Gold Price Forecast: XAU/USD stays defensive above $1,700, US ISM Services PMI, full markets eyed

- Gold price treads water after beginning the key week on softer footing.

- European energy crisis, US-China tussles weigh on sentiment but US holiday restricts market moves.

- Fears of recession, hawkish Fed bets underpin DXY strength.

- US ISM Services PMI for August, US traders’ reaction to latest developments awaited.

Gold price (XAU/USD) remains sidelined at around $1,710, defensive after a softer start to the week, as traders await the key US data and the return of the full markets on Tuesday. That said, the yellow metal’s losses could be linked to the escalating recession fears in Europe and the increasing tension between the US and China, not to forget worries of aggressive rate hikes by the US Federal Reserve (Fed).

Russia’s halting of energy supplies to European worsened the situation for the old continent after it joined the other Group of Seven (G7) leaders to announce a price cap on Moscow’s oil. Also adding to the European energy crisis were dimming hopes of the US-Iran oil deal and the output cut from the Organization of the Petroleum Exporting Countries and allies including Russia, known collectively as OPEC+.

Elsewhere, the US-China tussles over the trade deal and Taiwan escalated on Monday as the Biden Administration announced its intention to continue with the Trump-era tariffs for now. These tariffs were examined for removal and signalled the likely improvement in the relations previously.

Further, the US readiness to sell arms to Taiwan and Taipei’s no-visa entry for some of its friendly country residents, including the US, teased Beijing to utter harsh words for the US-Taiwan ties and increased the tussles.

Alternatively, Friday’s mixed US jobs report and People's Bank of China’s (PBOC) signals for a cut in the foreign exchange reserve requirement ratio (RRR) by 200 basis points (bps) to 6% from 8% beginning September 15, per Reuters, limited the bearish move.

Amid these plays, European equities were lower and the bond yields were firmer while the US Dollar Index (DXY) refreshed its 20-year high.

Looking forward, the full markets’ reactions to the latest recession fears and Friday’s softer US data will be crucial to watch for the XAU/USD traders. Also important will be ISM Services PMI for August, expected 55.5 versus 56.7 prior. Given the looming recession fears and the escalating geopolitical tension, any increase in the data could renew the hawkish Fed bets and favor the gold buyers.

Also read: ISM Services PMI Preview: High bar to help dollar bears pass through and take over

Technical analysis

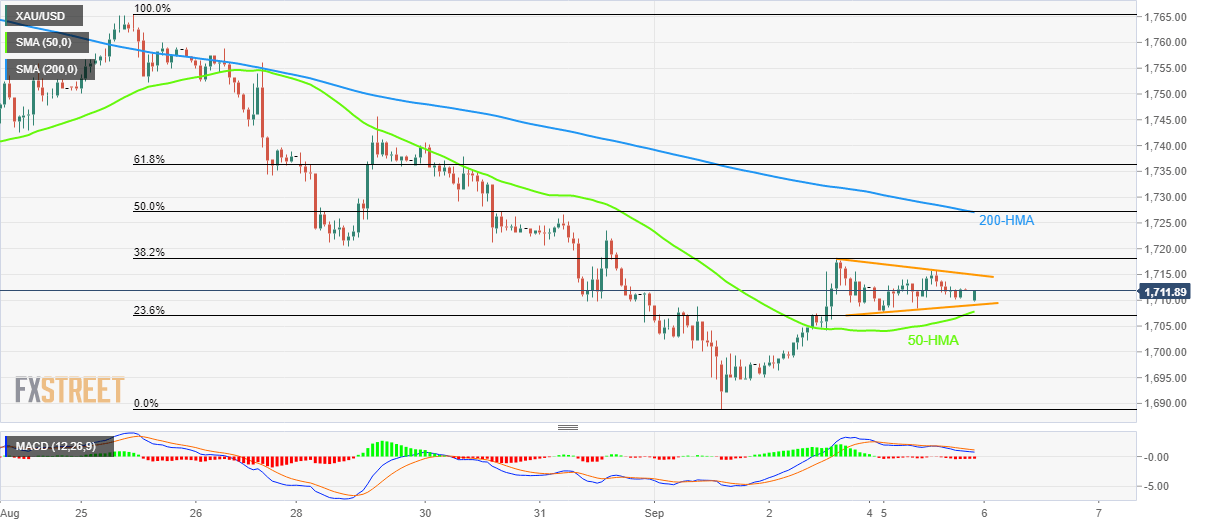

Gold price seesaws inside a two-day-old symmetrical triangle as traders await the return of the full markets.

In addition to the triangle area between $1,709 and $1,715, the 50-HMA and the 200-HMA also restrict short-term XAU/USD moves around $1,707 and $1,727 in that order.

It’s worth noting, however, that the bearish MACD signals and the commodity’s pullback from the 38.2% Fibonacci retracement of the August 25 to September 01 downturn, around $1,718, also keep sellers hopeful.

That said, a downside break of the $1,707 support comprising the 50-HMA won’t hesitate to drag the quote towards the monthly low near $1,688 before highlighting the yearly bottom marked in July, near $1,680.

Meanwhile, recovery remains elusive until crossing the 200-HMA hurdle near $1,727, a break of which could propel the XAU/USD buyers towards the August-end swing high near $1,745.

Gold bears are in control but the room towards the south is limited.

Gold: Hourly chart

Trend: Further weakness expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.