Mexican Peso recovers as market sentiment lifts

Most recent article: Mexican Peso recovers amid political turmoil and Banxico’s report

- The Mexican Peso is strengthening as risk appetite improves.

- Recent mixed US data is dispelling fears of a hard landing for the US economy.

- Political risk remains a negative background factor for the Peso.

The Mexican Peso (MXN) trades higher in its key pairs on Wednesday amid a cautiously optimistic market mood. European equities are trading modestly higher and the increasingly held view that the US Federal Reserve (Fed) will be able to lower interest rates in an orderly fashion – avoiding disruptions to the economy – is further buoying investor risk appetite.

Several lower tier US data releases have come out over recent days that have painted a mixed picture and helped allay concerns the economy is heading for a hard landing. These include higher-than-expected Consumer Confidence in August and a surge in US Durable Goods Orders in July released Monday, though labor-market pessimism lingers and the Richmond Fed Manufacturing Index sank below estimates.

Mexican Peso faces pressure from political factors

The Mexican Peso, meanwhile, has been pressured in recent sessions by a revival of the debate over reforms the new Morena-led government is planning for the Mexican judiciary. The proposed changes would make judges and magistrates elected by popular vote; critics say this will undermine justice, democracy, and investor confidence in Mexico.

Monday saw the new reforms voted through a committee for debate in the lower house in September when parliament opens, according to ABC News. Disagreement over the reforms has led to public demonstrations in Mexico City by members of the judiciary. The US ambassador to Mexico, Ken Salazar, said the “popular direct election of judges is a major risk to the functioning of Mexico's democracy.”

Salazar’s criticisms have led the Mexican government to “pause” diplomatic relations with both the US and Canada. If the stand-off escalates, there is the potential for it to negatively impact free trade between the three countries with negative implications for the Mexican Peso. This would especially be the case should former President Donald Trump win the presidential election.

The diplomatic skirmish comes at a time when Mexico stands to potentially benefit from an escalating trade war between North America and China. News on Tuesday revealed that Canada has decided to increase tariffs on Chinese electric vehicle (EV) and steel imports, by 100% and 25%, respectively.

The decision could benefit Mexico, however, because of its existing role as an intermediary manufacturer of Chinese EVs. These, destined for North America, are not subject to punitive tariffs because of the free-trade agreement that exists between the US, Canada and Mexico, according to Bloomberg News.

At the time of writing, one US Dollar (USD) buys 19.67 Mexican Pesos, EUR/MXN trades at 21.89, and GBP/MXN at 26.00.

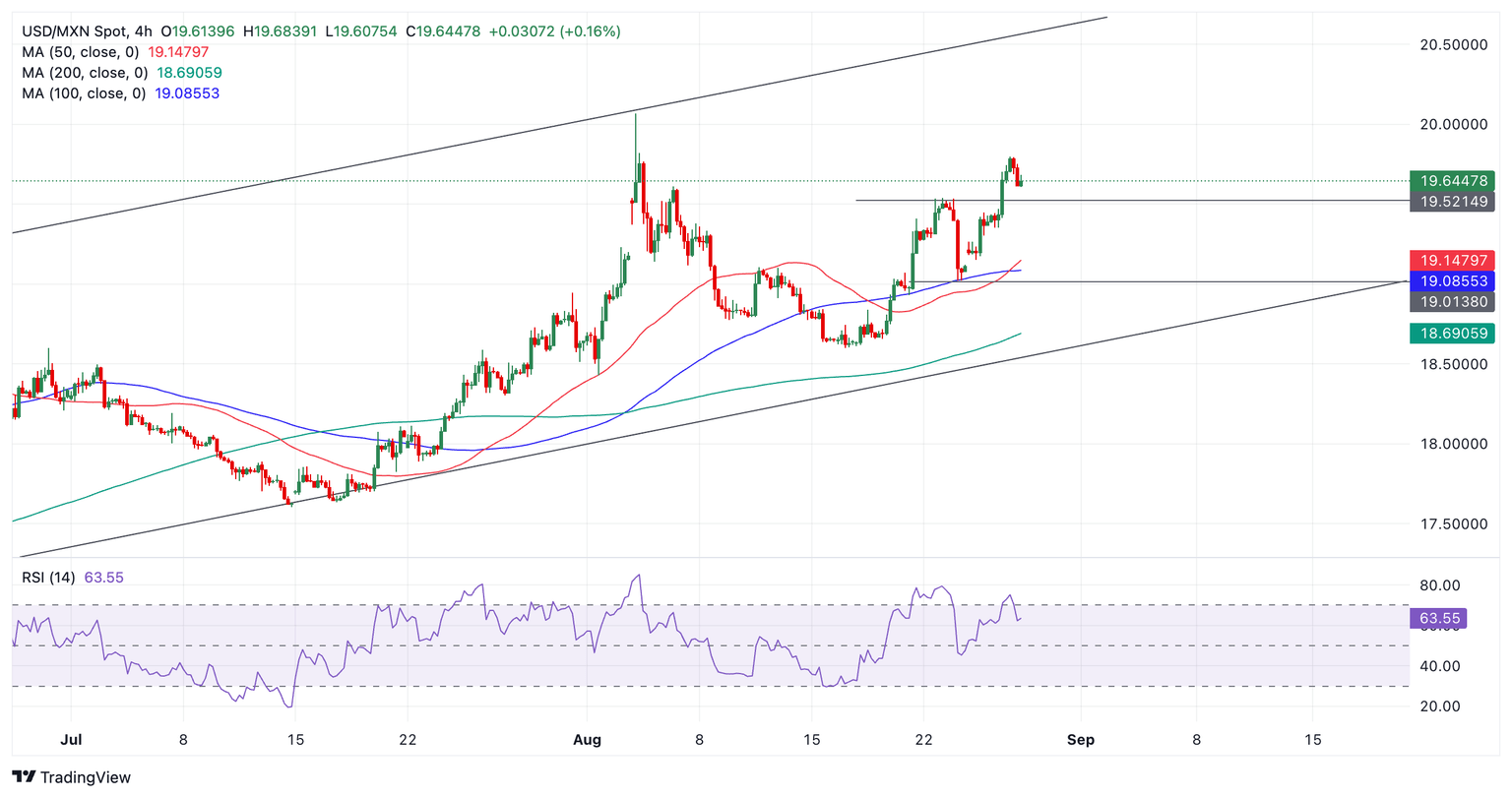

Technical Analysis: USD/MXN extends leg higher within rising channel

USD/MXN is moving up within a rising channel and the established uptrend favors longs over shorts.

The pair has broken above a key high that was capping upside at 19.52 (August 23 high), giving further impetus to the uptrend. A break above 19.80 would confirm more gains towards the upper channel line in the 20.60s.

USD/MXN 4-hour Chart

The Relative Strength Index (RSI) has just exited overbought and fallen back into neutral territory. This is a sell signal and indicates a pullback within the uptrend could be unfolding. Such a correction will probably find support at the 19.52 level (previous resistance turned support) and, from there, possibly resume its upside bias.

Economic Indicator

Durable Goods Orders

The Durable Goods Orders, released by the US Census Bureau, measures the cost of orders received by manufacturers for durable goods, which means goods planned to last for three years or more, such as motor vehicles and appliances. As those durable products often involve large investments they are sensitive to the US economic situation. The final figure shows the state of US production activity. Generally speaking, a high reading is bullish for the USD.

Read more.Last release: Mon Aug 26, 2024 12:30

Frequency: Monthly

Actual: 9.9%

Consensus: 4%

Previous: -6.6%

Source: US Census Bureau

Author

Joaquin Monfort

FXStreet

Joaquin Monfort is a financial writer and analyst with over 10 years experience writing about financial markets and alt data. He holds a degree in Anthropology from London University and a Diploma in Technical analysis.