Gold Price Forecast: XAU/USD flirts with $1,750 after the biggest fall in six weeks

- Gold was sold off in a heavy bout of supply as the US dollar catches a strong bid on US Retail Sales.

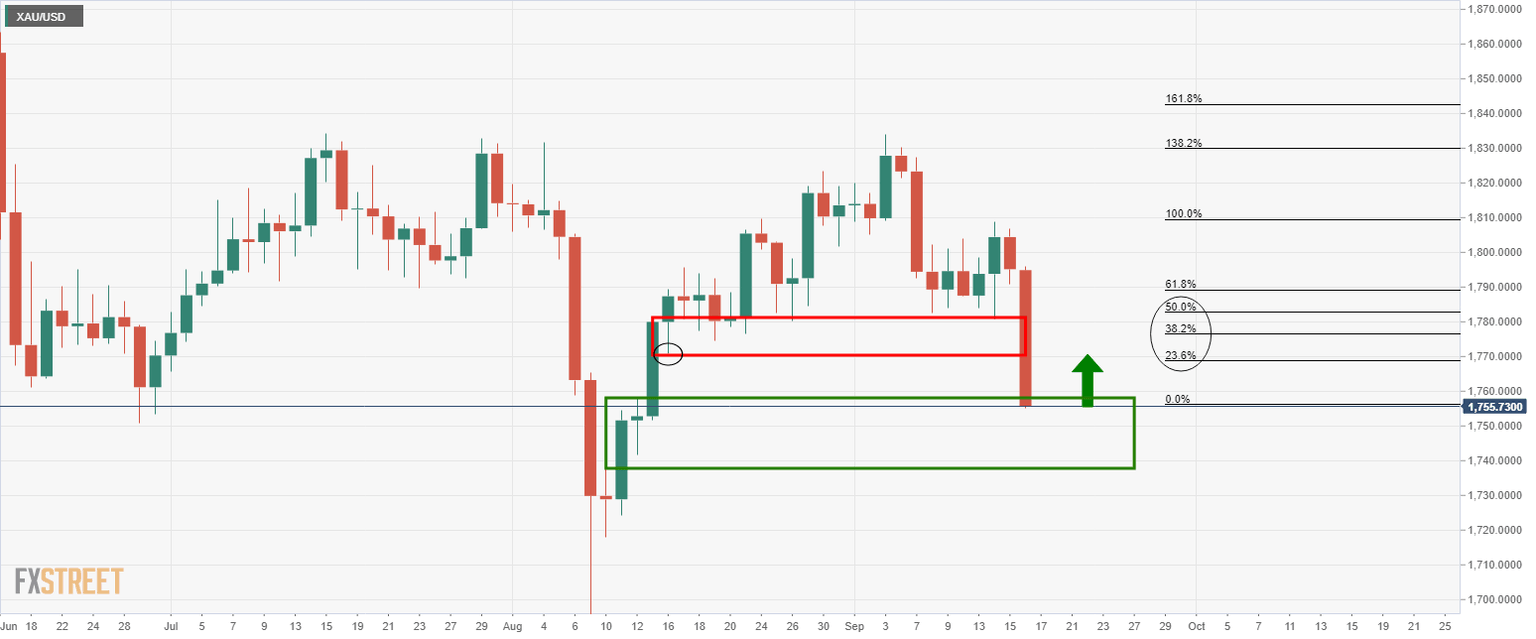

- Gold fell well above the daily ATR of $22 and the 23.6-50% ratios can be eyed into old support.

- All eyes are on the Fed as the hawks circle above 1709 New York Avenue.

Update: Gold (XAU/USD) bears take a breather around $1,753 amid Friday’s initial Asian session, following the longest south-run on a day since early August.

The bright metal’s $50.00 fall on Thursday could be best linked to the downside break of a monthly support line, around $1,787 by the press time, as well as the broad US dollar strength.

Strong prints of the US Retail Sales for August and Philadelphia Fed Manufacturing Index for September renewed Fed tapering concerns and helped the US Dollar Index (DXY) to post the strongest daily gains in a month on Thursday, which in turn weighed on gold prices.

Additionally, rumored ECB rate hike, which was rejected afterward, joined chatters that the US, the UK and Australia are indirectly challenging China with securities pact and the US hosting of the UK, India, Australia and Japan for diplomatic talks to please gold sellers.

As markets brace for the next week’s Federal Open Market Committee (FOMC), with the latest catalysts favoring tapering tantrums, today’s preliminary readings of the US Michigan Consumer Sentiment Index for September, expected 72.2 versus 70.3 prior, will be important to watch for fresh impulse.

Read: US Michigan Consumer Sentiment Preview: Markets will have to look hard for positive signs

End of update.

Gold came a cropper on Thursday in the countdown to the Federal Reserve's statement and when the Fed chair, Jerome Powell, will speak to the press on 22 Sep. The yellow metal has suffered a major sell-off as the US dollar hit a near 3-week high against a basket of currencies following a stellar US Retail Sales outcome.

Retail sales rose 0.7% last month, boosted in part by back-to-school shopping and child tax credit payments, while data for July was revised down. The data unexpectedly increased in August, easing some concerns about a sharp slowdown in economic growth. The news has bolstered investor expectations for next week's policy meeting and how soon the US central bank will start to taper stimulus.

The dollar index DXY, which measures the US currency against six others, added to gains following the report and was last up 0.5% at 92.932. It hit its highest level since Aug. 27 by printing 92.964 earlier. Consequently, XAU/USD, at the current spot price of $1,756.23, is trading down 2.08% and fell from a high of $1,796.25 earlier to a low of $1,745.35.

The focus is on the divergence between economies as highlighted in yesterday's Australian Employment report, for instance, which fell sharply. While there was arguably something for everyone, the bias fell into the hands of the bears which boosted the greenback. Canada's data was also disappointing today and concerns over the Federal election is not playing into the hands of the bulls. The dollar continues to attract a safe-haven bid and while the data of late has not been as solid, upside surprises such as today's Retail Sales goes a long way in regenerating confidence in the US economies robustness.

Moreover, recent Fedspeak has been more hawkish. We have been in a Fed speaker blackout period this week so investors will be looking for clarity on the outlook for both tapering and interest rates at the Fed's two-day policy meeting that ends next Wednesday. Should the outcome lean hawkish, this would be expected to lift the dollar as tapering would suggest that the Fed is one step closer to tighter monetary policy. It also means the central bank will be reducing the number of dollars in circulation, which in turn lifts the currency's value.

Gold's big sell-off explained

As for why gold has fallen so sharply, analysts at TD securities may have the answers. The analysts explained that central banks have slowed their purchases, paring back a critical bid for the market following their recent buying binge.

Additionally, the analysts explained that the ''aggregating net length for the top ten brokers in SHFE gold argues that liquidations in Shanghai may have catalyzed the ongoing de-risking.''

''After all,'' they add, ''this context created the opportune set-up for a speculative whipsaw, as easing momentum signals also put a halt to an algorithmic buying program, further sapping liquidity from the yellow metal.''

However, they argued that ''with Shanghai gold length nearing historical lows, a cleaner discretionary and CTA positioning slate suggests the decline in gold prices is unlikely to morph into a rout.''

Gold technical analysis

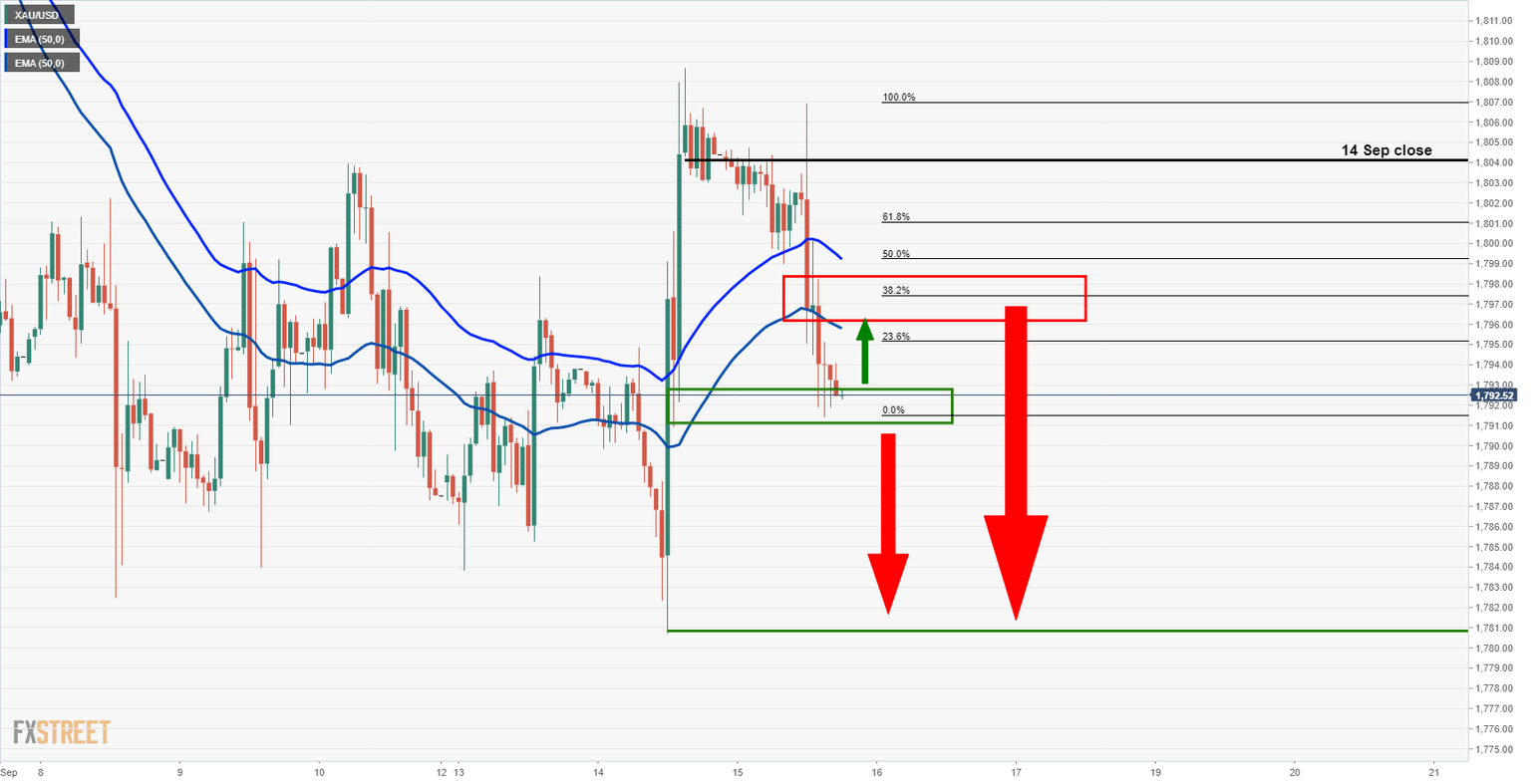

In a prior analysis, it was forecasted yesterday that the bias was to the downside:

The price is below the prior day's close and an hourly 50-day EMA channel as illustrated below within a firm bearish trend.

It was stated that ''a retest of the 50-EMA channel that has a confluence with the 38.2% ratios could be the last defence before a downside break of $1,790 and $1,780 14 Sep pivot low. This guards a critical daily support area and $1,770 is the line in the sand:

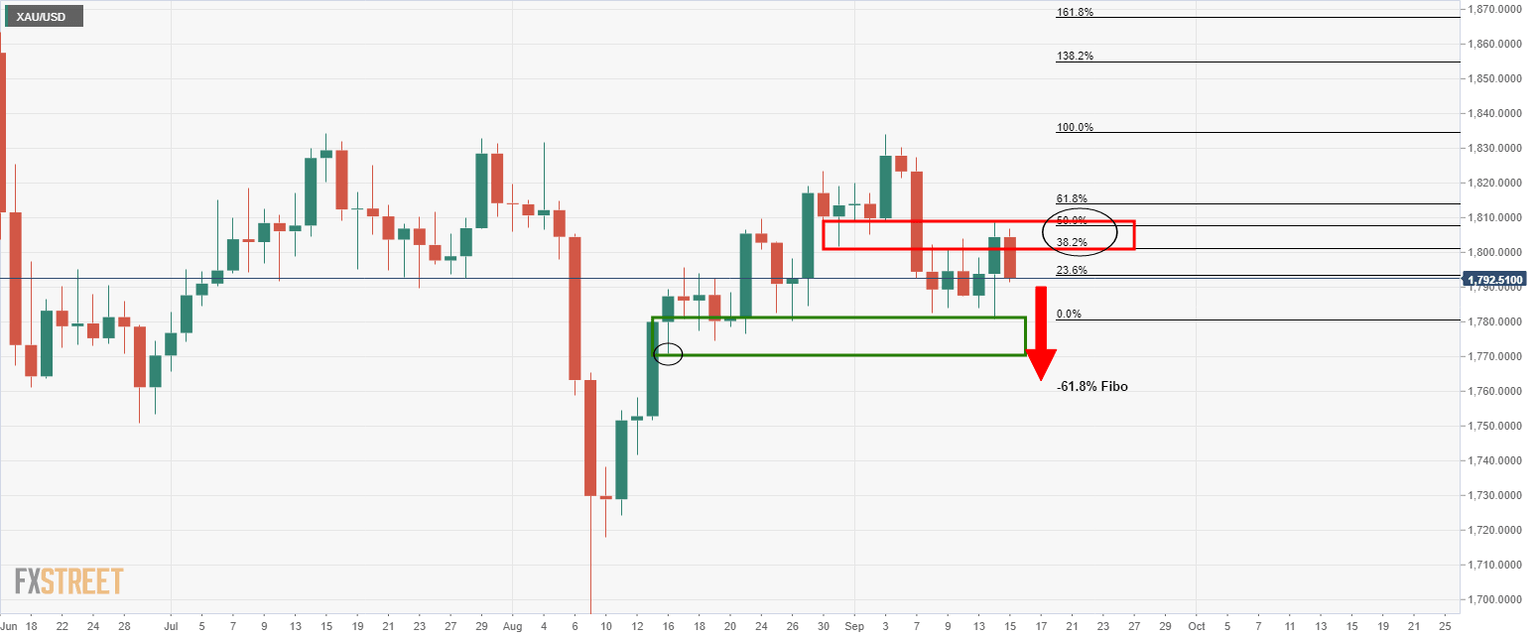

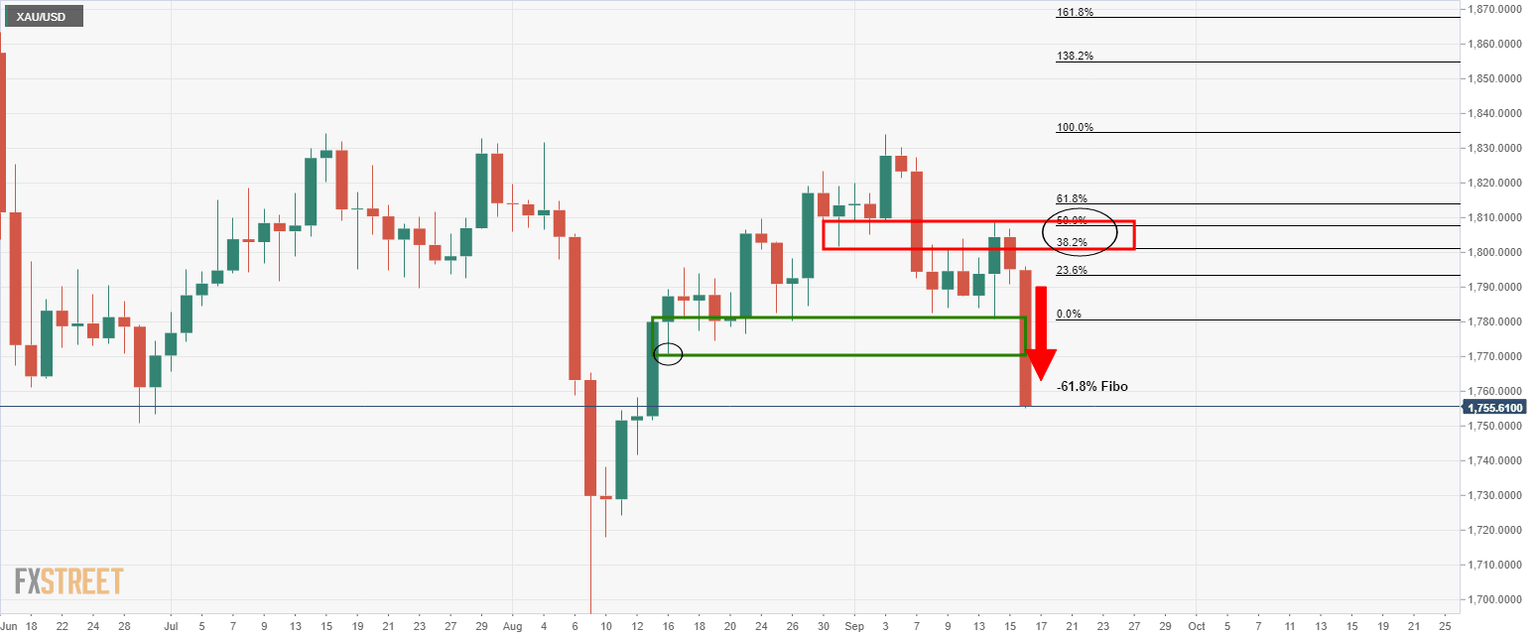

In the above daily chart, the price has reached a 50% mean reversion of the prior bearish impulse. The price is now headed lower below this area and a downside extension towards the -61.8% near $1,763 would be expected on a break of $1,770 prior 16 Aug lows.

Live market analysis

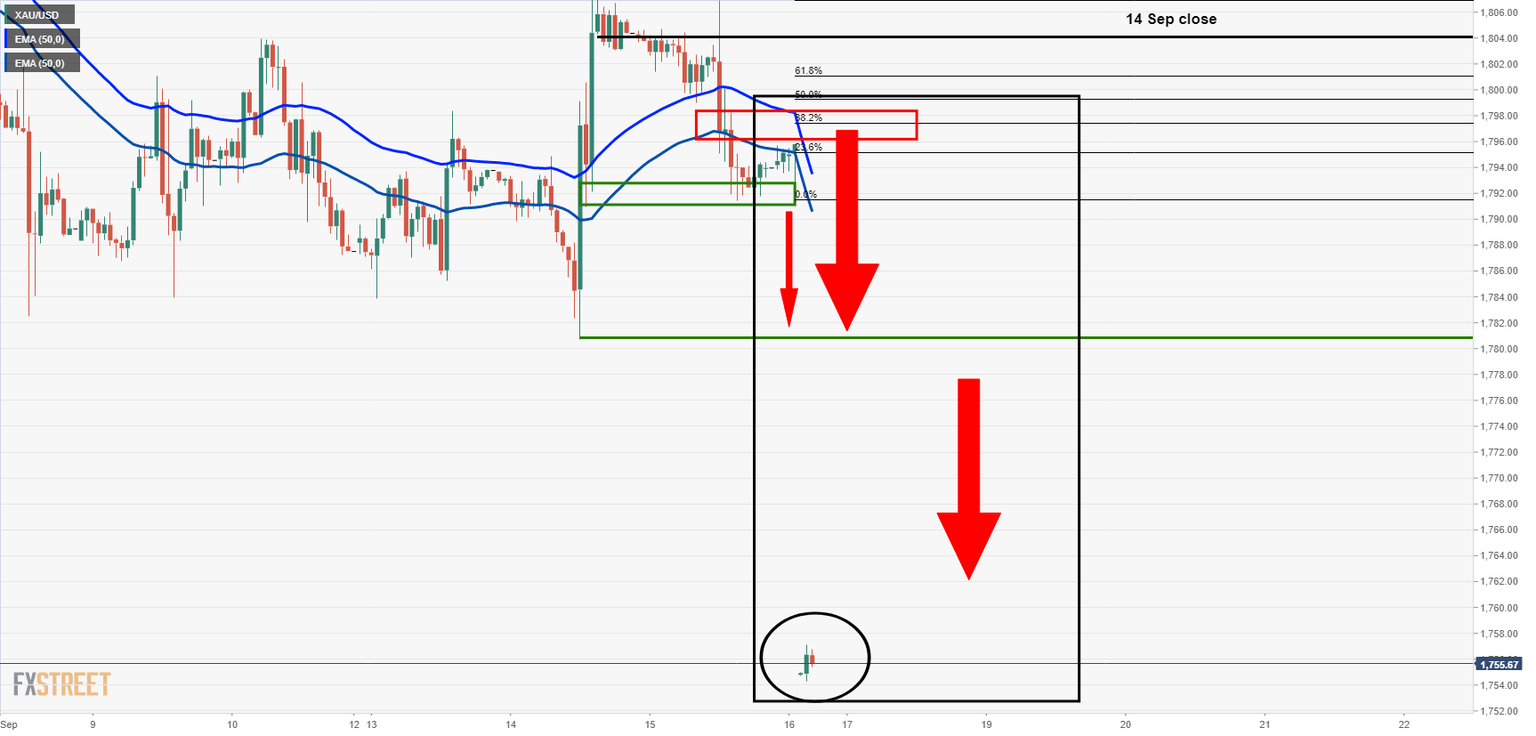

Here was the outcome of that analysis:

The hourly price action did indeed respect the 50 EMA channel, albeit stalling slightly ahead of the 38.2% ratio.

Nevertheless, the price fell from the resistance area and reached the -61.8% Fibonacci retracement level, and some.

At this juncture, consolidation would be expected as traders weigh additional data for the week and global economic conditions ahead of the Fed next week.

While there is room to go to the downside into $1,730 and 10 Aug highs, the price would be expected to stall and correct given the length of the drop beyond the daily ATR of $22. The 23.6-50% ratios can be eyed into old the support that is now expected to be retested as resistance.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.