Natural Gas sees gains halved on the back of weaker US Retail Sales

- Natural Gas eases gains after US Retail Sales turning ugly.

- Traders are jumping on the headline from Gassco, the Norwegian gas regulator.

- The US Dollar Index trades higher, ahead of US Retail Sales and an army of Fed speakers on Tuesday.

Natural Gas price (XNG/USD) is easing of its intraday high after softer US Retail Sales, while a hot headline by Reuters and Bloomberg is still trending on Norway. Norwegian gas regulator Gassco reported that the Nyhamna gas processing plat is down for unplanned maintenance. This takes out roughly 33.8 million cubic meters of Liquidied Natural Gas (LNG) production with uncertainty on when the plant will get back online.

Meanwhile, the US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, is giving back its gains as well, and is back to flat. This comes after US Retail Sales were a miss on all fronts with all prints coming in below consensus calls and all revisions were to the downside for the previous month. This shows that US consumers are starting to feel the pain of these elevated rates and might now filter through into the US labor market and US economic data.

Natural Gas is trading at $2.89 per MMBtu at the time of writing.

Natural Gas news and market movers: Europe facing delivery issues again

- After some steady days of Norwegian LNG flows into Europe, the main deliverer for Europe is facing issues again. The Nyhamna gas plant is out for unforseen maintenance and no timing available on when the plant will be operational again, according to Bloomberg.

- According to Bloomberg data, European combined Liquified Natural Gas (LNG) storages are filled up nearly 73.41%, back at levels from mid-January earlier this year.

- Shell Plc will buy LNG trader Pavilion Energy from the Singaporean state-owned company Temasek Holdings. Pavilion Energy trades and ships LNG in Asia and Europe, Reuters reports.

- Var Energi and VNG extend their collaboration for another 12 years, with an agreement from Var Energi to deliver 5 billion cubic meters of LNG to VNG, Bloomberg reports.

Natural Gas Technical Analysis: Norway remains weak spot on deliveries

Natural Gas prices are set to ease further despite efforts from traders to keep XNG prices at current levels. With European Ggas storages on track to be filled up in time when the heating season kicks in, the risk of sluggish demand could take over. Add in there the easing tensions from the Middle East, and the near term outlook for LNG looks bleak.

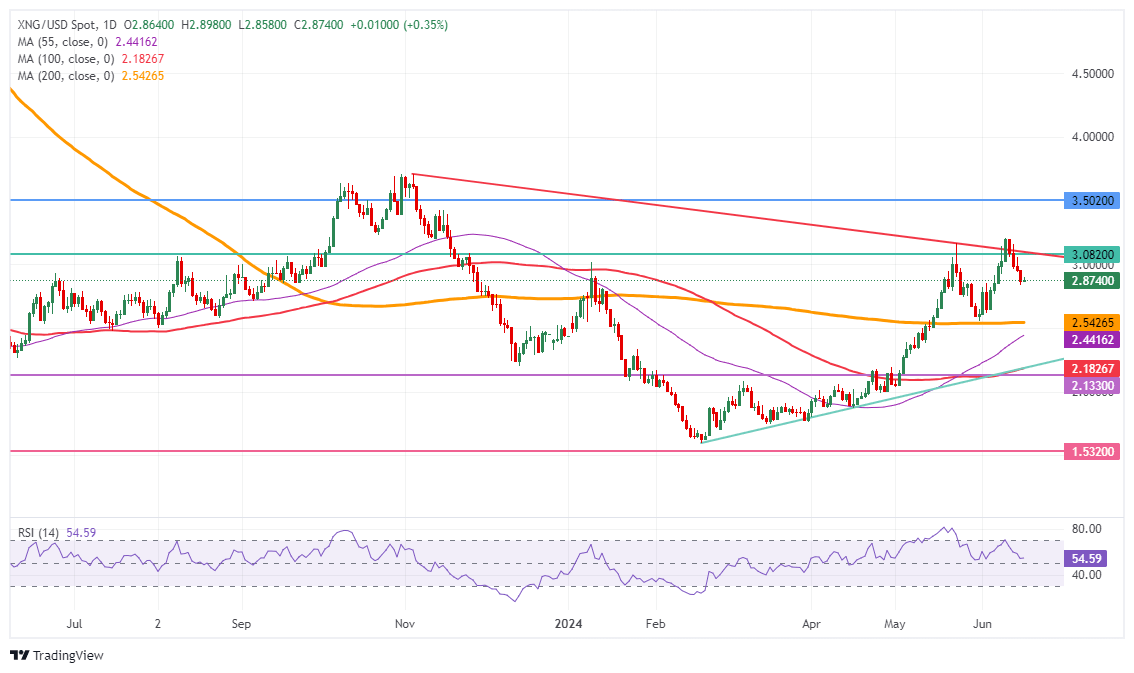

The pivotal level near $3.08 (the high from March 6, 2023) remains key after its false break last week. In addition, the red descending trendline at $3.10 will also weigh on this area as a cap. Further up, the fresh year-to-date high at $3.16 is the level to beat.

On the downside, the 200-day Simple Moving Average (SMA) acts as the first support near $2.54. Should that support area fail to hold, the next target could be the pivotal level near $2.14, with interim support by the 55-day SMA near $2.44. Further down, the biggest support comes at $2.18 with the 100-day SMA.

Natural Gas: Daily Chart

Natural Gas FAQs

Supply and demand dynamics are a key factor influencing Natural Gas prices, and are themselves influenced by global economic growth, industrial activity, population growth, production levels, and inventories. The weather impacts Natural Gas prices because more Gas is used during cold winters and hot summers for heating and cooling. Competition from other energy sources impacts prices as consumers may switch to cheaper sources. Geopolitical events are factors as exemplified by the war in Ukraine. Government policies relating to extraction, transportation, and environmental issues also impact prices.

The main economic release influencing Natural Gas prices is the weekly inventory bulletin from the Energy Information Administration (EIA), a US government agency that produces US gas market data. The EIA Gas bulletin usually comes out on Thursday at 14:30 GMT, a day after the EIA publishes its weekly Oil bulletin. Economic data from large consumers of Natural Gas can impact supply and demand, the largest of which include China, Germany and Japan. Natural Gas is primarily priced and traded in US Dollars, thus economic releases impacting the US Dollar are also factors.

The US Dollar is the world’s reserve currency and most commodities, including Natural Gas are priced and traded on international markets in US Dollars. As such, the value of the US Dollar is a factor in the price of Natural Gas, because if the Dollar strengthens it means less Dollars are required to buy the same volume of Gas (the price falls), and vice versa if USD strengthens.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.