VXRT Stock Price: Vaxart Inc. jumps after Q2 results, amid competitor weakness

- NASDAQ:VXRT gains 8.66% on Wednesday, as the micro-cap biotech industry rises.

- Operation Warp Speed funding to Johnson and Johnson gives investors hope of further payouts.

- Vaxart has a substantial war-chest to conduct a COVID-19 vaccine trial.

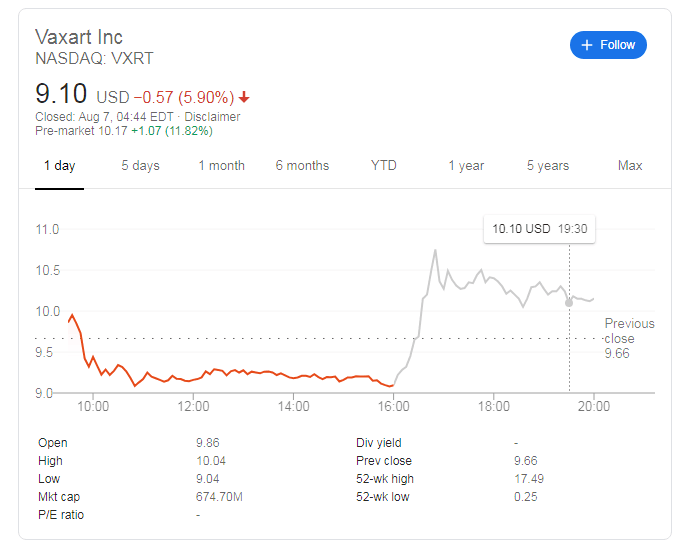

NASDAQ:VXRT has added to its recent surge, gaining 8.66% on Wednesday and closing the trading session at $9.66. The share price peaked after an early morning bump up to $10.99, but Vaxart spent the remainder of the day steadily declining. As with many of their rivals in the race to find a COVID-19 vaccine, Vaxart has seen its price increase by well over 2,500% so far this year, – pushing the firm’s market cap to over $1 billion. With the firm’s quarterly earnings call scheduled for next week – investors hope to hear news on the success of their vaccine in clinical development.

Update 2: VXRT shares are soaring on Friday, trading around $9.30 after hitting a daily high of $10.20. Earnings are keeping shares bid while worries about competitors' vaccines may also be in play, especially those with links to China, as Sino-American tensions are deteriorating See Reports US to sanction Hong Kong leader Carrie Lam.

Update: Vaxart is set to kick off Friday's trading session with a substantial double-digit rebound, recapturing the $10 level. The veteran company sai it had $140 million in cash at the end of July and that is it is preparing to enter a Phase 1 clinical trial with its coronavirus vaccine candidate. The upbeat news is inspiring investors, despite fierce competition, from firms such as Novavax. See: NVAX, which has three reasons to rise.

The big news of the day in the coronavirus news space has been that Johnson and Johnson (NYSE:JNJ) has agreed to provide 100 million doses of their coronavirus vaccine to Americans by 2021. The deal with the federal government is estimated to be valued at $1 billion. With the global demand for a COVID-19 vaccine at an all-time high, investors are optimistic that other companies would also be receiving government funding for their vaccine candidates. While Vaxart has five versions of its oral vaccine still in clinical trials, the firm’s candidate was selected as one of the vaccines that may be provided to Americans in 2021. Adding Vaxart’s continued involvement with Johnson and Johnson on an influenza vaccine – it is becoming clear why investors are excited about this relationship.

Vaxart Stock Forecast

As its earnings call approaches, Vaxart investors will want to know about the prospects of its oral vaccine – and how close the company is to potential distribution. Nevertheless, investors would be wise to temper their expectations of the company, as most of the Operation Warp Speed funding could be given to big-name companies like Johnson and Johnson or Glaxosmithkline (NYSE:GSK) and Pfizer (NYSE:PFE) – the latter also agreed to a deal to provide vaccines to Canada.

Author

Stocks Reporter

FXStreet