Japanese Yen lacks firm intraday direction; USD/JPY consolidates above 151.00

- The Japanese Yen rebounds from over one-week low touched against the USD on Tuesday.

- Doubts over BoJ’s ability to hike rates might hold back the JPY bulls from placing fresh bets.

- Expectations for a less dovish Fed could underpin the USD and lend support to USD/JPY.

The Japanese Yen (JPY) seesaws between tepid gains/minor losses against its American counterpart heading into the European session on Tuesday amid wavering expectations that the Bank of Japan (BoJ) will hike rates in December. The near-term bias, meanwhile, seems tilted in favor of the JPY bulls in the wake of the Bank of Japan's (BoJ) more hawkish stance. In fact, the BoJ remains on track for more interest rate hikes, while global major central banks, including the US Federal Reserve (Fed), are seen lowering borrowing costs further.

Adding to this, the cautious market mood, persistent geopolitical tensions and trade war fears might continue to underpin the safe-haven JPY. Furthermore, Fed rate cut bets cap the overnight recovery in the US Treasury bond yields, which turn out to be another factor lending support to the lower-yielding JPY. This, along with subdued US Dollar (USD) price action, acts as a headwind for the USD/JPY pair. Traders might also opt to wait for the US consumer inflation figures on Wednesday before placing directional bets around the currency pair.

Japanese Yen struggles for a firm intraday direction; downside seems limited

- Bank of Japan Governor Kazuo Ueda recently said that the timing of the next rate hike was approaching. This, along with data showing that the underlying inflation in Japan remains solid, lifted bets that the BoJ will hike rates at its December 18-19 policy meeting.

- Some media reports, however, suggested the BoJ may skip a rate hike this month. Moreover, BoJ's dovish board member Toyoaki Nakamura said that the central bank must move cautiously in raising rates, adding a layer of uncertainty and undermining the Japanese Yen.

- The US Nonfarm Payrolls (NFP) report released on Friday reaffirmed bets for a rate cut by the Federal Reserve in December. The Fed, however, could deliver a cautious message amid expectations that US President-elect Donald Trump's policies could reignite inflationary pressures.

- The yield on the benchmark 10-year US government bond staged a modest bounce on Monday, after closing at its lowest level since October 18 last Friday. This assists the US Dollar (USD) build on the post-NFP recovery and provides a modest lift to the USD/JPY pair.

- Investors remain concerned about Trump's impending trade tariffs and their effect on the global economic outlook. Moreover, turbulence in the Middle East increased over the weekend after Syrian rebels took control, forcing President Bashar al-Assad to flee to Russia.

- This week’s main event will be Wednesday’s release of the US Consumer Price Index for November, which should offer cues about the interest rate outlook in the US. This, in turn, should influence the currency pair ahead of the FOMC/BoJ policy meetings next week.

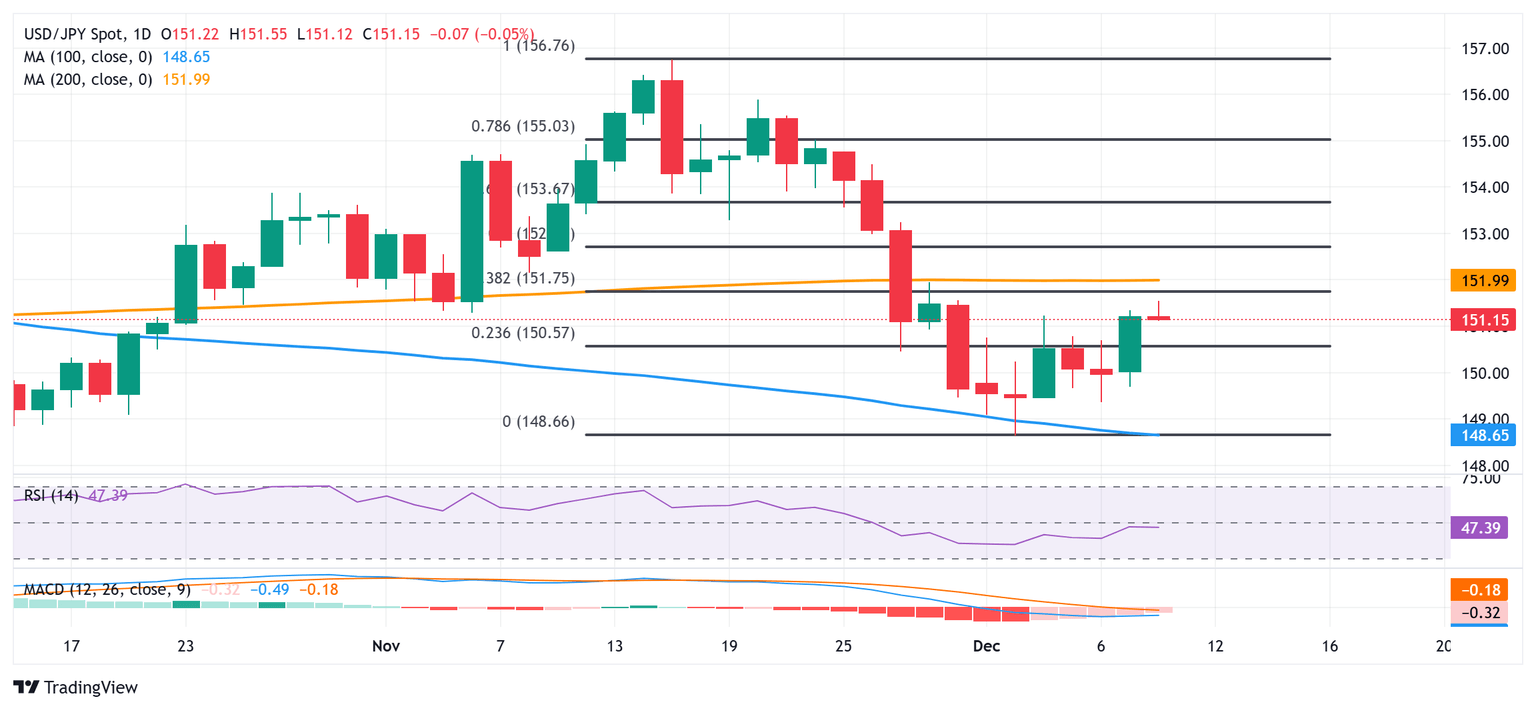

USD/JPY needs to find acceptance above 152.00 for bulls to seize control

From a technical perspective, any subsequent move up is more likely to confront stiff resistance and remain capped near the 151.75-152.00 confluence. The said area comprises the 38.2% Fibonacci retracement level of the recent pullback from a multi-month high touched in November and the very important 200-day Simple Moving Average (SMA). Given that oscillators on the daily chart have recovered from negative territory, a sustained move beyond the 152.00 mark should pave the way for additional gains towards the 152.70-152.75 region, or the 50% retracement level. This is followed by the 153.00 round figure, above which the USD/JPY pair could extend the momentum towards the 61.8% Fibo. level, around the 153.70 area.

On the flip side, weakness below the 151.00 mark now seems to find decent support near the 150.60 region, or the 23.6% Fibo. level resistance breakpoint. The next relevant support is pegged near the 150.00 psychological mark, below which the USD/JPY pair could weaken to the 149.50-149.45 region en route to the 149.00 mark and the monthly low, around the 148.65 area touched last week. The latter coincides with the 100-day SMA and a convincing break below will be seen as a fresh trigger for bearish traders, and set the stage for a further near-term depreciating move.

Economic Indicator

Consumer Price Index (YoY)

Inflationary or deflationary tendencies are measured by periodically summing the prices of a basket of representative goods and services and presenting the data as The Consumer Price Index (CPI). CPI data is compiled on a monthly basis and released by the US Department of Labor Statistics. The YoY reading compares the prices of goods in the reference month to the same month a year earlier.The CPI is a key indicator to measure inflation and changes in purchasing trends. Generally speaking, a high reading is seen as bullish for the US Dollar (USD), while a low reading is seen as bearish.

Read more.Next release: Wed Dec 11, 2024 13:30

Frequency: Monthly

Consensus: 2.7%

Previous: 2.6%

Source: US Bureau of Labor Statistics

The US Federal Reserve has a dual mandate of maintaining price stability and maximum employment. According to such mandate, inflation should be at around 2% YoY and has become the weakest pillar of the central bank’s directive ever since the world suffered a pandemic, which extends to these days. Price pressures keep rising amid supply-chain issues and bottlenecks, with the Consumer Price Index (CPI) hanging at multi-decade highs. The Fed has already taken measures to tame inflation and is expected to maintain an aggressive stance in the foreseeable future.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.