ISM Services PMI Preview: High bar to help dollar bears pass through and take over

- US ISM Services PMI is set to hold onto high ground in August.

- The closely watched new orders component carries elevated expectations.

- Profit-taking after the energy crisis-related rally could hit the buck as well.

Blue Monday – The name of New Order's greatest hit may be the fate of dollar bulls, only on Tuesday. Americans have enjoyed the long Labor Day weekend, with the greenback floating in familiar ranges. On Tuesday, the ISM Services PMI stands out as a market shaker, and the outcome heavily depends on the New Order component.

First, let me provide a quick explanation on what parts of the ISM Services PMI traders should ignore. This forward-looking survey is released after Nonfarm Payrolls have already come out, making the employment component irrelevant. It serves as a leading indicator for the jobs report. Not this time.

Another figure to dismiss is the Prices Paid component. While inflation is left, right, and center for the Federal Reserve, the market reaction to this component from the ISM Manufacturing PMI was a big shrug. When it showed a big drop in how businesses experience inflation, the dollar still advanced, responding to other figures.

The two numbers that matter

The headline ISM Services PMI matters more than any other figure. The upside surprise in the ISM Manufacturing PMI sent the dollar higher. After a period of focusing on various components, investors are now more focused on the one snapshot figure that considers everything.

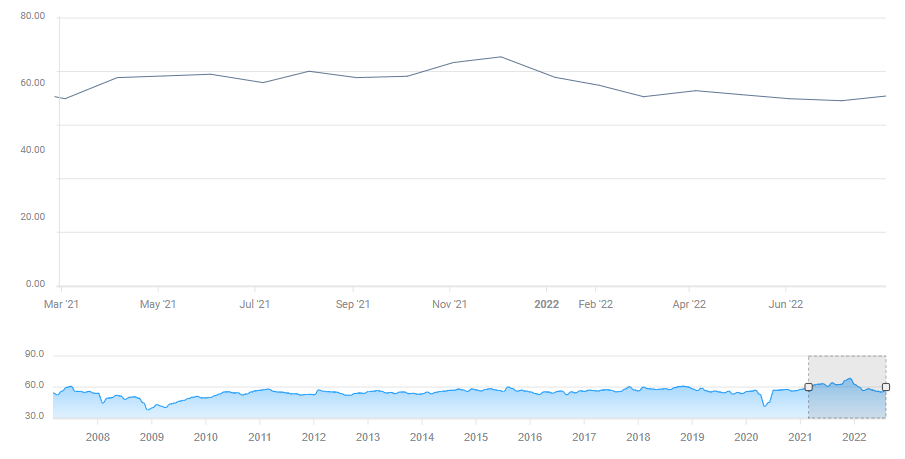

Source: FXStreet

The services sector, America's largest, has been humming along at a rapid clip since the worst of the pandemic. Despite easing in early 2022, the indicator remained well above 50. That is the level separating expansion from contraction.

After surprising with 56.7 points in July, the economic calendar is pointing to 55.5 points for August. Given the downbeat mood around recession expectations and various global woes, such a retreat makes sense.

If the fall is more severe, the dollar would follow with a decline. A better than expected outcome would support the greenback, but probably only if it exceeds last month's score of 56.7.

What happens if the headline comes out within estimates? That is where the New Orders component comes in. Even if the current economic situation is satisfactory – as seen by the recent Nonfarm Payrolls report for example – the future looks more worrying. At least that is the notion when examining financial media.

Nevertheless, expectations are optimistic – a robust score of 59.5 vs. 59.9 recorded in July. That reflects a substantial pipeline of orders, or certainty about the future.

Such high expectations seem detached from reality, especially when taking a look at how economists have fared so far in 2022:

Source: FXStreet

The New Orders component of the ISM Services PMI missed expectations in all of the seven publications so far this year. They were also too optimistic in December 2021. A ninth consecutive disappointment? That seems to be the case.

The timing could also play a role. Putting Monday aside, the dollar has been on a winning streak. It could now suffer a correction – and the ISM Services PMI could serve as the trigger for that.

Final thoughts

Coming after the Nonfarm Payrolls does not take away from the potential market impact that a forward-looking indicator for the largest sector in the world's biggest economy still matters. Expectations may be too high and that would hurt the dollar, which seems to need a trigger for a downside correction.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.