Pound Sterling dips below 1.3100 as Fed large rate cut bets wane

- The Pound Sterling underperforms the US Dollar as market expectations for the Fed opting for a big interest-rate cut have diminished.

- US employment growth came in lower than expected in August, while the jobless rate ticked down.

- This week, investors will majorly focus on the UK Employment and the US inflation data

The Pound Sterling (GBP) posts a fresh two-week below 1.3100 against the US Dollar (USD) in Monday’s North American session. The GBP/USD pair faces selling pressure as the US Dollar (USD) extends its recovery, with US Dollar Index (DXY) jumping to near 101.40. The Greenback gains ground as market bets that the Federal Reserve (Fed) will start its policy-easing process aggressively have diminished after Friday’s United States (US)Nonfarm Payrolls (NFP) data.

According to the CME FedWatch tool, the probability of the Fed reducing interest rates by 50 basis points (bps) to 4.75%-5.00% in September has declined to 27% from the 41% recorded before the release of the data for August.

The NFP report showed that job growth is broadly cooling compared to the readings seen in the last couple of years, the Unemployment Rate ticked lower, as expected, and wage growth accelerated. Even though there is increasing evidence that the labor market is softening, the latest data is strong enough to keep the US economy safe from entering a recession. The assessment that the labor market is holding up weighs on market expectations of a large Fed rate cut, uplifting the US Dollar.

For fresh cues over the interest-rate outlook, investors will keenly focus on the US Consumer Price Index (CPI) data for August, which will be published on Wednesday. The inflation report is expected to show that both monthly headline and core CPI – which excludes food and energy prices – are estimated to have grown steadily by 0.2%. Annual headline CPI is expected to have decelerated sharply to 2.6% from July’s reading of 2.9%.

US Dollar PRICE Today

The table below shows the percentage change of US Dollar (USD) against listed major currencies today. US Dollar was the strongest against the New Zealand Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.37% | 0.31% | 0.34% | -0.01% | 0.08% | 0.47% | 0.37% | |

| EUR | -0.37% | -0.11% | 0.03% | -0.37% | -0.34% | 0.11% | -0.02% | |

| GBP | -0.31% | 0.11% | 0.02% | -0.27% | -0.23% | 0.19% | 0.08% | |

| JPY | -0.34% | -0.03% | -0.02% | -0.34% | -0.24% | 0.12% | 0.23% | |

| CAD | 0.00% | 0.37% | 0.27% | 0.34% | 0.12% | 0.46% | 0.54% | |

| AUD | -0.08% | 0.34% | 0.23% | 0.24% | -0.12% | 0.43% | 0.29% | |

| NZD | -0.47% | -0.11% | -0.19% | -0.12% | -0.46% | -0.43% | -0.11% | |

| CHF | -0.37% | 0.02% | -0.08% | -0.23% | -0.54% | -0.29% | 0.11% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).

Daily digest market movers: Pound Sterling weakens with UK Employment in focus

- The Pound Sterling exhibits a mixed performance against its major peers on Monday. The British currency is expected to trade broadly sideways as investors focus on the United Kingdom (UK) Employment data for the quarter ending July, which will be published on Tuesday.

- The UK labor market data could influence market speculation for the Bank of England (BoE) interest-rate path for the remainder of the year. According to the estimates, the Unemployment Rate is seen ticking lower to 4.1% from the former reading of 4.2%. Average Earnings Including Bonuses are estimated to have softened to 4.1% from the prior release of 4.5%. Soft wage growth would increase expectations of more interest rate cuts by the BoE as it would imply a decline in inflation in the services sector.

- Meanwhile, a monthly report on Jobs from the Recruitment and Employment Confederation trade body and accountants KPMG showed that permanent job placements dropped at the fastest pace in five months, Reuters reported. The agency also noted that the pay growth offered for fresh hiring came in at a five-month low, one of the weakest readings since early 2021. "The news that while salaries rose last month it was at the weakest rate since March could help make the case for more rate cuts when the Monetary Policy Committee meets to decide the future path of interest rates," Jon Holt, KPMG's UK chief executive and senior partner, said.

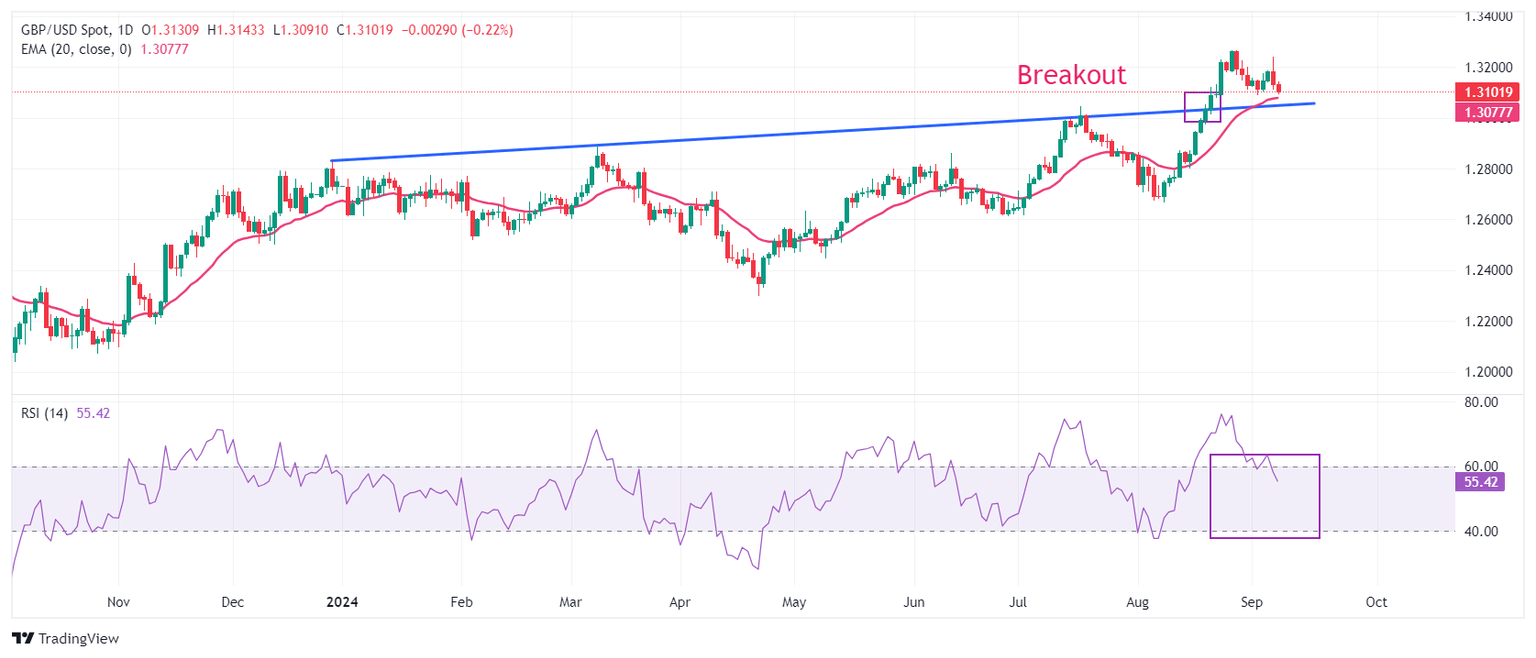

Technical Analysis: Pound Sterling declines sharply below 1.3100

The Pound Sterling extends its downside to near the crucial support of 1.3100 against the US Dollar. The GBP/USD pair is expected to find intermediate support near the 20-day Exponential Moving Average (EMA), which trades around 1.3075. Also, the upward-sloping trendline from the December 28, 2023, high of 1.2828 will act as key support for the Pound Sterling bulls.

The 14-day Relative Strength Index (RSI) declines into the 40.00-60.00 range, suggesting that the bullish momentum has concluded for now. However, the bullish trend remains intact as the indicator remains above the neutral level of 50.

Looking up, the Cable will face resistance near the round-level resistance of 1.3200 and the psychological level of 1.3500.

Fed FAQs

Monetary policy in the US is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability and foster full employment. Its primary tool to achieve these goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, it raises interest rates, increasing borrowing costs throughout the economy. This results in a stronger US Dollar (USD) as it makes the US a more attractive place for international investors to park their money. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates to encourage borrowing, which weighs on the Greenback.

The Federal Reserve (Fed) holds eight policy meetings a year, where the Federal Open Market Committee (FOMC) assesses economic conditions and makes monetary policy decisions. The FOMC is attended by twelve Fed officials – the seven members of the Board of Governors, the president of the Federal Reserve Bank of New York, and four of the remaining eleven regional Reserve Bank presidents, who serve one-year terms on a rotating basis.

In extreme situations, the Federal Reserve may resort to a policy named Quantitative Easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used during crises or when inflation is extremely low. It was the Fed’s weapon of choice during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy high grade bonds from financial institutions. QE usually weakens the US Dollar.

Quantitative tightening (QT) is the reverse process of QE, whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing, to purchase new bonds. It is usually positive for the value of the US Dollar.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.