Mexican Peso gains further ground, extends recovery

Most recent article: Mexican Peso edges lower after traders cover their longs

- The Mexican Peso reclaimed higher ground against the US Dollar on Thursday.

- The Greenback sold off after Retail Sales surged in the US.

- Markets still see a September Fed rate cut, but strong Retail Sales shed slowdown fears.

The Mexican Peso (MXN) climbed three-quarters of a percent against the US Dollar (USD) on Thursday after the Greenback broadly softened. US Retail Sales firmly eclipsed forecasts, causing investors to shrug off recent economic slowdown concerns. Rate markets pulled back on their bets of a double cut from the Federal Reserve (Fed) in September.

Mexico’s central bank (Banxico) is holding firm in its recent decision to cut interest rates from 11% to 10.75%, even as headline inflation figures rose to 5.57% in July. Citing a long-run slide in core inflation metrics and a broader slowdown looming over Mexico’s domestic economy, Banxico Deputy Governor Omar Mejia noted during an interview on Thursday that:

... a cut with a degree of restriction wasn’t just adequate, but opportune and efficient; to consider just one data point on the margin would mean renouncing a fair amount of information that... we must incorporate into our decisions.

Banxico’s measure of core inflation slowed to 4.05% in July, down from the previous month’s 4.13%. The Mexican central bank expects core inflation to reach its 3% target sometime in Q4 2025.

Daily digest market movers: Peso bolstered by risk-on sentiment crowding the bracket

- US Retail Sales surged to 1.0% in July, the indicator’s highest print since February of 2023.

- The jump in US Retail Sales, a firm indication of good economic health, prompted a broad recovery in risk appetite, sending the Greenback lower.

- Not all is rosy: markets are shrugging off a -0.6% contraction in US Industrial Production in July, the indicator’s worst print since November of 2023.

- Rate markets have pared back bets of a 50 bps double cut from the Fed in September to less than 25%, but they still see 76% odds of at least a quarter-point rate trim.

- Friday’s University of Michigan Consumer Sentiment Index will give one last data point for investors trying to nail down rate cut bets. The index of survey responses is expected to tick higher to 66.9 from 66.4.

Mexican Peso price forecast: Easing Greenback gives Peso room to move

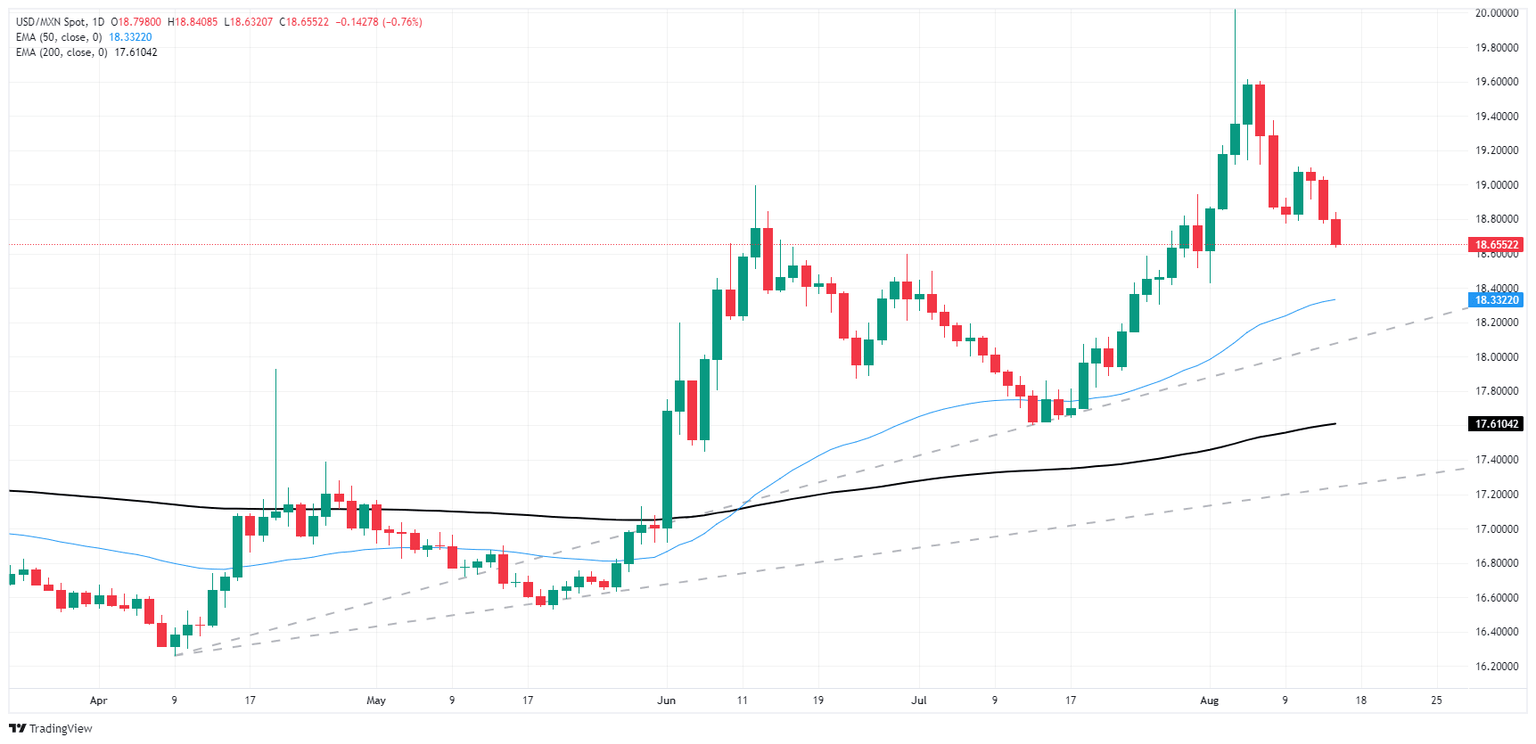

The Mexican Peso chalked in a third straight gain on Thursday as the US Dollar moved out of the way to allow a Peso recovery. USD/MXN has eased below 18.80 for the first time since the beginning of August and is headed toward the 50-day Exponential Moving Average (EMA) near 18.33 as long as current trends hold.

The MXN is on pace to gain ground against the Greenback for all but one of the last seven consecutive trading days. However, USD/MXN is easing down from a very high perch after the pair ran up the charts over 23% from 2024’s lows to tap a 22-month high above 20.00 in early August.

USD/MXN daily chart

Mexican Peso FAQs

The Mexican Peso (MXN) is the most traded currency among its Latin American peers. Its value is broadly determined by the performance of the Mexican economy, the country’s central bank’s policy, the amount of foreign investment in the country and even the levels of remittances sent by Mexicans who live abroad, particularly in the United States. Geopolitical trends can also move MXN: for example, the process of nearshoring – or the decision by some firms to relocate manufacturing capacity and supply chains closer to their home countries – is also seen as a catalyst for the Mexican currency as the country is considered a key manufacturing hub in the American continent. Another catalyst for MXN is Oil prices as Mexico is a key exporter of the commodity.

The main objective of Mexico’s central bank, also known as Banxico, is to maintain inflation at low and stable levels (at or close to its target of 3%, the midpoint in a tolerance band of between 2% and 4%). To this end, the bank sets an appropriate level of interest rates. When inflation is too high, Banxico will attempt to tame it by raising interest rates, making it more expensive for households and businesses to borrow money, thus cooling demand and the overall economy. Higher interest rates are generally positive for the Mexican Peso (MXN) as they lead to higher yields, making the country a more attractive place for investors. On the contrary, lower interest rates tend to weaken MXN.

Macroeconomic data releases are key to assess the state of the economy and can have an impact on the Mexican Peso (MXN) valuation. A strong Mexican economy, based on high economic growth, low unemployment and high confidence is good for MXN. Not only does it attract more foreign investment but it may encourage the Bank of Mexico (Banxico) to increase interest rates, particularly if this strength comes together with elevated inflation. However, if economic data is weak, MXN is likely to depreciate.

As an emerging-market currency, the Mexican Peso (MXN) tends to strive during risk-on periods, or when investors perceive that broader market risks are low and thus are eager to engage with investments that carry a higher risk. Conversely, MXN tends to weaken at times of market turbulence or economic uncertainty as investors tend to sell higher-risk assets and flee to the more-stable safe havens.

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.