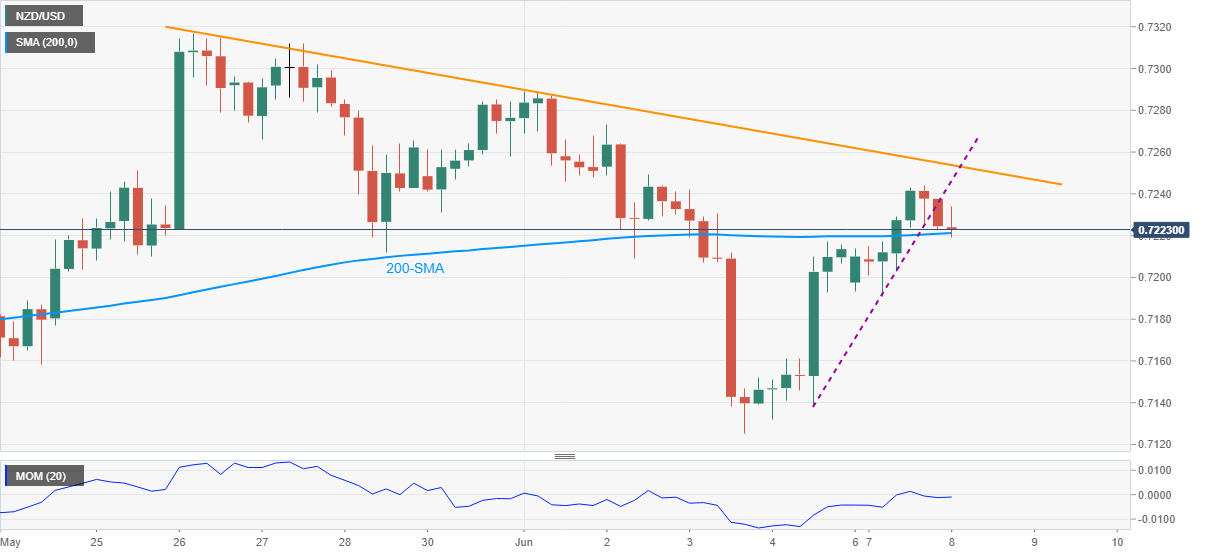

NZD/USD Price Analysis: Sellers attack 200-SMA on the way to 0.7200

- NZD/USD snaps two-day uptrend, holds lower ground of late.

- Immediate trend line breakdown battles the key SMA amid recovering Momentum.

- Sellers may wait for clear SMA break, bulls needs sustained run-up beyond fortnight-old resistance for re-entry.

NZD/USD remains on the back foot around the day’s low of 0.7220 during early Tuesday. In doing so, the Kiwi pair marks the first intraday loss in three days as bears battle with 200-SMA.

Although recovery of the Momentum line and the strong SMA tests NZD/USD sellers, for now, the pair’s U-turn from 0.7244 and a falling trend line from late May signal further downside of the quote.

In doing so, the 0.7200 and 0.7190 levels could act as intermediate rests for the bears ahead of dragging the quote towards the monthly low of 0.7125.

On the flip side, a corrective pullback beyond the support-turned-resistance line from Friday, near 0.7245, will have to cross the two-week-long falling trend line around 0.7255 to convince NZD/USD buyers.

Following that, the monthly high near 0.7300 and late May tops close to 0.7320 will be in the spotlight.

Overall, NZD/USD remains pressured and the latest trend line break offers entry signals to intraday sellers.

NZD/USD four-hour chart

Trend: Further weakness expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.