Gold Price Forecast: XAU/USD ranges below $1,800 amid a quiet start to a busy week

- Gold prices fade bounce off five-month-old support line.

- Risk appetite remains weak on mixed concerns over coronavirus, Fed’s next moves.

- Geopolitical fears, market bets for Fed rate hike in March 2022 weigh on sentiment, US CPI is the key.

- Gold Weekly Forecast: Technicals and rising US yields point to lower XAU/USD

Update: Gold price is posting small losses while ranging below $1,800 so far this Monday, as holiday-thinned market conditions combined with a broad-based US dollar rebound offer headwinds to bulls. Traders also turn cautious ahead of this week’s US inflation data, as the Fed appears behind the curve after Friday’s upside surprise in the wage growth numbers.

The headline US Nonfarm Payrolls disappointed and triggered a sharp sell-off on Wall Street indices, especially tech-heavy indices, smashing the greenback across the board and lifting gold price. The bright metal rebounded firmly from three-week lows of $1,783 even though the Treasury yields exploded, as a March Fed rate hike appeared a done deal.

All eyes will remain on Fed Chair Jerome Powell’s testimony due on Tuesday and Wednesday while US inflation data will be closely followed as well.

Read: Inflation and geopolitics in the week ahead

Gold (XAU/USD) offers a sluggish week-start to the markets while fading the previous day’s rebound near $1,795 during Monday’s Asian session.

In doing so, the gold prices portray typical market inaction amid an absence of major data/events, as well as due to the recently mixed signals from the US employment report and the global coronavirus details.

That said, the headline US Nonfarm Payrolls (NFP) disappointed markets with 199K figures for December versus 400K forecasts and 249K prior (upwardly revised from 210K). However, the Unemployment Rate dropped to 3.9% compared to 4.1% market consensus and 4.2% in November while the U6 Underemployment Rate that fell to 7.3% against November's downwardly revised 7.7%, both closing in the pre-pandemic levels.

The US Dollar Index (DXY) portrayed the biggest daily loss in six weeks after the December month jobs report failed to impress Fed hawks.

It should be noted, however, that an NFP-led disappointment was largely overruled by the Unemployment Rate and U6 Underemployment Rate, which in turn seems to challenge the market sentiment of late. As a result market bets for the Fed rate hike in March 2022 remains around 80%, following Friday’s uptick to 90% ahead of the data.

Read: US Payrolls Disappoint for the Second Month: Economy seems strong despite Omicron

Elsewhere, global covid cases crossed the 10 million mark and the death toll recently jumped in the UK, as well as the US. On the same line are the concerns that the latest virus strain linked from France named IHU, which has both the characteristics of Omicron and Delta while showing the capacity to wider spread. It should, however, be noted that scientific studies keep the markets hopeful of overcoming the virus spread with lesser damages, health-wise, than the previous rounds of the virus spread.

Further, the US-China tussles continue, recently over trade and the human rights issues, while the Russia-Ukraine matter gains major attention ahead of this week’s Washington-Moscow meeting, which in turn challenge the market sentiment.

Amid these plays, S&P 500 Futures drop 0.20% and the DXY stabilizes around 95.75 amid an absence of the Japanese bond traders.

Moving on, gold traders will keep their eyes on the US Consumer Price Index (CPI) and Retail Sales details for December, up for publishing on Wednesday and Friday respectively, to get a confirmation of March’s rate hike. Meanwhile, challenges to market sentiment may weigh on the quote.

Technical analysis

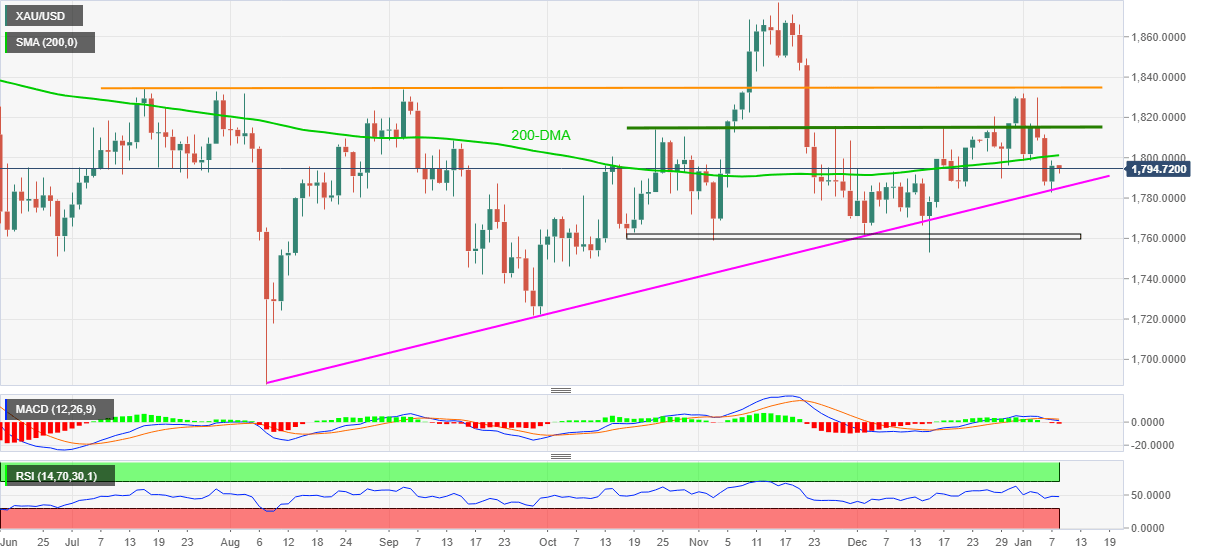

Friday’s corrective pullback from an ascending support line from early August, around $1,785 by the press time, fails to push gold buyers towards the 200-DMA level of $1,800 for one more time.

The failures to rebound join bearish MACD signals and steady RSI to keep sellers hopeful of breaking the $1,785 support, which in turn will drag the metal towards $1,770 before challenging the multiple levels around $1,760.

It should be noted, however, that a clear downside break of the $1,760 will be a green signal for the gold bears to aim for September’s low of $1,721.

Alternatively, the 200-DMA level surrounding $1,801 guards the quote’s immediate upside ahead of a horizontal area established from late October, surrounding $1,815. However, any further advances will be challenged by tops marked during July and September around $1,834.

Should the gold buyers manage to cross the $1,834 hurdle, $1,850 and November’s peak of $1,877 will gain the market’s attention.

Gold: Daily chart

Trend: Pullback expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.