Gold Price Forecast: XAU/USD claims $1,800 mark ahead of the Fed

- Gold fades corrective pullback, on a defensive mode of late.

- Market sentiment sours amid China crackdown on IT, tuition stocks, covid woes and mixed US data.

- Fed is widely expected to keep monetary policy intact, FOMC statement, press conference will be the key.

- Gold Weekly Forecast: XAU/USD bears await break below 100-day SMA at $1,796

Update: Gold prices hover in a familiar trading range of $1,795 and $1,805 on Wednesday. The US 10-year bond Treasury yields retreat to 1.23% as investors await the FOMC meeting for further clues on the Fed’s next move on interests rates and growth outlook. The higher interests rates and the Treasury yields are inversely correlated. Lower Treasury yields remain supportive of the gold prices. Further, the rapid increase of the coronavirus delta variant also affects the demand for the precious metal. China reflects the strong demand in the first half of the year and India struggles with its COVID-19 pandemic, which weighs on the prices. The US Dollar remains steady just below the $93.00 mark, which makes the gold expansive for the other currencies holders.

Gold (XAU/USD) aptly repeats the pre-Fed trading lull, consolidates the previous day’s bounce in a tight range surrounding $1,800 amid the early Asian session on Wednesday. The yellow metal cheered the US dollar weakness to snap a two-day downtrend on Tuesday but the recently cautious sentiment seems to weigh on the commodity prices.

Mixed data, virus update keep markets worries

Although US Durable Goods Orders and housing numbers came in softer-than-expected for June and May respectively, the notable upward revision to the priors renewed bets that the Fed hawks have scope. Also on the same line could be the strong readings of US CB Consumer Confidence figures that jumped to the pre-pandemic levels, to 129.10 for July.

Elsewhere, the US Centers for Disease Control and Prevention (CDC) edits mask mandate and Australia’s key coronavirus infected state, New South Wales (NSW) is up for refreshing the 16-month high of the daily cases. Further, the UK reports the highest death toll since March 17 and offers another reason to be worried.

In addition to the mixed data and COVID-19 fears, China’s crackdown on technology and tuition stocks, as well as the Sino-American tussles, also weighs on the market’s mood.

Against this backdrop, Wall Street benchmarks snapped a five-day uptrend and the US 10-year Treasury yields also slipped 3.7 basis points (bps) to 1.23% by the press time.

Although the risk-off mood puts a safe-haven bid under the US dollar, bulls are cautious ahead of the key US Federal Open Market Committee (FOMC) verdict.

While inflation pressure remains the concern to press the Fed policymakers towards tapering, recently escalating Delta covid strain woes may stop Chairman Jerome Powell and Company to replay the old art of defending easy-money but keeps bulls on the edge.

Amid these plays, Westpac said, “Policy is set to remain on hold at the July FOMC meeting, but we will be looking for additional guidance on the Committee’s perception of the outlook and the balance of risks, and any discussion of the pace of asset purchases. The statement should continue to refer to inflationary pressures as transitory. Fed Chair Powell will deliver the post-meeting press conference at 04:30 AEST.”

Read: Federal Reserve Preview: Three reasons why Powell could pause, pummeling the dollar

Technical analysis

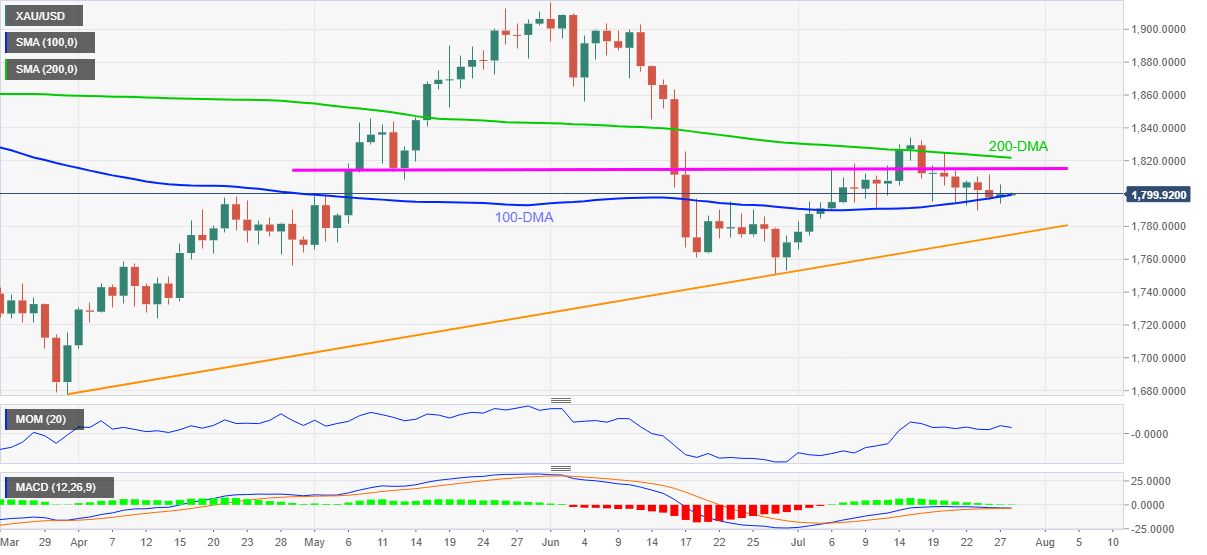

100-DMA defends gold buyers and so does the upbeat Momentum line but the receding bullish bias of the MACD histogram indicates challenges for the buyers on the way ahead.

Also testing the gold optimists is a horizontal line from early May and 200-DMA, close to $1,815 and $1,821 in that order.

It’s worth mentioning that the monthly high near $1,835 and May 10 peak around $1,845 offer extra hurdles to the north.

Hence, a bumpy road to the north tests the gold’s upside whereas the alternative path has fewer blocks, namely 100-DMA and an ascending trend line from March-end, respectively around $1,799 and $1,775.

In a case where the gold prices drop below $1,775, June’s low surrounding $1,750 should return to the chart.

Gold: Daily chart

Trend: Pullback expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.