Michigan Consumer Sentiment Index Preview: Modest improvement not enough to boost the mood

- The Michigan Consumer Sentiment Index is foreseen at 63.0 in May.

- Easing inflation in the United States suggests the country could avoid a hard landing.

- DXY may extend its corrective advance but remains far from bullish.

On Friday, May 12, the United States (US) will release the preliminary estimate of the May Michigan Consumer Sentiment Index. The key consumer sentiment gauge is expected to have declined modestly, from 63.5 in April to 63.

Where is the US economy standing?

The sentiment report will come out after multiple US first-tier figures that confirmed the Federal Reserve’s (Fed) suggested next steps, so the impact of the release on the US Dollar is likely to be limited.

On the one hand, the Fed hiked its benchmark rate by 25 basis points (bps) and announced future monetary policy decisions would be taken meeting-by-meeting based on data. Chairman Jerome Powell, however, hinted at a potential pause as the unfolding banking crisis forced policymakers into a more dovish stance.

Following the decision, market players rushed to price in a pause in both June and July, and a potential rate cut in September. Fed officials tried to cool down the latter, but speculative interest ignored them.

Meanwhile, the Consumer Price Index (CPI) rose by 4.9% YoY in April, slightly below the 5% expected, while the April Producer Price Index (PPI) was up by 2.3% YoY, also easing from the March figure. Softer-than-anticipated inflation-related figures boosted speculation the Fed will stand pat in its upcoming meetings, which translated into diminishing chances of a hard landing for the economy.

Finally, the local economy grew at an annualized pace of 1.1% in the first quarter of the year, according to preliminary estimates, slowing from 2.6% in the last quarter of 2022.

Generally speaking, those seem to be good news, although it may take some time until the effects of decreasing price pressures reach consumers. A pickup in consumer confidence is possible, but the most likely scenario is just a mild improvement.

Possible USD reactions to the news

Still, and given financial markets are in a risk aversion mood, the news could do little to boost market sentiment. The US Dollar is up amid collapsing equities, still lacking self-strength. The rally could continue if a dismal Michigan report exacerbates the negative mood on Friday. At the same time, it seems unlikely that an upbeat report could be enough to change the ruling sentiment.

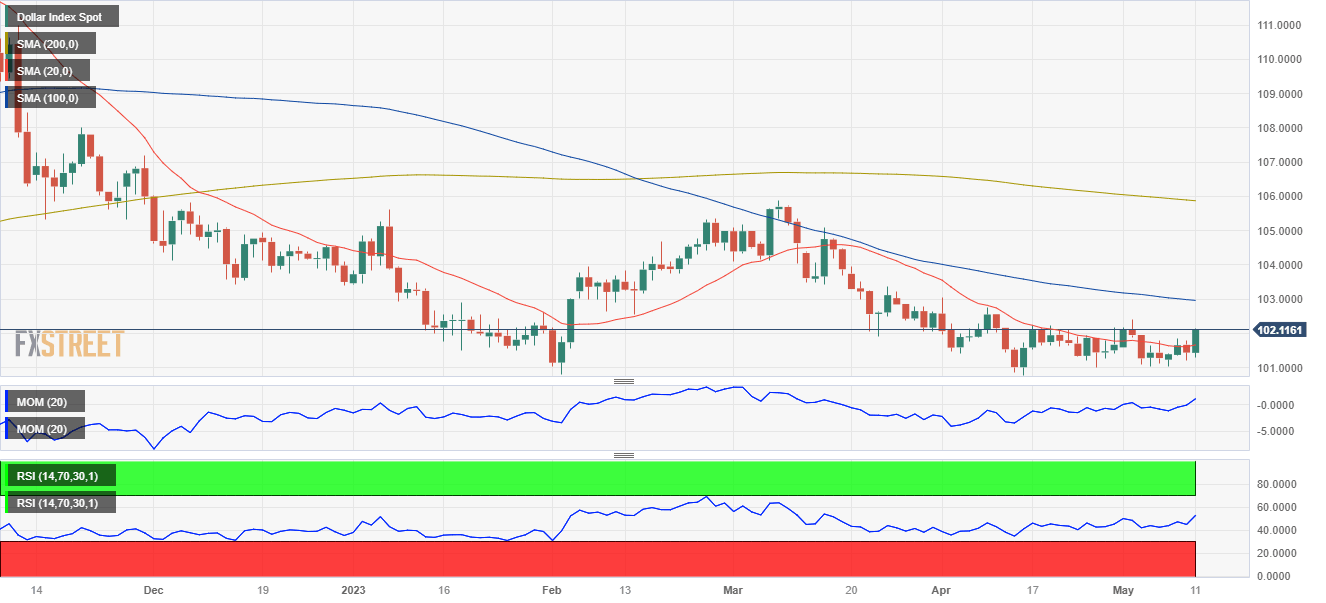

The US Dollar Index (DXY) currently hovers just above 102.10, not far below the May monthly high of 102.40. Technical readings in the daily chart suggest the recovery may continue, although the index remains far from bullish. It is currently breaking above a flat 20 Simple Moving Average (SMA) but remains far below the longer ones. Technical indicators, in the meantime, picked up modestly, currently advancing within neutral levels. More relevantly, the DXY is not far above its yearly low at 100.78.

Failure to hold above the 102.00 level should hint at the index resuming its bearish trend once the dust settles. A break through 102.40, on the other hand, may result in a continued recovery, initially towards 103.00 and later towards the 103.60 region.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.