IBIO Stock Price - iBio Inc.ready to rise after shedding a quarter of its value

- NYSEAMERICAN:IBIO gains around 2% at the beginning of August.

- Investors remain hopeful that the micro-cap company can provide a COVID-19 vaccine.

- Shares are set to react to updated coronavirus cases and government support.

NYSEAMERICAN:IBIO has kicked the month off on the right foot, rising 1.80% on Monday to close at $4.52. After briefly touching a daily high of $4.68, the stock steadily fell throughout the afternoon. A lower than normal trading – volume could be a sign that investors are hesitant about buying or selling the stock ahead of its quarterly earnings announcement in mid-August. iBio Inc. also has a tremendously high short-volume-ratio at 36%, which shows that over a third of investors are banking on the stock price to fall in the future.

Update 8: IBIO is down but not out – trading 8.5% higher in Wednesday's pre-market trading and licking its wounds from the crash of 25.2% on Tuesday. The pharma firm's issues and Russia's vaccine announcement fueled a ferocious bear attack. Robinhood traders may now jump in, especially as gold is tumbling down.

Update 7: After edging up at the beginning of Friday's session, Ibio Inc is trading some 4.68% down, changing hands under $4. IBio's links to China – working with a factory based in Beijing – may have an adverse impact. Sino-American relations are worsening. See Reports US to sanction Hong Kong leader Carrie Lam

Update 6: Friday's pre-market trading is pointing to a rebound of sorts for Ibio, with a minor rise. The company seems able to weather the storm – and especially fierce competition. Another firm, Vaxart, has been receiving attention after publishing robust financial results. Fending off competitors may not be necessary if government funding is secured.

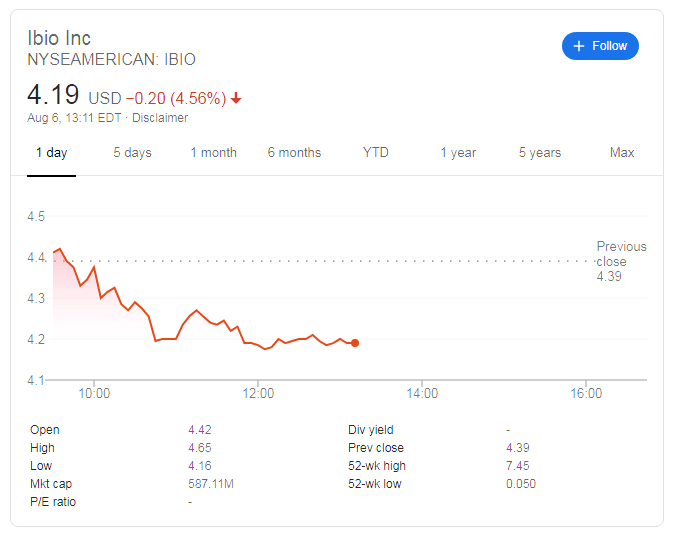

Update 5: Thursday's session has been characterized by selling of various shares in the electric vehicle and also coronavirus sectors. Ibio Inc. is trading around $4.20 at the time of writing, down some 4.5% and contrary to pre-market trading. Is this correction a buying opportunity? Or perhaps markets may find other stocks. Another such company is NVAX, which has three reasons to rise.

Update 4: Thursday's could turn into IBIO's day, with a projected upside open at 4.5% higher. OWS funds going to Johnson and Johnson and Dr. Anthony Fauci's drive toward immunization have both been helping all companies developing vaccines to move higher.

Update 3: Ibio Inc. has defied selling pressure and is rising around 1% in Wednesday's trading, despite opening on lower ground. It seems that the Novavax's highly publicized progress in developing immunization is lifting all companies involved in the race to provide humanity with a silver bullet – despite downbeat projections by the World Health Organization. NYSEAMERICAN: IBIO is holding its ground at $4.43 at the time of writing.

Update 2: NYSEAMERICAN: IBIO is expected to kick off Wednesday's trading on the back foot, extending the 2.88% loss experienced on Tuesday. While Ibio's plant-based immunization sounds promising, it is essential to note that the coronavirus vaccine field is becoming crowded.

Update: Ibio Inc has kicked off Tuesday's trade some profit-taking, falling at the open but bouncing back to around $4.50 later on. Coronavirus cases in Florida, Texas, California, and other states are in play, and so is news about the next fiscal relief package.

iBio Inc. is positioning itself well, whether it is able to create a COVID-19 vaccine, or, perhaps more realistically, it ends up helping to manufacture another company’s vaccine. Its FastPharming Facility has shown that it can mass-produce plant-based vaccines in a short period, making it an ideal partner for a successful vaccine maker. One other note that is not often mentioned is that iBio Inc. has a partnership with a vaccine company in China called CC Pharming. The significance here is that CC Pharming has already successfully created a vaccine for a sister-strain of COVID-19 – so iBio Inc. should have access to some extremely valuable information and knowledge.

iBio Stock Forecast

iBio Inc. stock price may remain flat until any sort of news or announcement acts as a catalyst ahead of their earnings call. With President Donald Trump announcing that he has a desire for schools to be open come September, the next month could be a mad scramble for companies, like iBio Inc., to get a vaccine to market, if possible.

Author

Stocks Reporter

FXStreet