NZD/USD Price Analysis: Bulls defending the 38.2% Fibo support

- An upside extension in NZD/USD on the hourly chart is to play for in a weak US dollar environment.

- NZD/USD bulls are seeking a break of resistance.

It has been a bust start to the week for the bird with the ope offering a considerable downside gap only to be met with strong demand in European trade on the back of a vicious slide in the greenback:

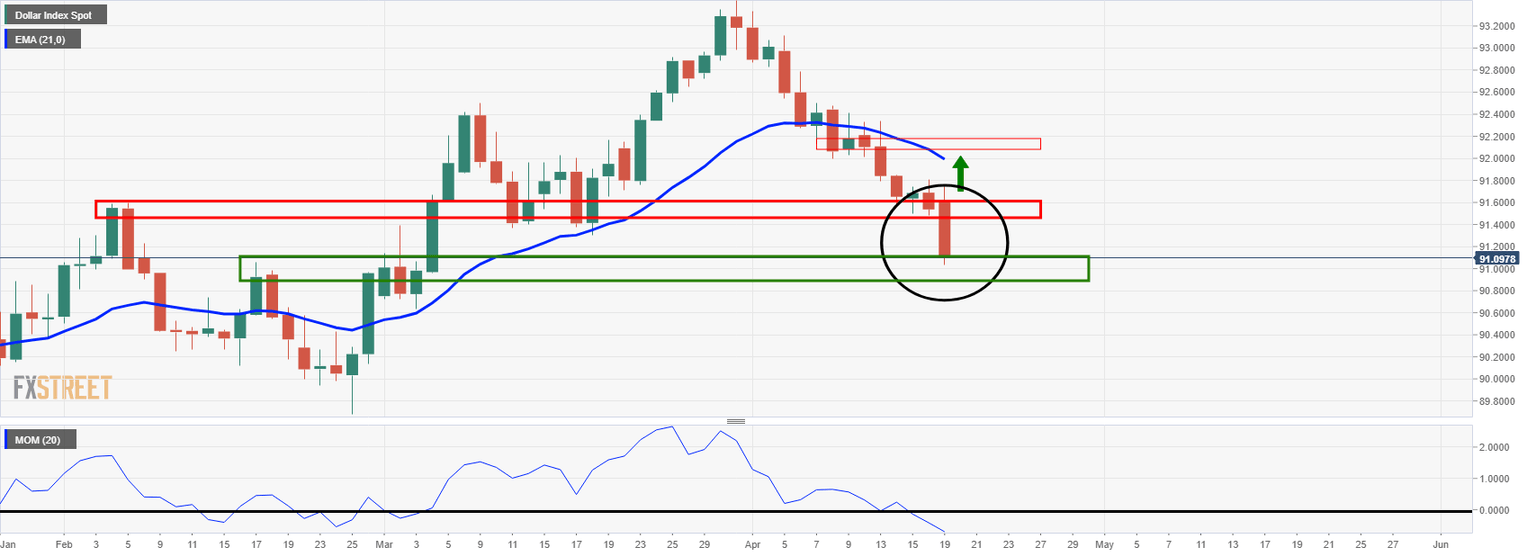

DXY daily chart

The price action has distorted the downside bias and leaves prospects of an hourly bullish extension on the table as follows:

NZD/USD, 1-hour chart

So far, there is strong resistance on bullish attempts, but the price is holding at a 38.2% Fibonacci confluence that meets prior resistance structure looking left.

The bulls can continue to monitor for bullish price action and structure on a lower time frame for an optimal entry:

30-min chart

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.