Mexican Peso soars on solid data and reaches a 5-day peak

Most recent article: Mexican Peso to recover to 17.00s against the USD, say analysts

- Mexican Peso rises as Private Spending and Aggregate Demand show solid economic performance.

- Political concerns ease with support for AMLO’s judiciary reform, discussions to start soon.

- US Dollar weakened by lower-than-expected Retail Sales and downward revisions for previous months.

The Mexican Peso registered solid gains on Tuesday against the Greenback due to upbeat Mexican economic data and a softer-than-expected Retail Sales report from the United States (US). Woes surrounding changes to the Mexican Constitution had eased, a tailwind for the emerging market currency. The USD/MXN trades at 18.40, down 0.67%

Mexico’s economic schedule revealed that Private Spending expanded more than 2023 last quarter in Q1 2024. Alongside that, Aggregate Demand shows the economy remains solid, and it might deter the Bank of Mexico (Banxico) from easing monetary policy due to risks of inflation reacceleration.

In the meantime, presumptive President Claudia Sheinbaum revealed that citizens support current President Andres Manuel Lopez Obrador's (AMLO) judiciary reform, according to three surveys commissioned by Mexico’s ruling party, Morena.

“These polls are information, they don't have another objective,” Sheinbaum said in a press conference. “This is just information to be considered in the discussions that will start in the coming days.”

Across the border, Retail Sales in May were slightly shy of estimates, a sign of economic slowdown. However, downward revisions for the previous months hurt the US Dollar, which according to the US Dollar Index (DXY), edges down 0.05% at 105.28

Despite that, the USD/MXN exchange rate would continue to be driven by political uncertainty as some of the reforms pushed by AMLO to change the Mexican Constitution threaten the state of law.

Daily digest market movers: Mexican Peso on defensive amid risk-aversion

- Mexico’s Aggregate Demand for Q1 2024 rose by 1.5% QoQ, exceeding 2023’s Q4 by 0.4%. In the twelve months to Q2, it expanded 2.6% YoY, above the 2.2% in Q4 2023.

- Private Spending grew 1.5% QoQ in the first quarter of 2024, above the previous 0.9% reading. In the yearly comparison, spending rose by 3.6%, lower than the 5.1% in the previous figures.

- USD/MXN stabilizes following last week’s verbal intervention by Banxico Governor Victoria Rodriguez Ceja, who said the central bank is attentive to volatility in the Mexican currency exchange rate and could act to restore “order” in markets.

- Today’s data and the Mexican currency depreciation could deter Banxico from easing policy in the next meeting on June 27. A rate cut could weaken the Mexican Peso and expose the USD/MXN year-to-date high at 18.99.

- US Retail Sales for May came at 0.1% MoM, which improved compared to April’s -0.2% plunge but still missed the estimates of 0.2%. Annually based, sales dipped from 2.7% to 2.3%.

- US Industrial Production in May exceeded projections of 0.3%, increasing by 0.9% MoM.

- Last week’s CPI report increased the odds of a Fed rate cut in September from 57% to 62%, according to the CME FedWatch Tool.

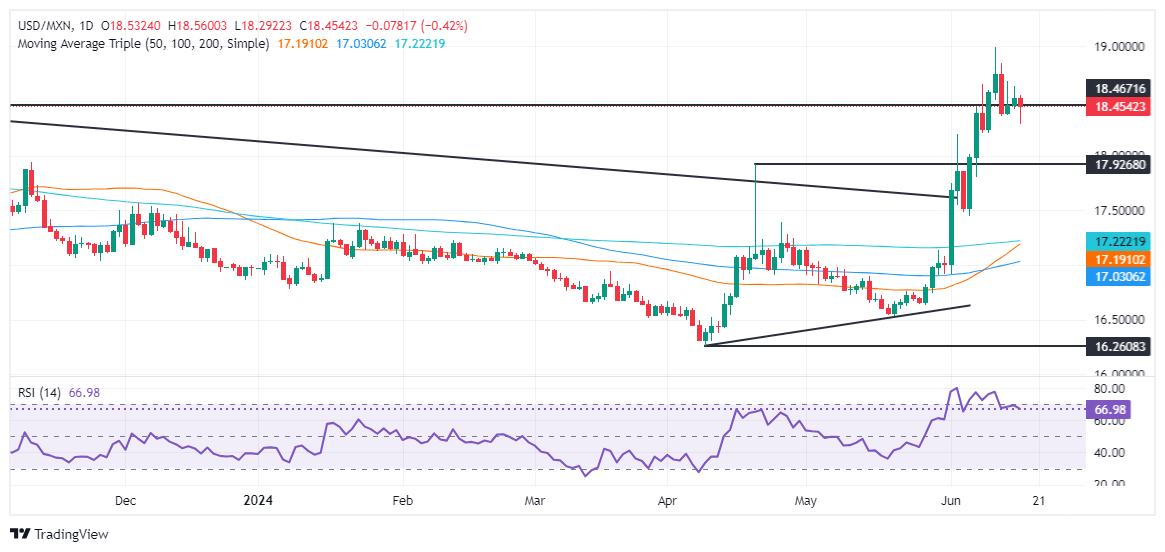

Technical analysis: Mexican Peso remains firm as USD/MXN drops below 18.50

The USD/MXN is bullishly biased despite dipping to a five-day low of 18.29 as momentum shows buyers are in charge. The Relative Strength Index (RSI) is bullish above the 50-midline, indicating that bullish momentum is intact.

Buyers achieving a daily close above 18.50 could pave the way for further upside. Next would be the year-to-date high of 18.99, followed by the March 20, 2023, high of 19.23. A breach of the latter will sponsor an uptick to 19.50, ahead of the psychological 20.00 mark.

Conversely, if sellers push prices below the April 19 high of 18.15, that will keep the exotic pair trading within the 18.00-18.15 range.

Economic Indicator

Retail Sales (MoM)

The Retail Sales released by INEGI measures the total receipts of retail stores. Monthly percent changues reflect the rate of changes of such sales. Changes in retail sales are widely followed as an indicator of consumer spending. Generally speaking, a high reading is seen as positive or bullish for the Mexican peso, while a low reading is seen as negative or bearish.

Read more.Author

Christian Borjon Valencia

FXStreet

Christian Borjon began his career as a retail trader in 2010, mainly focused on technical analysis and strategies around it. He started as a swing trader, as he used to work in another industry unrelated to the financial markets.