NZD/JPY Price Prediction: Seems vulnerable below 38.2% Fibo. amid RBNZ’s dovish tilt

- NZD/JPY witnessed a dramatic turnaround from a nearly two-week high touched this Wednesday.

- The RBNZ’s surprise rate cut prompts aggressive selling, though a positive risk tone helps limit losses.

- The technical setup favors bearish traders and supports prospects for a further near-term downfall.

The NZD/JPY cross retreated around 150 pips from the 89.50 area, or a nearly two-week high touched earlier this Wednesday in reaction to the Reserve Bank of New Zealand's (RBNZ) surprise 25 basis points (bps) rate cut. Spot prices, however, manage to rebound a few pips from the daily low and trade around mid-0.8800s during the first half of the European session, still down 0.80% for the day.

A generally positive tone around the equity markets, along with diminishing odds of the Bank of Japan (BoJ) hiking interest rates again this year, undermines the safe-haven Japanese Yen (JPY) and offers some support to the NZD/JPY cross. That said, any meaningful recovery still seems elusive in the wake of the RBNZ's dovish tilt, indicating more cuts over the coming months in the wake of the recent progress towards meeting the annual inflation target and weaker domestic economic growth.

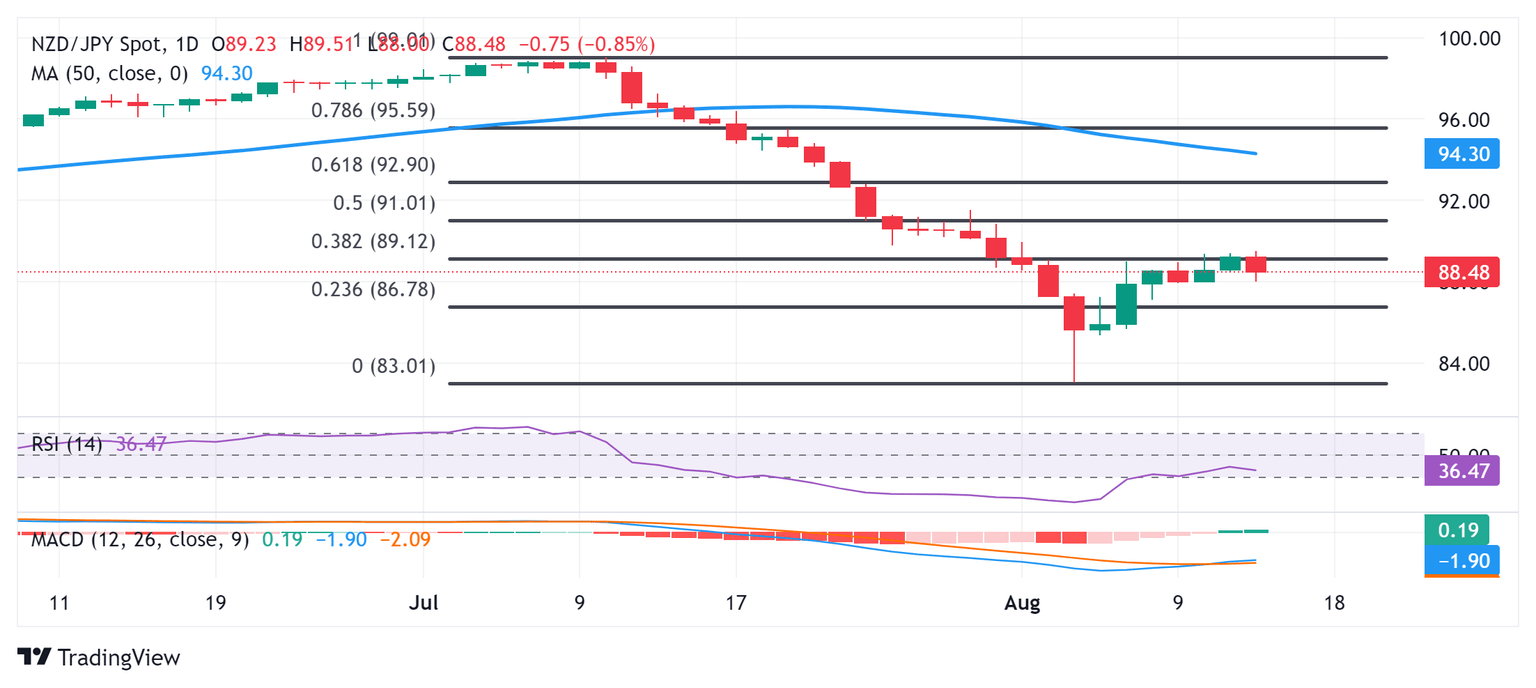

From a technical perspective, the NZD/JPY cross once again failed to make it through the 38.2% Fibonacci retracement level of the July-August fall. The said barrier is pegged around the 89.10-89.15 region and is followed by the daily high, around the 89.50 area. A sustained strength beyond the latter will be seen as a fresh trigger for bullish traders and set the stage for the resumption of the recent strong recovery from the vicinity of the 83.00 mark, or the lowest level since May 2023 touched last week.

The NZD/JPY cross might then aim to surpass the 90.00 psychological mark and climb further towards the next relevant hurdle near the 90.50-90.55 region. The momentum could extend further towards the 50% Fibo. level, around the 91.00 mark, which could act as a strong barrier and cap the upside for spot prices.

Meanwhile, oscillators on the daily chart are holding deep in negative territory and have also recovered from the oversold zone. This, in turn, suggests that any meaningful positive move might still be seen as a selling opportunity and runs the risk of fizzling out rather quickly. That said, bearish traders are likely to wait for a convincing break below the 88.00 mark before placing fresh bets. The NZD/JPY cross might then turn vulnerable to test sub-87.00 levels, or the 23.6% Fibo. level support.

NZD/JPY daily chart

New Zealand Dollar FAQs

The New Zealand Dollar (NZD), also known as the Kiwi, is a well-known traded currency among investors. Its value is broadly determined by the health of the New Zealand economy and the country’s central bank policy. Still, there are some unique particularities that also can make NZD move. The performance of the Chinese economy tends to move the Kiwi because China is New Zealand’s biggest trading partner. Bad news for the Chinese economy likely means less New Zealand exports to the country, hitting the economy and thus its currency. Another factor moving NZD is dairy prices as the dairy industry is New Zealand’s main export. High dairy prices boost export income, contributing positively to the economy and thus to the NZD.

The Reserve Bank of New Zealand (RBNZ) aims to achieve and maintain an inflation rate between 1% and 3% over the medium term, with a focus to keep it near the 2% mid-point. To this end, the bank sets an appropriate level of interest rates. When inflation is too high, the RBNZ will increase interest rates to cool the economy, but the move will also make bond yields higher, increasing investors’ appeal to invest in the country and thus boosting NZD. On the contrary, lower interest rates tend to weaken NZD. The so-called rate differential, or how rates in New Zealand are or are expected to be compared to the ones set by the US Federal Reserve, can also play a key role in moving the NZD/USD pair.

Macroeconomic data releases in New Zealand are key to assess the state of the economy and can impact the New Zealand Dollar’s (NZD) valuation. A strong economy, based on high economic growth, low unemployment and high confidence is good for NZD. High economic growth attracts foreign investment and may encourage the Reserve Bank of New Zealand to increase interest rates, if this economic strength comes together with elevated inflation. Conversely, if economic data is weak, NZD is likely to depreciate.

The New Zealand Dollar (NZD) tends to strengthen during risk-on periods, or when investors perceive that broader market risks are low and are optimistic about growth. This tends to lead to a more favorable outlook for commodities and so-called ‘commodity currencies’ such as the Kiwi. Conversely, NZD tends to weaken at times of market turbulence or economic uncertainty as investors tend to sell higher-risk assets and flee to the more-stable safe havens.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.