’s speech.

- BoE Greene attributed soft volatile components to the decline in UK inflation in September.

- The IMF has upwardly revised US growth projections for the current and the next year.

The Pound Sterling (GBP) retreats against the majority of its peers on Wednesday. The British currency falls despite BoE Monetary Policy Committee member Megan Greene delivered a slightly hawkish interest rate guidance in a discussion with the Atlantic Council think-tank on the sidelines of the International Monetary Fund’s (IMF) meeting on Tuesday.

“I think it's most likely that monetary policy must continue to bear down to bring inflation to target,” Greene said. When asked whether the recent drop in United Kingdom (UK) inflation will influence her vote in the monetary policy in November, Greene said that a sharp fall in inflation came from volatile components. Therefore, she would not put too much weight on them.

Investors should note that Greene was one of the four Monetary Policy Committee (MPC) members who voted to keep interest rates unchanged in August, in which the BoE reduced them by 25 basis points (bps) to 5%.

Going forward, investors will focus on Bank of England (BoE) Governor Andrew Bailey’s speech, who is expected to speak on the sidelines of the IMF meeting on Wednesday, Thursday and early Saturday. Investors will pay close attention to get fresh cues about the likely monetary policy action in November and December. Meanwhile, traders have priced in another interest rate cut in November.

On the economic front, market participants will focus on the flash S&P Global/CIPS Purchasing Managers Index (PMI) data for October, which will be published on Thursday. The PMI report is expected to show that the overall business activity expanded at a modest pace.

British Pound PRICE Today

The table below shows the percentage change of British Pound (GBP) against listed major currencies today. British Pound was the strongest against the Japanese Yen.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.22% | 0.27% | 1.25% | 0.24% | 0.67% | 0.56% | 0.14% | |

| EUR | -0.22% | 0.07% | 1.04% | 0.04% | 0.48% | 0.35% | -0.07% | |

| GBP | -0.27% | -0.07% | 0.97% | -0.05% | 0.41% | 0.29% | -0.09% | |

| JPY | -1.25% | -1.04% | -0.97% | -1.01% | -0.58% | -0.69% | -1.06% | |

| CAD | -0.24% | -0.04% | 0.05% | 1.01% | 0.44% | 0.34% | -0.05% | |

| AUD | -0.67% | -0.48% | -0.41% | 0.58% | -0.44% | -0.10% | -0.48% | |

| NZD | -0.56% | -0.35% | -0.29% | 0.69% | -0.34% | 0.10% | -0.39% | |

| CHF | -0.14% | 0.07% | 0.09% | 1.06% | 0.05% | 0.48% | 0.39% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the British Pound from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent GBP (base)/USD (quote).

Daily digest market movers: Pound Sterling slumps against US Dollar

- The Pound Sterling stays below the psychological resistance of 1.3000 against the US Dollar (USD) in Wednesday’s North American session. The GBP/USD pair faces pressure as the USD extends its upside on multiple tailwinds. The US Dollar Index (DXY), which gauges Greenback’s value against six major currencies, jumps to near 104.35 and approaches the August high of 104.45.

- The appeal of the US Dollar as safe-haven has been strengthened by uncertainty over the United States (US) presidential elections on November 5. According to the Reuters/Ipsos polls, Vice President Kamala Harris leads a slight margin against former President Donald Trump.

- Market participants worry that the scenario of Trump winning the election will result in higher tariffs, which will have a significant impact on exports from the Eurozone, Canada, Mexico, China, and Japan, which are closed trading partners to the US.

- Also, firm expectations for a Federal Reserve’s (Fed) gradual policy-easing cycle in the remaining year and 2025 have also boosted the appeal of the US Dollar. Meanwhile, the IMF has raised US growth forecasts for this year to 2.8% compared to 2.6% projected in July. The agency has also raised Gross Domestic Product (GDP) projections for 2025 to 2.2% from prior expectations of 1.9%.

- For the current status of economic health, investors will focus on the Fed’s Beige Book, which summarizes economic conditions across 12 Fed districts and will be published at 18:00 GMT.

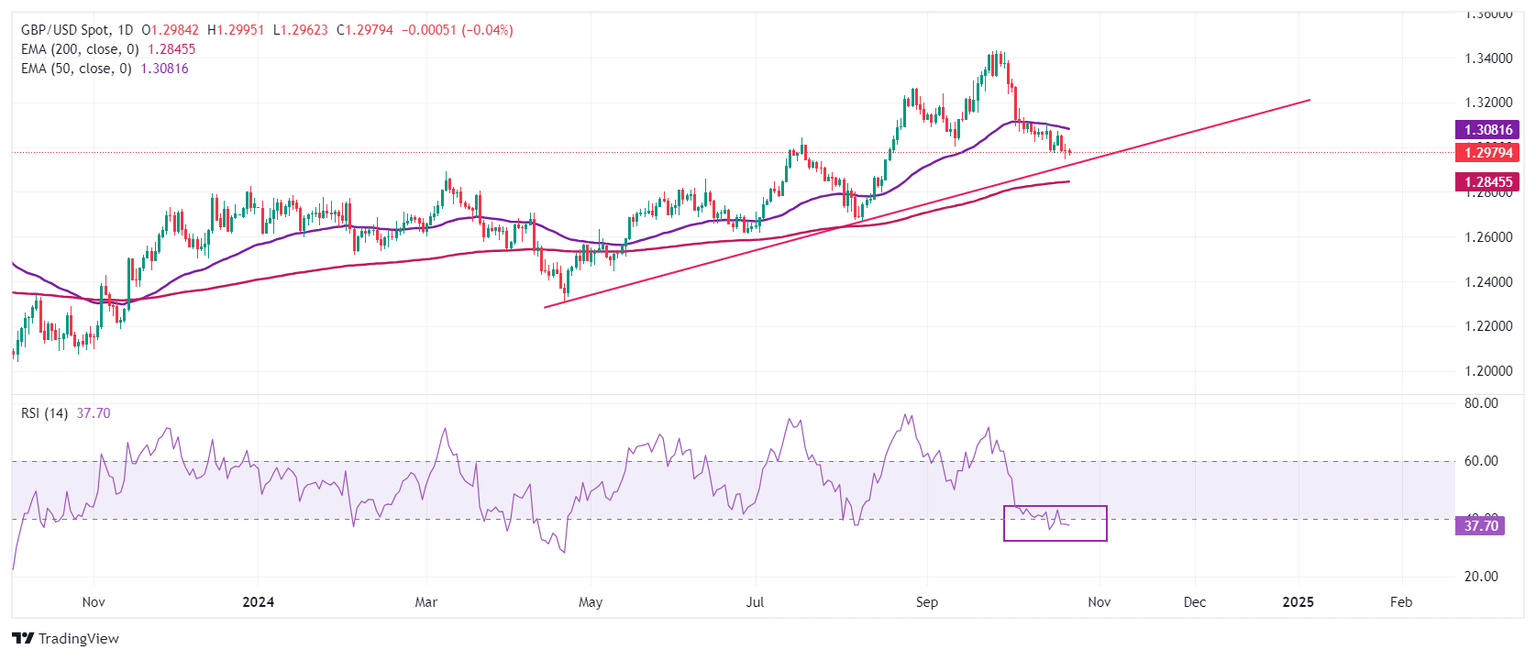

Technical Analysis: Pound Sterling remains below 50-day EMA

The Pound Sterling slumps to near 1.2950 in North American trading hours. The outlook of the GBP/USD pair is bearish as it remains below the 50-day Exponential Moving Average (EMA), which trades around 1.3080.

The 14-day Relative Strength Index (RSI) slides near 40.00, signaling that a bearish momentum is underway.

Looking down, the upward-sloping trendline drawn from the April 22 low of 1.2300 will be a major support zone for Pound Sterling bulls near 1.2920. A downside move below the same would drag the pair toward the 200-day EMA, which trades around 1.2845. On the upside, the Cable will face resistance near the 20-day EMA around 1.3110.

BoE FAQs

The Bank of England (BoE) decides monetary policy for the United Kingdom. Its primary goal is to achieve ‘price stability’, or a steady inflation rate of 2%. Its tool for achieving this is via the adjustment of base lending rates. The BoE sets the rate at which it lends to commercial banks and banks lend to each other, determining the level of interest rates in the economy overall. This also impacts the value of the Pound Sterling (GBP).

When inflation is above the Bank of England’s target it responds by raising interest rates, making it more expensive for people and businesses to access credit. This is positive for the Pound Sterling because higher interest rates make the UK a more attractive place for global investors to park their money. When inflation falls below target, it is a sign economic growth is slowing, and the BoE will consider lowering interest rates to cheapen credit in the hope businesses will borrow to invest in growth-generating projects – a negative for the Pound Sterling.

In extreme situations, the Bank of England can enact a policy called Quantitative Easing (QE). QE is the process by which the BoE substantially increases the flow of credit in a stuck financial system. QE is a last resort policy when lowering interest rates will not achieve the necessary result. The process of QE involves the BoE printing money to buy assets – usually government or AAA-rated corporate bonds – from banks and other financial institutions. QE usually results in a weaker Pound Sterling.

Quantitative tightening (QT) is the reverse of QE, enacted when the economy is strengthening and inflation starts rising. Whilst in QE the Bank of England (BoE) purchases government and corporate bonds from financial institutions to encourage them to lend; in QT, the BoE stops buying more bonds, and stops reinvesting the principal maturing on the bonds it already holds. It is usually positive for the Pound Sterling.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.