Ethereum Price Forecast: Short-term holders may not impact ETH's price, Pectra mainnet upgrade set for May 7

Ethereum price today: $1,800

- Ethereum short-term holders' selling pressure may reduce in the coming weeks after scaling down their holdings in March.

- Ethereum developers agreed to ship Pectra on mainnet on May 7.

- ETH could decline to $1,500 if the tested trough at $1,800 fails to hold.

Ethereum (ETH) declined by 3% on Thursday as market participants continued to react to President Donald Trump's announcements regarding reciprocal tariffs. However, the selling pressure may not persist since most ETH short-term holders (STHs) already sold their assets in March.

Short-term holders are less likely to affect price, Pectra mainnet upgrade scheduled for May 7

Following President Trump's "Liberation Day" reciprocal tariff announcements, Ethereum whales depleted their holdings by 380K ETH, causing ETH to further decline in the past 24 hours, per Santiment data.

Despite the decline, the dormant circulation metric, which measures the total number of coins distributed daily based on the last time they changed addresses, showed most investors remained on the sidelines during the event. The metric's downtrend in the past two days indicates that investors across all age cohorts weren't active sellers despite the reciprocal tariffs announcement.

ETH dormant circulation. Source: Santiment

The spikes seen throughout March — stemming majorly from short-term holders — suggest that this investor cohort has already scaled down their holdings in anticipation of the tariffs. Considering STHs are susceptible to selling during market uncertainty, their absence could reduce the downside pressure on ETH.

Meanwhile, in the latest All Core Developers Consensus (ACDC) call, Ethereum developers shifted the date for the Pectra mainnet upgrade to May 7. A successful mainnet upgrade could alter the sentiment around ETH toward a positive tone.

Pectra will introduce several features to Ethereum, including wallet recovery, transaction batching, sponsored transactions, an increased staking limit of 2,048 ETH and blobspace expansion.

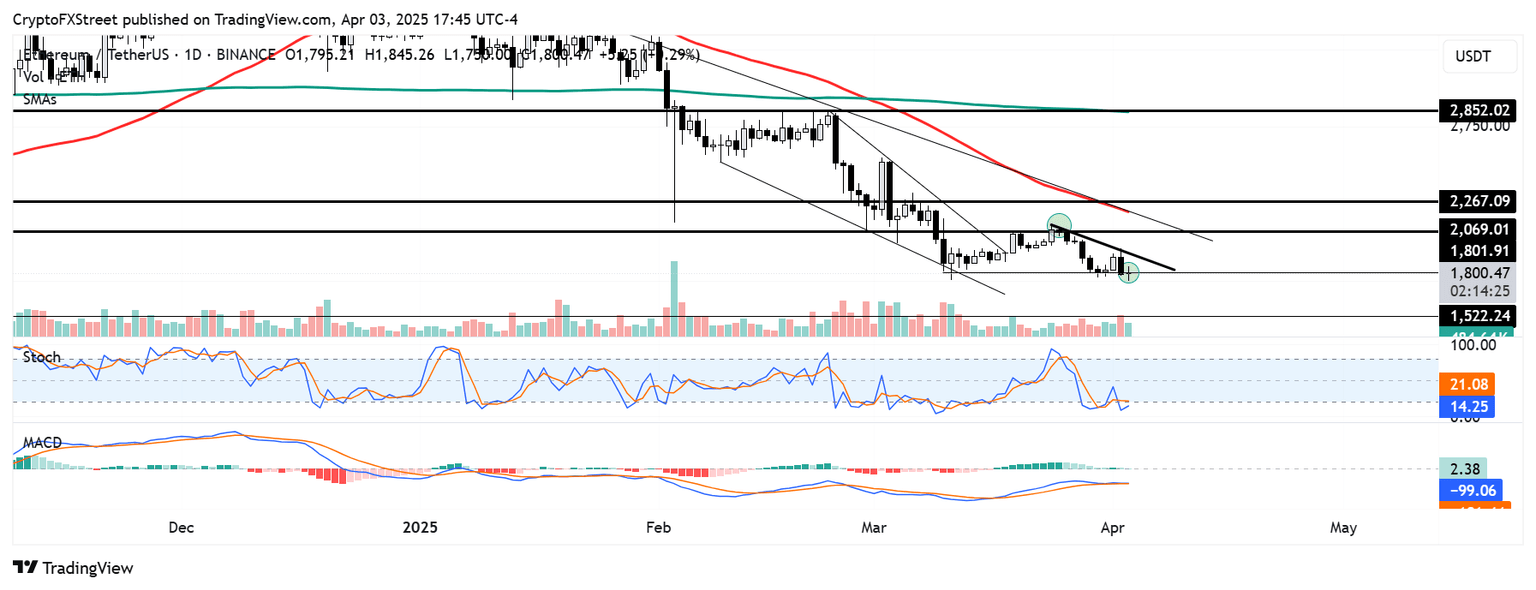

Ethereum Price Forecast: ETH risks a further decline if $1,800 is taken by the bears

Ethereum is down over 3%, triggering $47.7 million in futures liquidations in the past 24 hours, per Coinglass data. The total amount of liquidated long and short positions accounted for $34.52 million and $13.18 million, respectively.

ETH is testing the $1,800 support on Thursday after seeing a rejection at the $2,070 resistance last week. The decline could send ETH to find support at the $1,500 level in the short term. If the bearish pressure persists, ETH risks a sharp correction to $1,000 — a level last seen during the UST/LUNA crash in 2022.

ETH/USDT daily chart

The Stochastic Oscillator (Stoch) is in its oversold region, while the Moving Average Convergence Divergence (MACD) histogram bars are on the verge of flipping bearish, indicating dominant bearish momentum.

A firm recovery of the $1,800 support will invalidate the thesis and potentially send ETH to retest the resistance at $2,070.

Ethereum FAQs

Ethereum is a decentralized open-source blockchain with smart contracts functionality. Its native currency Ether (ETH), is the second-largest cryptocurrency and number one altcoin by market capitalization. The Ethereum network is tailored for building crypto solutions like decentralized finance (DeFi), GameFi, non-fungible tokens (NFTs), decentralized autonomous organizations (DAOs), etc.

Ethereum is a public decentralized blockchain technology, where developers can build and deploy applications that function without the need for a central authority. To make this easier, the network leverages the Solidity programming language and Ethereum virtual machine which helps developers create and launch applications with smart contract functionality.

Smart contracts are publicly verifiable codes that automates agreements between two or more parties. Basically, these codes self-execute encoded actions when predetermined conditions are met.

Staking is a process of earning yield on your idle crypto assets by locking them in a crypto protocol for a specified duration as a means of contributing to its security. Ethereum transitioned from a Proof-of-Work (PoW) to a Proof-of-Stake (PoS) consensus mechanism on September 15, 2022, in an event christened “The Merge.” The Merge was a key part of Ethereum's roadmap to achieve high-level scalability, decentralization and security while remaining sustainable. Unlike PoW, which requires the use of expensive hardware, PoS reduces the barrier of entry for validators by leveraging the use of crypto tokens as the core foundation of its consensus process.

Gas is the unit for measuring transaction fees that users pay for conducting transactions on Ethereum. During periods of network congestion, gas can be extremely high, causing validators to prioritize transactions based on their fees.

Author

Michael Ebiekutan

FXStreet

With a deep passion for web3 technology, he's collaborated with industry-leading brands like Mara, ITAK, and FXStreet in delivering groundbreaking reports on web3's transformative potential across diverse sectors. In addi

%2520%5B22.11.53%2C%252003%2520Apr%2C%25202025%5D-638793138293622741.png&w=1536&q=95)