Nvidia stock dinged by report of overheating Blackwell chips

Nvidia sinks 3% as report surfaces of overheating Blackwell AI chips

- The Information reports that Blackwell chips are overheating at data centers.

- Nvidia reports Q3 earnings on Wednesday with Wall Street expecting more than $33 billion in revenue.

- Dow Jones sheds weight as NVDA retreats 1.28% on Monday.

- Google is working with Nvidia supercomputer to study quantum computing.

Nvidia (NVDA) stock slumped 3% at the start of trading on Monday after a report over the weekend shed light on allegations from customers that the chipmaker’s leading artificial intelligence (AI) chip is having problems with overheating.

On Sunday, The Information reported that Nvidia's newest Blackwell GPU chip has been known to overheat when working in concert with others in large server racks. This could prove to be a snag for Nvidia’s rollout schedule as customers deal with the setback.

Nvidia stock ended the day 1.28% lower, while the Dow Jones Industrial Average, of which it is a member, fell 0.13% on the day.

Nvidia stock news

The Information reported that many of Nvidia’s AI customers are having to re-jigger their data centers as overheating caused by the inclusion of Blackwell graphics processing units deals a blow to their operations. Hyperscalers like Microsoft (MSFT), Alphabet (GOOGL) and Amazon (AMZN) are all thought to be facing similar issues.

Nvidia has been releasing statements in an attempt to tamp down worries and calling the situtation normal "iterations" of a new product.

The Blackwell GPUs, which were first rolled out in the second quarter and continue to have a large, constrained backorder, are set up in sets of 72 on server racks. The server racks are then overheating and failing to meet workload requirements due to downtime.

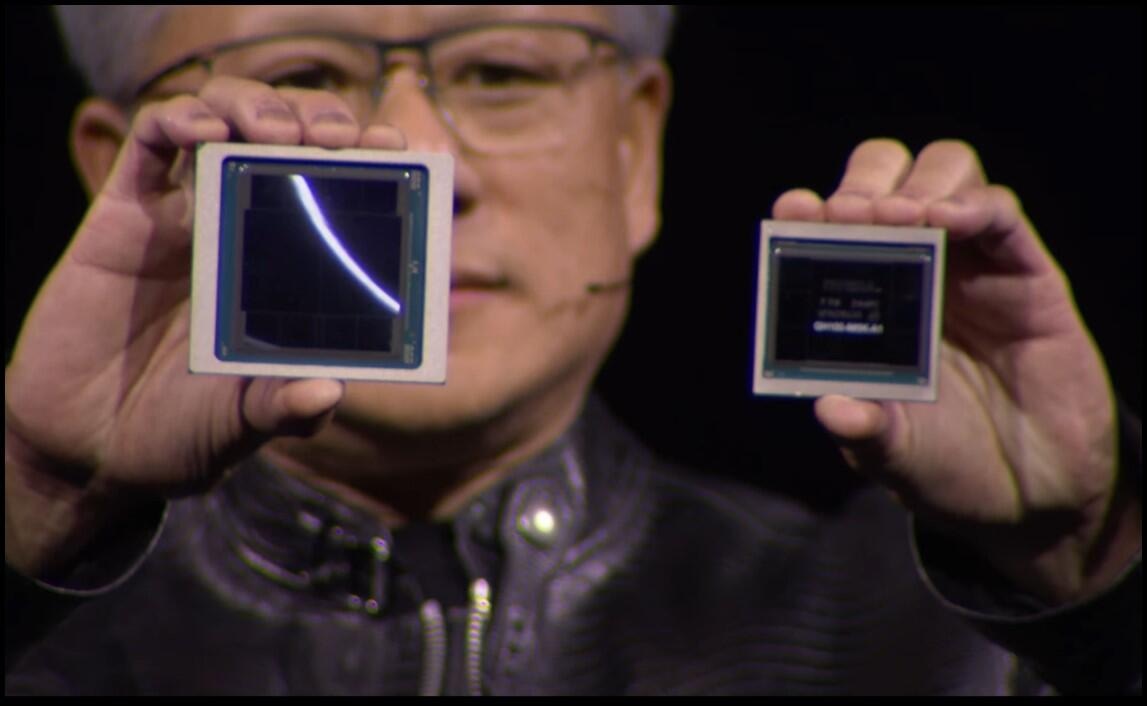

Nvidia CEO Jensen Huang holds a Blackwell GPU on the left and an H100 GPU on the right. (Source:Nvidia)

Packed with 208 billion transistors each, the Blackwell GPUs are said to work between seven and 30 times better on a performance basis for AI iterations than Nvidia’s previous generation of H100 GPUs. Astoundingly, it is said to use just a fraction of the energy as the previous generation as well, in some cases just 4% of the prior level of power.

In other news, Nvidia is working in partnership with Google to build quantum AI processors. Engineers at Google are utilizing a Nvidia supercomputer that has stitched together 1,024 H100 chips to study the physics of quantum processors.

“AI supercomputing power will be helpful to quantum computing’s success,” Nvidia executive Tim Costa said in a statement. “Google’s use of the CUDA-Q platform demonstrates the central role GPU-accelerated simulations have in advancing quantum computing to help solve real-world problems.”

This all precedes Nvidia’s Q3 results, which are scheduled to be released in Wednesday’s post-market. Wall Street projects adjusted earnings per share of $0.74 on revenue just above $33 billion.

Nvidia stock forecast

Ahead of the earnings release on Wednesday, which is the main point of interest this week on the Street, NVDA stock has tilted below the $140.76 former resistance level from June 20. That's a bad sign, but everyone knows all will depend on the outlook given on Wednesday evening. Nvidia's a $3.5 trillion company, so why not $4 trillion?

The next resistance level is in the area just north of $149, while true support hangs much lower in the vicinity of $92 and $96. If the market sees a good quarter but nothing to write home about, expect shares to drift back into the $120s.

The Moving Average Convergence Divergence (MACD) is looking a tad glum or bearish at the moment. The 100-day Simple Moving Average (SMA) near $125 seems like a pullback catcher if it comes to that.

NVDA daily stock chart

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Clay Webster

FXStreet

Clay Webster grew up in the US outside Buffalo, New York and Lancaster, Pennsylvania. He began investing after college following the 2008 financial crisis.