Gold Price Forecast: XAU/USD slides on hawkish Federal Reserve Minutes, United States data eyed

- Gold price remains pressured around short-term key support after three-day downtrend.

- XAU/USD drops as Federal Reserve Minutes suggest policymakers discussed need of more rate hikes.

- Geopolitical fears, comments from Fed’s Bullard also weigh on Gold price.

- Gold sellers poke 100-day Exponential Moving Average support with eyes on United States statistics.

Gold price (XAU/USD) bears the burden of hawkish Federal Reserve (Fed) bias, as well as the geopolitical fears, as the yellow metal pokes a short-term key support surrounding $1,820 during early Thursday. In doing so, the XAU/USD also justifies the hawkish comments from a Fed Official while portraying the cautious mood ahead of the second-tier United States data amid firmer US Dollar.

Gold drops on hawkish Federal Reserve Minutes

As per the latest Federal Open Market Committee’s (FOMC) Monetary Policy Meeting Minutes, all participants agreed more rate hikes are needed to achieve the inflation target while also favoring further Fed balance sheet reductions. Adding strength to the hawkish Fed Minutes were statements suggesting that a few participants favored a 50 basis point (bps) rate hike, while some believed there was an elevated risk of a recession in 2023.

Given the hawkish Fed Minutes, the odds of sustained rate hikes are high, which in turn weigh on the Gold price, via firmer US Dollar and despite a pullback in the US Treasury bond yields.

Geopolitics, Fed’s Bullard also weigh on XAU/USD

In line with the FOMC Minutes, St. Louis Federal Reserve President James Bullard also mentioned that the Fed will have to go north of 5% to tame inflation, as reported by Reuters. The policymaker also stated that he believes there are good chances they could beat inflation this year without creating a recession. The same suggests higher Fed rates for longer and exerts downside pressure on the Gold price.

Elsewhere, geopolitical fears surrounding China and Russia escalated and favored the rush towards the risk-safety, which in turn propelled the US Dollar and weighed on the XAU/USD. The reason could be linked to the comments from China's top diplomat Wang Yi who met Russian President Vladimir Putin and said that they are ready to deepen strategic cooperation with Russia on Wednesday, as reported by Reuters. The Chinese policymaker also added that their relations will not succumb to pressure from third countries. Meanwhile, Putin noted that it's very important for them to have a cooperation with China and said he is looking forward to Chinese President Xi Jinping visiting Moscow.

Gold sellers cheer US Dollar strength ahead of data

Following the hawkish Federal Reserve minutes, comments from Fed’s Bullard and geopolitical fears, the US Dollar Index (DXY) stretched its previous run-up to refresh the multi-day high and pleased the Gold sellers.

That said, the DXY refreshed the weekly high and approached the seven-week high marked in mid-February. It should be noted, however, that the US 10-year and two-year Treasury bond yields retreat from their three-month high and Wall Street also closed mixed, which in turn should have put a floor under the Gold price.

Looking ahead, Gold bears will be interested in seeing a strong print of the Personal Consumption Expenditures for the fourth quarter (Q4), as well as no disappointment from the second readings of the US Gross Domestic Product (GDP) for the said period.

Gold price technical analysis

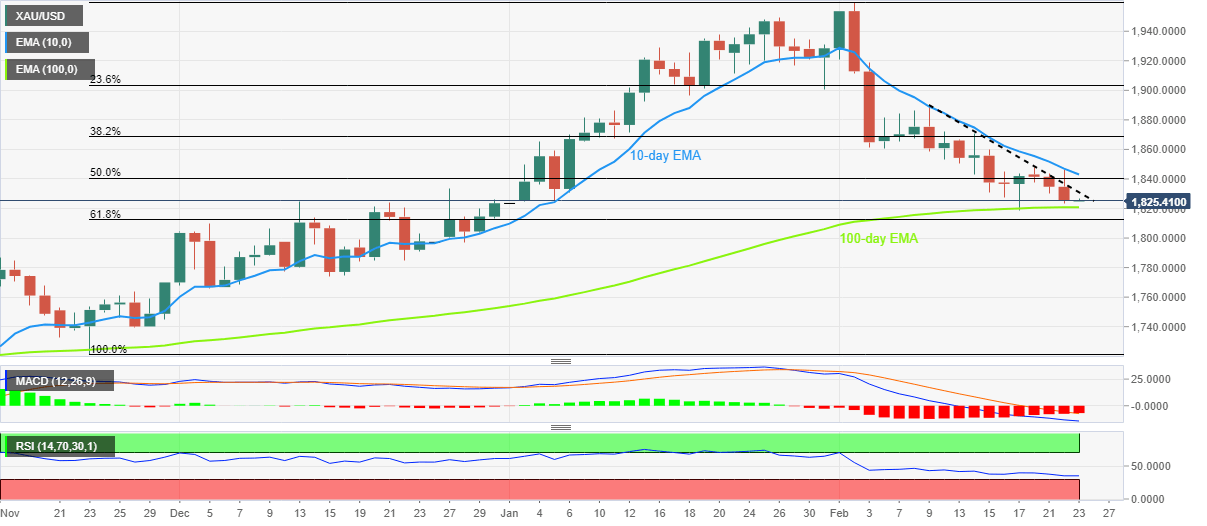

Gold price extends pullback from a 10-day Exponential Moving Average (EMA) towards testing the 100-day EMA support, following a failed attempt to cross the two-week-old resistance line.

The downside bias also takes clues from the Moving Average Convergence and Divergence (MACD) indicator’s bearish signals, which in turn suggests the downside break of the immediate 100-day EMA support of $1,820.

However, the Relative Strength Index (RSI) line, placed at 14, is near the oversold territory and hence suggests the limited room toward the south. As a result, the 61.8% Fibonacci retracement level of the Gold price run-up from late November 2022 to early February 2023, close to $1,812, could challenge the XAU/USD bears.

In a case where the Gold price remains weak past $1,812, the $1,800 threshold and the last December’s low of $1,766 will be in focus.

Alternatively, the aforementioned two-week-old descending trend line and the 10-day EMA< respectively near $1,834 and $1,844, could challenge the XAU/USD rebound.

However, the Gold price recovery remains elusive unless crossing the February 09 swing high surrounding $1,890.

Overall, the Gold price remains bearish but the downside room appears limited.

Gold price: Daily chart

Trend: Further downside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.