Gold Price Forecast: XAU/USD appears vulnerable above $2,000 ahead of more US inflation clues

- Gold price remains pressured for third consecutive day, eyes the first weekly loss in three.

- Mixed sentiment in the market, downbeat Treasury bond yields underpin US Dollar rebound and weigh on XAU/USD.

- Debt ceiling fears, banking woes allow Gold sellers to sneak in ahead of Michigan CSI, inflation expectations.

Gold price (XAU/USD) takes offers to refresh intraday low near $2,012 amid early Friday in Europe, marking the consecutive third daily loss amid the market’s fears emanating from the US debt ceiling negotiations and banking woes. Also exerting downside pressure on the Gold price could be the softer yields and a cautious mood ahead of more clues of the US inflation.

While portraying the mood, S&P 500 Futures print mild gains to differ from Wall Street’s mixed closing. However, the US 10-year and two-year Treasury bond yields remain pressured around 3.37% and 3.88% by the press time.

The recently escalating market fears surrounding the US debt ceiling expiry and banking fallouts, seem to allow the US Dollar to brace for the first weekly gain in three while pushing down the US Treasury bond yields for the third consecutive week.

Recently, the postponement of the debt ceiling talks between US President Joe Biden and House Speaker McCarthy and a slump in the share price of PacWest Bancorp appear the main negative developments to weigh on the sentiment. Additionally, warnings from US Treasury Secretary Janet Yellen and Beth Hammack, Chair of the Treasury Borrowing Advisory Committee and Co-Head of Goldman's Global Financing Group, about US default, also threaten the market sentiment.

Alternatively, the softer US Consumer Price Index (CPI) and Producer Price Index (PPI) for April join mixed Federal Reserve (Fed) talks to prod the risk appetite.

Looking ahead, further developments to avoid the US default and defend the banking system may entertain Gold traders ahead of the preliminary readings of the University of Michigan’s (UoM) Consumer Sentiment Index (CSI) for May, as well as the UoM 5-year Consumer Inflation Expectations for the said month.

Also read: Michigan Consumer Sentiment Index Preview: Modest improvement not enough to boost the mood

Gold price technical analysis

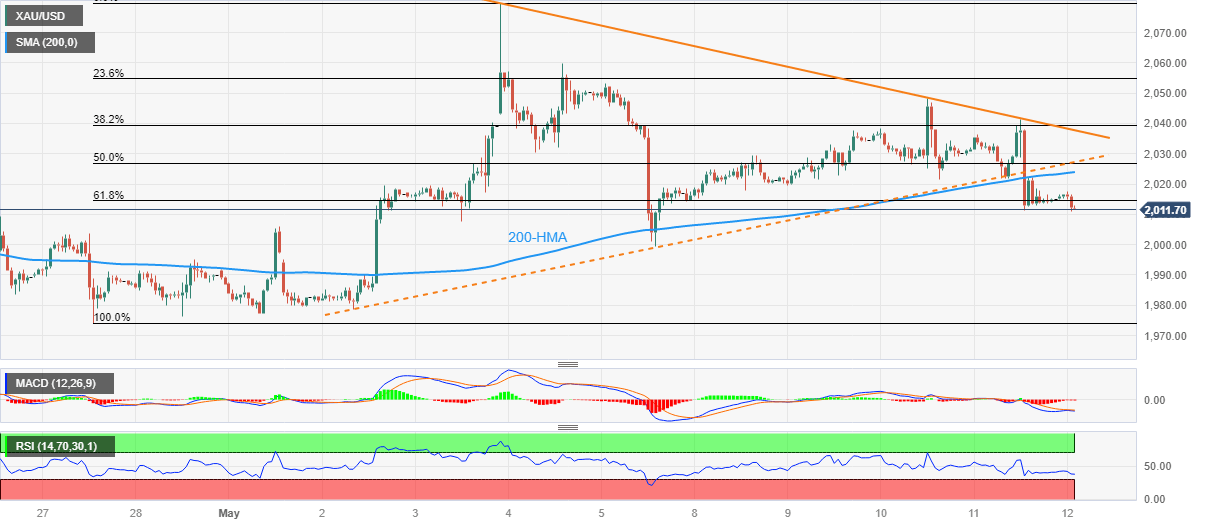

Gold price remains bearish while justifying the downside break of a one-week-old symmetrical triangle and the 200-Hour Moving Average (HMA). Apart from the 200-HMA and the stated triangle’s bottom line, respectively near $2,024 and $2,027, bearish MACD signals and downbeat RSI, not oversold, also underpin bearish bias about the Gold price.

That said, the XAU/USD bears may currently target the previous Friday’s bottom of around the $2,000 round figure.

However, the monthly bottom of around $1,977, quickly followed by a late April swing low of around $1,974, can prod the Gold sellers afterward.

On the contrary, the 200-HMA and the stated triangle’s bottom line, close to $2,024 and $2,027 in that order, restrict short-term recovery moves of the Gold price.

Even so, a convergence of the triangle’s top line and the 38.2% Fibonacci retracement level, near $2,040, may challenge the XAU/USD upside.

In a case where the Gold Price remains firmer past $2,040, the metal buyers may witness the $2,050 hurdle as the last defense of the bears.

Gold price: Hourly chart

Trend: Further downside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.