Mexican Peso rallies Friday, ends June with over 7% losses

Most recent article: Mexican Peso weakens against the Euro after French election results

- Mexican Peso rebounds to 18.24 vs. US Dollar following Banxico's decision to maintain 11.00% rate.

- Decision aligned with recent inflation data, targeting 3% inflation by Q4 2025.

- Inflation risks heightened by service sector, cost pressures, Peso fall and geopolitical tensions.

The Mexican Peso recovered ground against the US Dollar and rallied more than 1% on Friday after the Bank of Mexico (Banxico) decided to keep rates unchanged due to “idiosyncratic factors” and the Peso’s depreciation following the June 2 general election results. Although the USD/MXN trades with losses of 0.73% at 18.30 during the day, ends the week and month with gains of 1.19% and 7.72%, respectively.

Banxico left a lifeline to the battered Peso on Thursday, holding rates at 11.00% after inflation reaccelerated, according to June’s mid-month inflation data.

The Mexican institution expects headline inflation to converge to the bank’s 3% target by Q4 2025 and acknowledged that inflation risks are skewed to the upside due to high services inflation, cost pressures, Mexican Peso depreciation and geopolitical conflicts.

Across the border, the US Federal Reserve’s (Fed) preferred inflation gauge came as expected by the consensus, showing an improvement in headline and core Personal Consumption Expenditures (PCE) Price Index.

The data failed to underpin the Greenback, which remains pressured, losing some 0.16% as revealed by the US Dollar Index (DXY). Therefore, the USD/MXN might continue on the back foot toward the remainder of the day as sellers eye an April 19 high of 18.15.

Daily digest market movers: Mexican Peso strengthens after Banxico hold

- Banxico’s decision was not unanimous and was perceived as dovish as Deputy Governor Omar Mejia Castelazo opted for a quarter of a percentage rate cut.

- Mexico’s central bank monetary policy statement highlighted the Governing Board expects the disinflation process to evolve and added that “Looking ahead, the board foresees that the inflationary environment may allow for discussing reference-rate adjustments.”

- A Citibanamex survey showed economists priced out fewer rate cuts by the central bank. They also revised the Gross Domestic Product (GDP) for 2024 downward from 2.2% to 2.1% YoY and expect the USD/MXN exchange rate to finish the year at 18.70, up from 18.00 previously reported.

- US PCE was lower than April’s 0.3% and was 0% MoM as expected. Core PCE expanded by 0.1% MoM as estimated, which is also beneath the previous reading of 0.3%.

- US Consumer Sentiment final reading for June of 68.2 deteriorated compared to May’s 69.1, yet improved as the preliminary reading was 65.8. Inflation expectations remained steady in the short and long periods at 3%.

- CME FedWatch Tool shows odds for a 25-basis-point Fed rate cut at 59.5%, unchanged from the previous day.

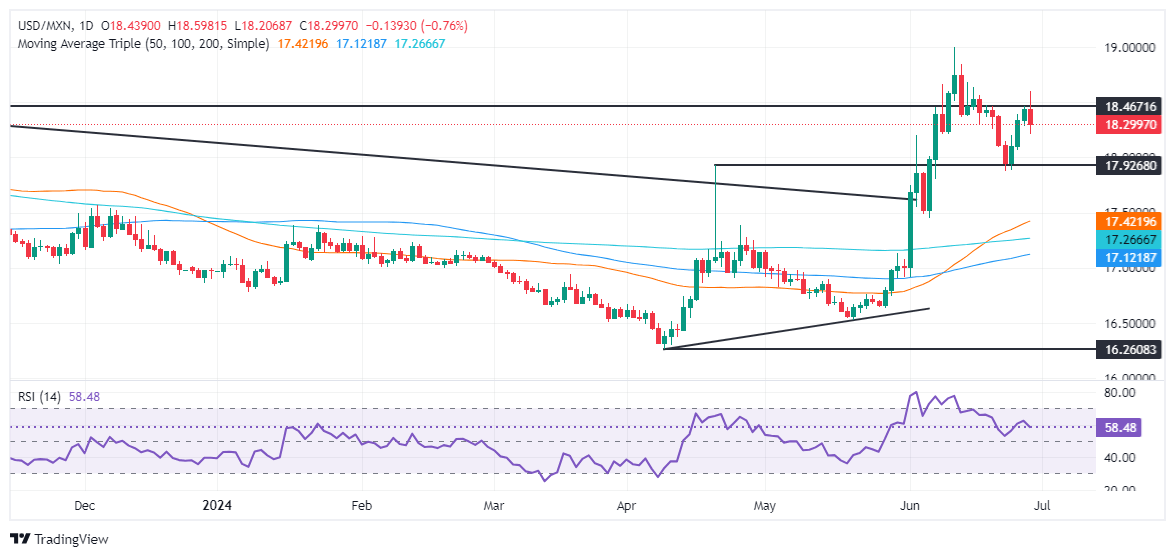

Technical analysis: Mexican Peso climbs as USD/MXN tumbles below 18.30

The USD/MXN is undergoing a pullback after hitting a daily high of 18.59 earlier in the day, opening the door to challenging key support levels. From a momentum standpoint, sellers are gathering some steam. This is depicted by the Relative Strength Index (RSI) pointing downward though still remaining bullish, suggesting the pullback could be short-lived.

For a bearish continuation, sellers need to reclaim the April 19 high turned support at 18.15, which would pave the way toward 18.00. The next support would be the 50-day Simple Moving Average (SMA) at 17.37 before testing the 200-day SMA at 17.23.

On the other hand, if buyers achieve a decisive break above the psychological 18.50 level, the next stop would be the year-to-date (YTD) high of 18.99, followed by the March 20, 2023, high of 19.23.

Inflation FAQs

Inflation measures the rise in the price of a representative basket of goods and services. Headline inflation is usually expressed as a percentage change on a month-on-month (MoM) and year-on-year (YoY) basis. Core inflation excludes more volatile elements such as food and fuel which can fluctuate because of geopolitical and seasonal factors. Core inflation is the figure economists focus on and is the level targeted by central banks, which are mandated to keep inflation at a manageable level, usually around 2%.

The Consumer Price Index (CPI) measures the change in prices of a basket of goods and services over a period of time. It is usually expressed as a percentage change on a month-on-month (MoM) and year-on-year (YoY) basis. Core CPI is the figure targeted by central banks as it excludes volatile food and fuel inputs. When Core CPI rises above 2% it usually results in higher interest rates and vice versa when it falls below 2%. Since higher interest rates are positive for a currency, higher inflation usually results in a stronger currency. The opposite is true when inflation falls.

Although it may seem counter-intuitive, high inflation in a country pushes up the value of its currency and vice versa for lower inflation. This is because the central bank will normally raise interest rates to combat the higher inflation, which attract more global capital inflows from investors looking for a lucrative place to park their money.

Formerly, Gold was the asset investors turned to in times of high inflation because it preserved its value, and whilst investors will often still buy Gold for its safe-haven properties in times of extreme market turmoil, this is not the case most of the time. This is because when inflation is high, central banks will put up interest rates to combat it. Higher interest rates are negative for Gold because they increase the opportunity-cost of holding Gold vis-a-vis an interest-bearing asset or placing the money in a cash deposit account. On the flipside, lower inflation tends to be positive for Gold as it brings interest rates down, making the bright metal a more viable investment alternative.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.