Gold price dives below $2,400 as profit-booking intensifies

- Gold price slides below $2,400 after profit-booking but holds ground on multiple tailwinds.

- The Fed is expected to cut interest rates by more than 100 bps this year.

- The US Dollar falls near the March bottom, and bond yields post fresh annual lows.

Gold price (XAU/USD) exhibits sheer weakness performance despite deepening geopolitical tensions and growing fears of a global economic slowdown. Conflicts in the Middle East appear to have widened as Iran-backed Hezbollah said it launched dozens of missiles on Israel on Saturday in retaliation to the assassination of Hamas leader Ismail Haniyeh by an Israeli airstrike in Tehran. Historically, geopolitical tensions increased Gold’s appeal as a safe-haven asset.

The global demand environment has deteriorated due to higher interest rates by the central banks. The world’s second-largest country, China, is going through a vulnerable phase due to poor demand from both the domestic and overseas markets. The Caixin Manufacturing PMI surprisingly contracted in July to 49.8. The Eurozone economy is also facing demand issues in its largest nation, to which the German administration has provided tax relief to individuals and the corporate sector. And now, slowing US economic growth has spurted slowdown fears.

Meanwhile, the upbeat US ISM Services PMI for July is expected to provide some relief to global markets amid worries about the US slowdown. The PMI report showed that activities in the services sector expanded at a faster pace to 51.4 from the estimates of 51.0 after contracting to 48.8 the previous month.

Daily digest market movers: Gold price plummets along with US Dollar, and bond yields

- Gold price drops vertically below $2,400 in Monday’s American session. The precious metal faced selling pressure as profit booking kicked in while attempting to recapture all-time highs above $2,480. The overall outlook of the Gold price remains firm as US bond yields post fresh annual lows.

- 10-year US Treasury yields plunge to 3.67% as speculation for rate cuts by the Federal Reserve (Fed) in September seems certain. Lower yields on interest-bearing assets reduce the opportunity cost of holding an investment in non-yielding assets, such as Gold. The US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, plummets to the March low near 102.60.

- According to the CME FedWatch tool, 30-day Federal Funds futures pricing data shows that traders see a 50-basis point (bp) cut in interest rates in September as imminent. The data also shows that the Fed is expected to reduce its key borrowing rates by more than 100 bps this year.

- Market expectations for larger rate cuts have been prompted by a string of weak United States (US) economic data, which pointed to an economic slowdown and raised doubts on whether the Fed will achieve a ‘soft landing’. A soft landing is a situation in which the central bank grips over inflation without triggering a recession in the economy.

- Deteriorating labor market conditions and a sharp slowdown in the manufacturing sector are the major triggers that boosted expectations of bulk rate cuts. The July Nonfarm Payrolls (NFP) report showed that labor demand slowed significantly, and the Unemployment Rate unexpectedly rose to its highest level since November 2021.

- Fresh payrolls at 114K were significantly lower than estimates of 175K and June’s reading of 179K. The Unemployment Rate jumped to 4.3% from expectations and the prior release of 4.1%. Meanwhile, activities in the manufacturing sector, as measured by the ISM Manufacturing Purchasing Managers Index (PMI), contracted at a faster pace to 46.8 in July.

- Meanwhile, expectations of emergency rate cuts by the Fed have also strengthened. In an interview with CNBC on Monday, Chicago Fed Bank President Austan Goolsbee said, "Everything is always on the table, including raises and cuts," when he was asked about emergency cuts. Goolsbee assured, "If the economy deteriorates, the Fed will fix it."

US Dollar Price Today:

US Dollar PRICE Today

The table below shows the percentage change of US Dollar (USD) against listed major currencies today. US Dollar was the strongest against the Australian Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.40% | 0.38% | -2.99% | -0.01% | 0.98% | 0.33% | -1.03% | |

| EUR | 0.40% | 0.69% | -2.77% | 0.26% | 1.39% | 0.62% | -0.76% | |

| GBP | -0.38% | -0.69% | -3.39% | -0.41% | 0.70% | -0.10% | -1.43% | |

| JPY | 2.99% | 2.77% | 3.39% | 3.11% | 4.04% | 3.44% | 2.07% | |

| CAD | 0.01% | -0.26% | 0.41% | -3.11% | 1.03% | 0.34% | -1.20% | |

| AUD | -0.98% | -1.39% | -0.70% | -4.04% | -1.03% | -0.76% | -2.11% | |

| NZD | -0.33% | -0.62% | 0.10% | -3.44% | -0.34% | 0.76% | -1.36% | |

| CHF | 1.03% | 0.76% | 1.43% | -2.07% | 1.20% | 2.11% | 1.36% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).

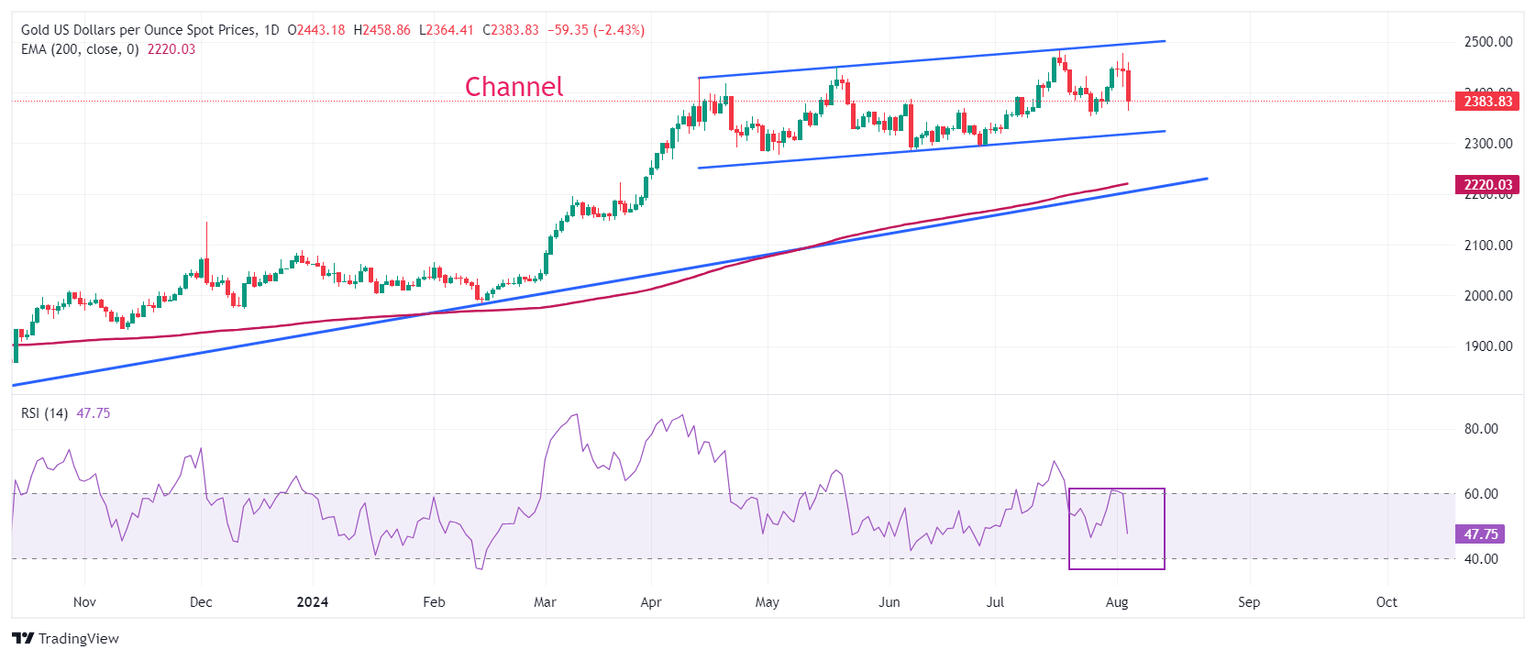

Technical Analysis: Gold price stays below $2,400

Gold price oscillates inside Friday’s trading range. The precious metal trades in a channel formation on a daily timeframe, which is slightly rising but broadly exhibited a sideways performance for more than three months. The 50-day Exponential Moving Average (EMA) near $2,370 continues to provide support to the Gold price bulls.

The 14-day Relative Strength Index (RSI) oscillates within the 40.00-60.00 range, suggesting indecisiveness among market participants.

A fresh upside would appear if the Gold price breaks above its all-time high of $2,483.75, which will send it into unchartered territory.

On the downside, the upward-sloping trendline at $2,225, plotted from the October 6 low near $1,810.50, will be a major support in the longer term.

Economic Indicator

Nonfarm Payrolls

The Nonfarm Payrolls release presents the number of new jobs created in the US during the previous month in all non-agricultural businesses; it is released by the US Bureau of Labor Statistics (BLS). The monthly changes in payrolls can be extremely volatile. The number is also subject to strong reviews, which can also trigger volatility in the Forex board. Generally speaking, a high reading is seen as bullish for the US Dollar (USD), while a low reading is seen as bearish, although previous months' reviews and the Unemployment Rate are as relevant as the headline figure. The market's reaction, therefore, depends on how the market assesses all the data contained in the BLS report as a whole.

Read more.Last release: Fri Aug 02, 2024 12:30

Frequency: Monthly

Actual: 114K

Consensus: 175K

Previous: 206K

Source: US Bureau of Labor Statistics

America’s monthly jobs report is considered the most important economic indicator for forex traders. Released on the first Friday following the reported month, the change in the number of positions is closely correlated with the overall performance of the economy and is monitored by policymakers. Full employment is one of the Federal Reserve’s mandates and it considers developments in the labor market when setting its policies, thus impacting currencies. Despite several leading indicators shaping estimates, Nonfarm Payrolls tend to surprise markets and trigger substantial volatility. Actual figures beating the consensus tend to be USD bullish.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.