Gold Weekly Forecast: Technicals and rising US yields point to lower XAU/USD

- Gold broke below $1,800, snapped a three-week winning streak.

- 10-year US Treasury bond yield rose more than 15% this week.

- US CPI inflation data could have an impact on rate hike odds next week.

Gold started the new year on the back foot and suffered heavy losses on Monday. Buyers, however, managed to defend the key $1,800 level and XAU/USD climbed all the way up to $1,830 mid-week before coming under renewed bearish pressure. The pair fell sharply on surging US Treasury bond yields on Thursday and struggled to stage a convincing rebound despite the disappointing Nonfarm Payrolls data on Friday.

What happened last week

After losing strength ahead of the New Year holiday, the dollar staged a decisive recovery on the first trading day of 2022 and forced XAU/USD to push lower. The US Dollar Index, which tracks the greenback’s performance against a basket of six major currencies, retraced the previous week’s decline in a single day by rising nearly 0.6%. The benchmark 10-year US Treasury bond yield rose nearly 8% at the start of the week and helped the USD find demand while putting additional weight on gold’s shoulders.

On Tuesday, the data published by the ISM revealed that the Prices Paid component of the December Manufacturing PMI report dropped sharply to 68.2 in December from 82.4 in November. With this print eased inflation concerns, the dollar rally lost its steam and helped gold stage a decisive rebound.

The minutes of the FOMC’s December policy meeting, which was published late Wednesday, showed that policymakers saw it appropriate to start reducing the balance sheet soon after the first rate hike. The statement’s surprisingly hawkish tone triggered a sharp upsurge in US T-bond yields and caused gold to reverse its direction. Meanwhile, ADP reported that private-sector employment in the US rose by 807,000 in December, compared to analysts’ estimate of 505,000.

The CME Group’s FedWatch Tool’s March rate hike probability jumped above 70% early Thursday and gold broke below $1,800. The ISM’s Services PMI report showed that price pressures remained high in the service sector in December and the 10-year US T-bond yield reached its highest level since April at 1.75%. Gold’s inverse correlation with US T-bond yields remained intact in the second half of the week, forcing the yellow metal to fall to its weakest in more than two weeks below $1,790.

According to the US Bureau of Labor Statistics' monthly publication, Nonfarm Payrolls in the US increased by only 199,000 in December, falling short of experts' forecast of 400,000. On a positive note, the Unemployment Rate declined to 3.9% from 4.2% in November and the monthly wage inflation, as measured by the Average Hourly Earnings, rose to 0.6% from 0.4%. Even though the dollar faced modest selling pressure after the mixed jobs report, the 10-year US T-bond yield held above 1.7%, limiting gold's upside.

Next week

On Wednesday, the US Bureau of Labor Statistics will release the Consumer Price Index data for December. In November, the annual CPI jumped to 6.8% from 6.2% in October but the market reaction was largely muted. Nevertheless, a reading close to 7% is likely to allow US T-bond yields to push higher with investors pricing three rate hikes and the beginning of a balance sheet runoff in 2022. On the other hand, a soft CPI inflation figure could open the door for a near-term rebound in XAU/USD.

The other high-tier data release next will be Friday’s Retail Sales data from the US. Although this report by itself is unlikely to alter the Fed’s policy outlook in a meaningful way, an upbeat print could help the dollar outperform its rivals and vice versa.

In short, gold's recovery attempts are likely to remain technical in nature unless investors have a change of heart on the timing of the Fed rate liftoff.

Gold technical outlook

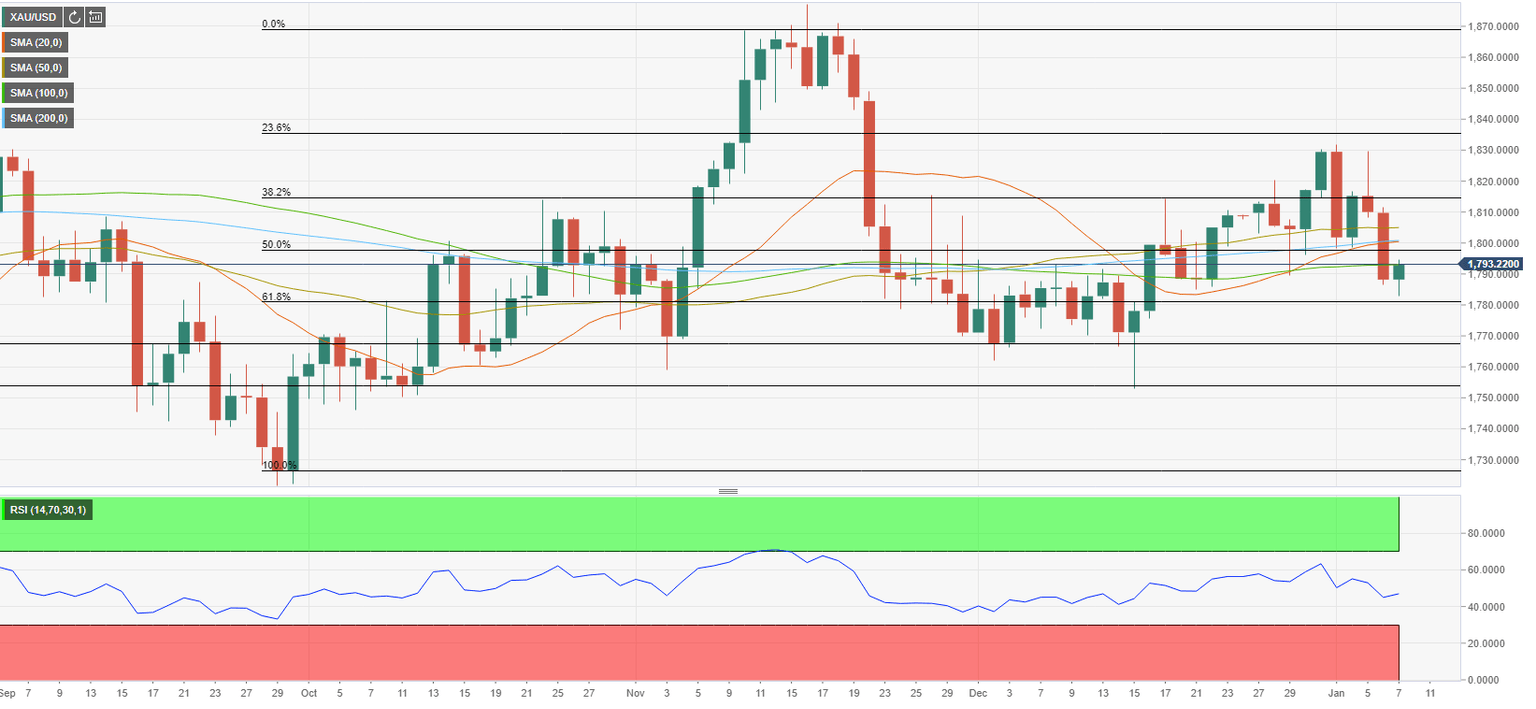

The Relative Strength Index (RSI) indicator on the daily stays a little below 50. The main bearish development is the fact that gold closed below the 200-day SMA on Thursday and failed to reclaim that level so far.

On the downside, first technical support aligns at $1,780 - the Fibonacci 61.8% retracement of the uptrend that started in October and ended in mid-November. With a daily close below that level, additional losses toward $1,770 (static level) and $1,753 (December 15 low) could be witnessed.

On the flip side, buyers could show interest in the precious metal if it manages to reclaim $1,800 (200-day SMA, Fibonacci 50% retracement) and starts using that level as support. Above that hurdles, $1,815 (Fibonacci 38.2% retracement) and $1,830 (static level, Fibonacci 23.6% retracement) align as strong resistances.

Gold sentiment poll

The FXStreet Forecast poll shows that experts have adopted an overwhelmingly bearish view for gold in the near term with an average price target of $1,763 on a one-week view. Toward the end of January gold is forecast to extend its decline.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.