Mexican Peso remains steady against strong US Dollar

- Mexican Peso strengthens despite judiciary reform and AMLO's diplomatic "pause" with US and Canadian embassies.

- Focus on Banxico’s Q2 report and Fiscal Balance data this Friday amid a light economic calendar.

- USD/MXN spikes near 19.80 due to political worries despite a weakening US Dollar post-Powell dovish Jackson Hole remarks.

The Mexican Peso recovered some ground against the Greenback on Wednesday, yet it remains strongly influenced by political turmoil in Mexico linked to the judiciary reform and President Andres Manuel Lopez Obrador's decision to “pause” relations with the US and Canadian Embassies. At the time of writing, the USD/MXN trades at 19.64, falling some 0.44%.

Mexico’s economic docket remains absent, and traders are bracing for Bank of Mexico’s (Banxico) Q2 report ahead of Friday's reveal of July’s Fiscal Balance. In the meantime, Wall Street trades with losses as speculators await the release of Nvidia’s fiscal Q2 2025 earnings.

Political developments in Mexico weighed on the Peso after a commission of deputies approved the ruling on the judiciary reform. The reform is expected to be voted on once the new Mexican Congress takes office on September 1.

This and AMLO’s pausing relations with the embassies of Mexico’s largest trading partners triggered a rally in the USD/MXN, which rose over 1.70% and was a whisker of hitting 19.80, even though the US Dollar sustained losses against most G7 FX currencies after Federal Reserve (Fed) Chair Jerome Powell hinted that rate cuts are looming at his Jackson Hole speech.

Across the border, the US economic docket is absent. Yet traders are awaiting the release of the second estimate of Q2’s 2024 Gross Domestic Product (GDP) and Initial Jobless Claims data for the week ending August 24.

Later, Atlanta Fed President Raphael Bostic will cross the newswires at around 22:00 GMT.

Daily digest market movers: Mexican Peso shrugs off risk-off mood and rises

- Comments from US Ambassador Ken Salazar, expressed on August 22, were the reason behind AMLO’s decision. Salazar said that the judiciary reform threatens the rule of law and added that “the direct election of judges represents a major risk to the functioning of Mexico’s democracy. Any judicial reform must have safeguards that guarantee that the judiciary is strengthened and not subject to the corruption of politics.”

- Market sentiment remains mixed, yet it would greatly influence the USD/MXN’s direction, given the US Dollar’s safe-haven status.

- Traders will eye Fed speakers, the release of US Q2’s 2024 GDP, and the Fed’s preferred inflation gauge, the core Personal Consumption Expenditures Price Index (PCE).

- Data from the Chicago Board of Trade (CBOT) suggests the Fed will cut at least 100 basis points (bps), according to the fed funds rate futures contract for December 2024.

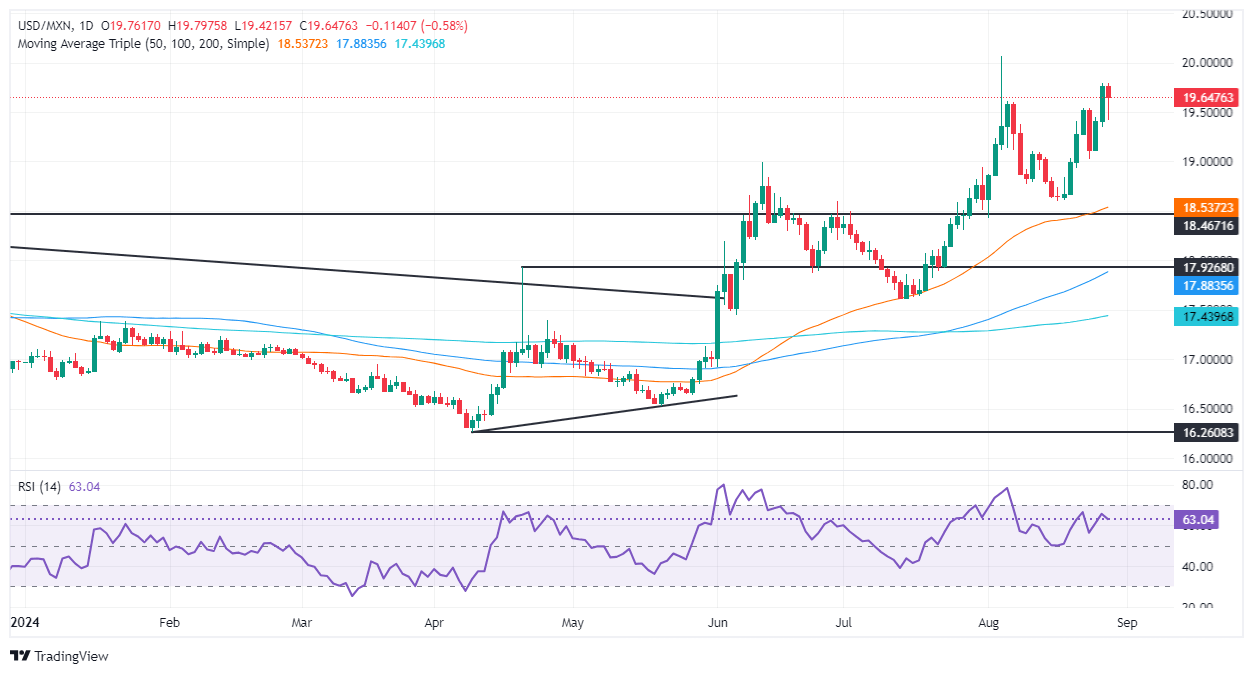

Technical outlook: Mexican Peso strengthens as USD/MXN falls below 19.60

The USD/MXN daily chart hints that the uptrend remains intact despite the ongoing pullback. Momentum favors buyers as seen by the Relative Strength Index (RSI).

On further USD/MXN strength, the pair could challenge the current week-to-date (WTD) high of 19.79. A breach of the latter will expose 20.00, followed by the year-to-date (YTD) high at 20.22 and the psychological 20.50 supply area.

Conversely, if USD/MXN tumbles below 19.50, this could expose the 19.00 figure. Further losses lie beneath that level, opening the door to test the August 19 low of 18.59, followed by the 50-day Simple Moving Average (SMA) at 18.48.

Mexican Peso FAQs

The Mexican Peso (MXN) is the most traded currency among its Latin American peers. Its value is broadly determined by the performance of the Mexican economy, the country’s central bank’s policy, the amount of foreign investment in the country and even the levels of remittances sent by Mexicans who live abroad, particularly in the United States. Geopolitical trends can also move MXN: for example, the process of nearshoring – or the decision by some firms to relocate manufacturing capacity and supply chains closer to their home countries – is also seen as a catalyst for the Mexican currency as the country is considered a key manufacturing hub in the American continent. Another catalyst for MXN is Oil prices as Mexico is a key exporter of the commodity.

The main objective of Mexico’s central bank, also known as Banxico, is to maintain inflation at low and stable levels (at or close to its target of 3%, the midpoint in a tolerance band of between 2% and 4%). To this end, the bank sets an appropriate level of interest rates. When inflation is too high, Banxico will attempt to tame it by raising interest rates, making it more expensive for households and businesses to borrow money, thus cooling demand and the overall economy. Higher interest rates are generally positive for the Mexican Peso (MXN) as they lead to higher yields, making the country a more attractive place for investors. On the contrary, lower interest rates tend to weaken MXN.

Macroeconomic data releases are key to assess the state of the economy and can have an impact on the Mexican Peso (MXN) valuation. A strong Mexican economy, based on high economic growth, low unemployment and high confidence is good for MXN. Not only does it attract more foreign investment but it may encourage the Bank of Mexico (Banxico) to increase interest rates, particularly if this strength comes together with elevated inflation. However, if economic data is weak, MXN is likely to depreciate.

As an emerging-market currency, the Mexican Peso (MXN) tends to strive during risk-on periods, or when investors perceive that broader market risks are low and thus are eager to engage with investments that carry a higher risk. Conversely, MXN tends to weaken at times of market turbulence or economic uncertainty as investors tend to sell higher-risk assets and flee to the more-stable safe havens.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.