NZD/USD is faded as the US dollar finds solace on hawkish Fed member statements

- NZD/USD pressured as Fed speakers play up the hawkish outlook following hot US CPI.

- NZD/USD bulls meet a wall of resistance and suffer heavy supply.

- The bears could be encouraged to move in for a test of critical support on the daily time frame.

NZD/USD traders were taken on a ride of volatility on Thursday as the markets positioned for macro inflationary pressures which flows made their way through every facet of the forex space. The commodity complex was bid on the inflation hedge play which initially supported the kiwi after the knee-jerk bid in the greenback before it was met with heavy supply again in midday trade.

At 0.6685 during the time of writing, NZD/USD is around flat on the day after travelling between a low of 0.6652 and a high of 0.6732 in the final hours of Wall Street's trade. The bird spiked lower after the Federal Reserve James Bullard spoke out over the hot US inflation data, commenting that the central bank could be considering meeting rate hikes. He has said that he favours a 50bp hike in March and 10bps by July.

''Volatility remains the order of the day. Higher US yields are battling things like higher commodity prices for attention; while rates have had less of an influence on FX of late, the knee-jerk reaction to higher US bond yields tends to be NZD-negative,'' analysts at ANZ Bank explained.

NZD/USD technical analysis

As per the prior analysis, whereby it ws noted:

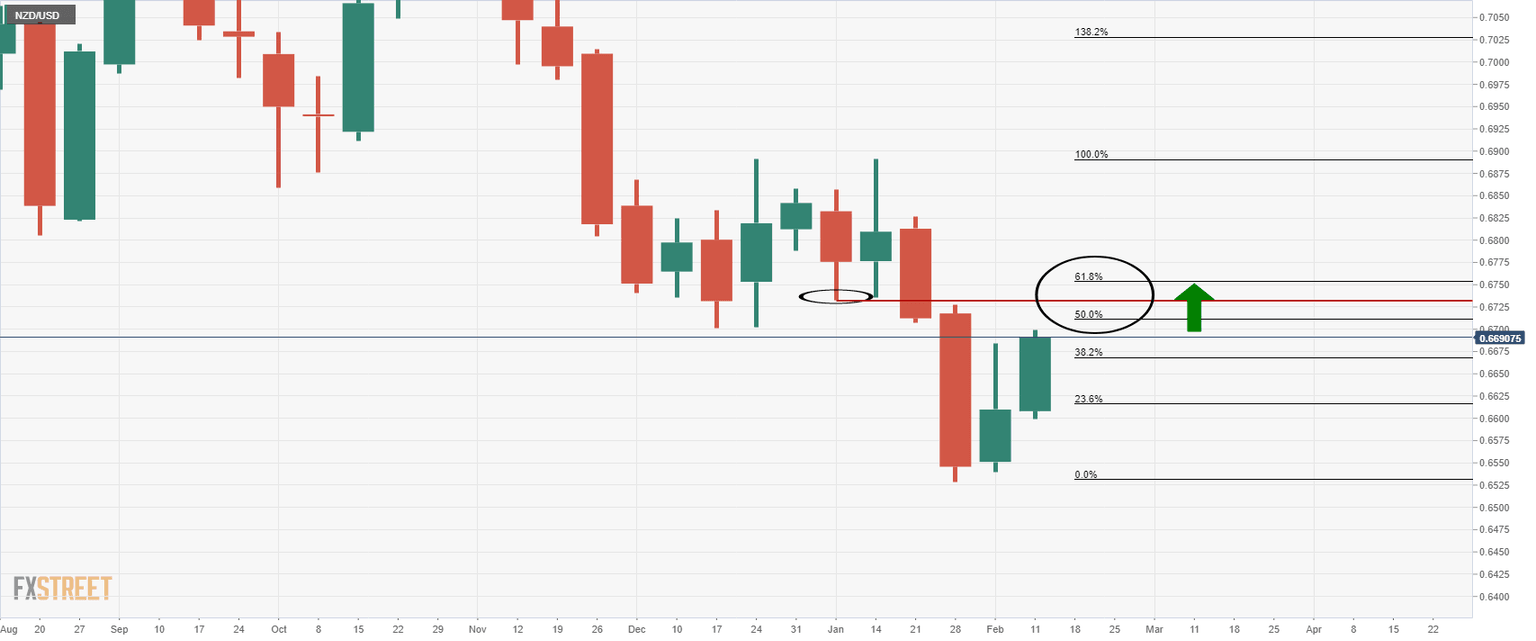

The ''NZD/USD bulls are taking charge in a significant correction,'' that was moving ''in on old lows near 0.67 the figure and towards the neckline of the M-formation near 0.6733,'' the price reache dthe target on Thursday.

This resided between the 50% mean reversion and the 61.8% ratio as follows:

NZD/USD prior and live analysis

NZD/USD daily chart

The Doji candle, if followed by a bearish close on Friday, could set case for a downside continuation for next week's business:

NZD/USD weekly chart

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.