NVAX Stock Forecast: Novavax set for a happy Monday as analyst sets $290 target, new deal in India

- NASDAQ: NVAX has been extending its gains after a vaccine manufacturing deal with Fujifilm.

- The massive government grant also provides Novavax inc. room to rise.

- After a successful immunization test, additional results may trigger more buying.

Update: NASDAQ: NVAX is set to kick off the second week of August with a rise to $175 – and that may only the beginning according to Vernon Bernardino. The analysts with H.C. Wainwright set a target of $290 – calculated using potential COVID-19 dose prices. In addition to the deal with Japan's Takeda, Novavax announced an accord with the Serum Institute of India Private Limited (SIIPL) for commercializing the NVX-CoV2373 immunization option for non-rich countries. The broader market mood is tense as China sanctions Senators Ted Cruz and Marco Rubio.

While there may be no silver bullet against COVID-19 – according to the World Health Organization – Novavax has three powerful reasons to create gold for its investors. Contrary to other contenders for a coronavirus vaccine, the Gaithersburg, Maryland-based pharma firm specializes in immunization, yet there are other factors fueling the rise.

Update 6: Novavax shares are rising toward $170 in Friday's trading, defying the mixed market mood. Investors are concerned with Sino-American tensions while they are pleased with the relatively upbeat Non-Farm Payrolls report. See Reports US to sanction Hong Kong leader Carrie Lam

Update 5: NASDAQ: NVAX bulls seem to be preparing to resume buying and push shares higher after Thursday's 3.45% downside correction. Novavax is changing hands at $171 in Friday's pre-market, indicating demand remains strong for the immunization firm. The firm announced a collaboration with Japan's Takeda for the potential manufacturing of over 250 million doses of its COVID-19 vaccine candidate. Nevertheless, it is essential to note that it has competition from financially fit Vaxart.

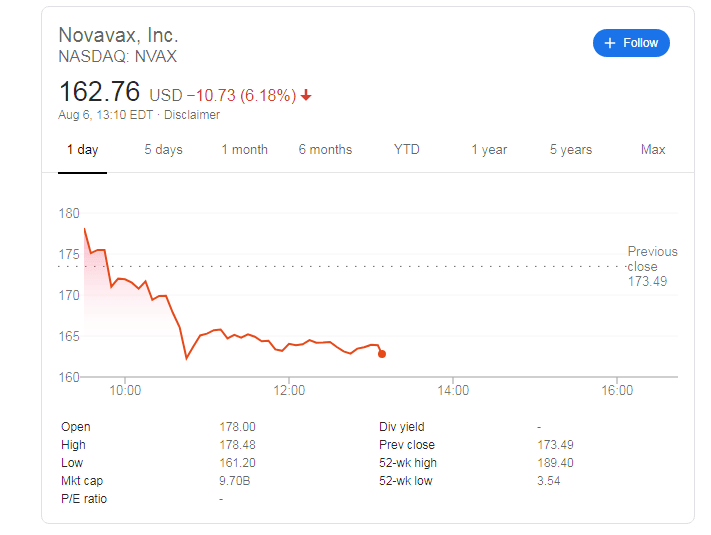

Update 4: Profit-taking has finally reached NVAX's stock – which is changing hands at around $163 on Thursday, down some 6% after kicking Thursday's session to the upside. While hopes for a solution to the pandemic are of high importance, tension is mounting ahead of Friday's jobs report, grabbing attention. See Non-Farm Payrolls complicated by coronavirus and confusing data, dollar, gold implications

Update 3: NASDAQ: NVAX closed Wednesday's trading at $173.49, up another 10% or so. That is not the end, as shares are changing hands at around $178 in Thursday's pre-market trading. Dr. Anthony Fauci, the director of the National Institute of Allergy and Infectious Diseases, gave an interview to Bloomberg, touting tens of millions of coronavirus doses by the end of the year. While he did not name any specific company, all the firms involved in developing immunization – including Novavax – are on the rise. Hopes for a vaccine are high on Thursday's agenda.

Update 2: Novavax has been gaining substantial traction, with CEO Stanley C. Erck giving interviews to financial media outlets such as Bloomberg and touting the test success. NASDAQ: NVAX is up to some 12% on Wednesday, above $176 level at the time of writing, the highest since September 2015. The small company's success may also be contributing to a broader increase in stock markets, pushing the S&P 500 higher, to around 3,330 points – despite rising coronavirus cases.

Update: Novavax has kicked off Tuesday's trading on the back foot, alongside the broader stock market and nearing the $150 mark before stabilizing. Does that provide a buying opportunity? Its upbeat fundamentals, as described below, have not changed.

Here are three reasons to be bullish on the company:

1) Fujifilm manufacturing motor

The latest upward driver for Novavax has been the announcement that it will collaborate with Fujifilm Diosynth Biotechnologies in producing its vaccines. The Japanese conglomerate – better known for its cameras – has been at the forefront of COVID-19 from the outset, with its Avagan medication.

Stanley C. Erck, CEO, and President of Novavax hailed the collaboration and said it will ensure the large-scale production of the firm's vaccine candidate. Indeed, providing the world with immunity depends on rapid output and distribution.

2) Federal funds

That large-scale manufacturing capacity does not come cheap, and here, NVAX has a funding source closer to home – the federal government in Washington. Uncle Sam will pay Novavax a whopping $1.6 billion to accelerate development and manufacturing, using the White House's "Operation Warp Speed."

OWS has already granted funds to several competitors, yet the sum of over $1 billion is one of the largest, putting Novaax in a pole position to reach the market ahead of competitors such as Moderna, Pfizer, AstraZeneca, Sanofi, and others. It is essential to note that NVAX also works with the Department of Defense.

3) Promising COVID-19 candidate

To produce a vaccine at a massive scale backed by funding, Novavax first needed a promising candidate. Its Phase 1 trial kicked off already in May in Australia, and results are due out shortly. That would open the door to Phase 2 and Phase 3, which could be conducted in the US.

Nevertheless, stocks surged on August 3, before news of the trial came out. Are investors too optimistic, or do they know something others do not? Some may assume that the firm would not jump into the deal with Fujifilm – nor take vast sums from the US government – without seeing some promising initial outcomes.

The waiting is set to come to an end and high volatility is likely.

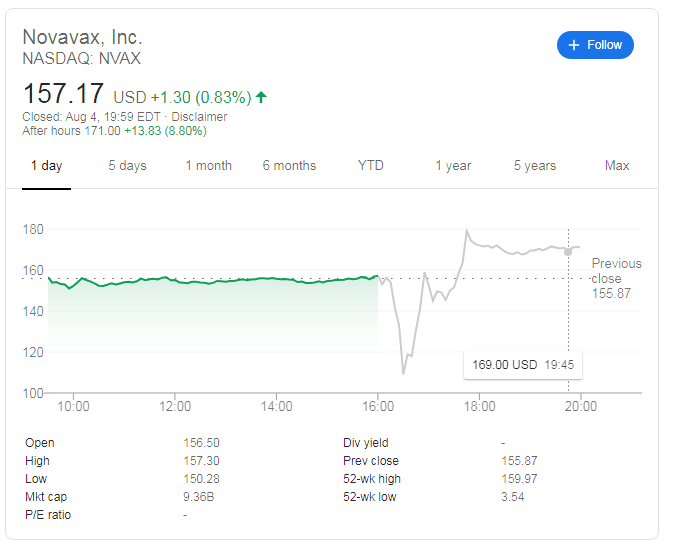

Update 2: Novavax announced promising immune response among healthy adults that participated in its trial. The vaccine candidate was generally well-tolerated, albeit not without non-life-threatening side effects. The most promising responses to the NVX-CoV2373 candidate came from those receiving two doses three weeks apart. These subjects had neutralizing antibodies levels that were on average four times higher than recovered COVID-19 patients, 35 days after the shots.

NASDAQ: NVAX has surged above $171 in after-hours trading, an increase of nearly 9% ahead of Wednesday's regular trading session.

All in all, Novavax Inc's shares seem well-positioned to continue gaining ground.

NVAX Stock Forecast

At August 3's closing price of $155, Novavax is just below the swing high of $159.97, which serves as the next barrier. Further above, $174 was a peak back in December 2015, and it is followed by $211, another high from that year. Further above, $241 and $294 are next.

Looking down, support awaits at $140, $135, and then at $110 1nd $97.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.