Gold Price Forecast: Bears on the backside, lining up to target $1,880s

- Gold holds near $1,900 critical support as Fed hawks keep the greenback bid.

- The US dollar flipped bullish in the US session, leaving the outlook for Gold price bearish on a break below support.

Gold is holding near $1,900 towards the close for the day. XAU/USD travelled between a low of $1,896.67 and a high of $1,925.94 on the day but fell into the lows despite the US session as a weak US Dollar gained traction on hawkish comments from Federal Reserve speakers.

St. Louis Federal Reserve's President James Bullard said US interest rates have to rise further to ensure that inflationary pressures recede.

''We’re almost into a zone that we could call restrictive - we’re not quite there yet,” Bullard said Wednesday in an online Wall Street Journal interview. Officials want to ensure inflation will come down on a steady path to the 2% target. “We don’t want to waver on that,” he said.

“Policy has to stay on the tighter side during 2023” as the disinflationary process unfolds, Bullard added.

Bullard has pencilled in a forecast for a rate range of 5.25% to 5.5% by the end of this year.

However, investors expect the Federal Reserve to raise interest rates by just 25 basis points when its policy committee meets at month's end.

Fed official Loretta Mester also warned more hikes are needed and said,'' we're beginning to see the kind of actions that we need to see."

Her comments to the Associated Press fall in following today's slew of economic data, specifically the Producer Price Index and Retail Sales. These showed disinflationary tendencies in the data and reinforced expectations that the Fed will continue to reduce its tightening pace in upcoming meetings.

Gold technical analysis

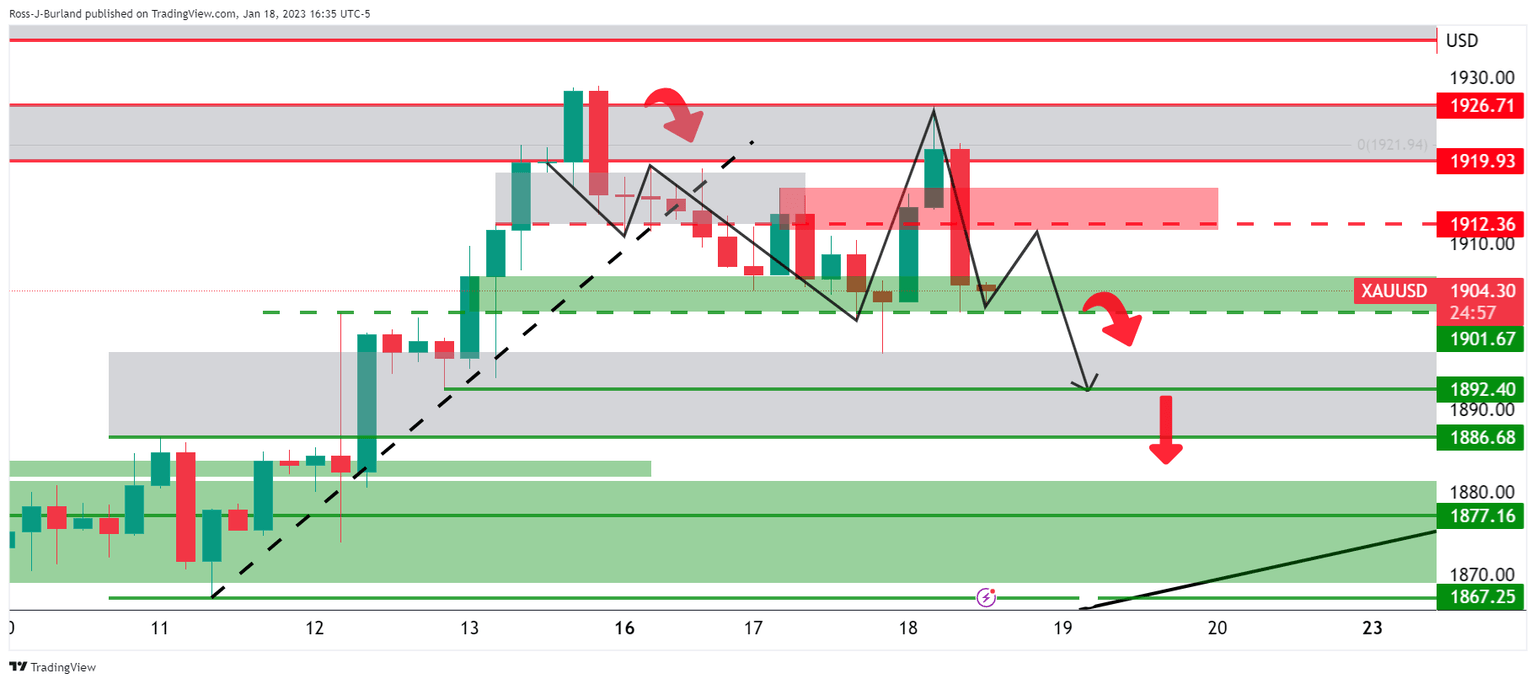

In this week's pre-open Gold price analysis, Gold, Chart of the Week: XAU/USD meets $1,920 resistance area, eyes on 4-hour structures to the downside, it was explained that the Gold price bears need to get the market on the backside of the 4-hour trendline as follows:

The above Gold price schematic was illustrated as typical of such a breakdown and deceleration of the trend, in a) breaking the trendline, b) retesting the peak formation highs and c), eventually breaking the horizontal support structure.

Gold update

We have seen all of the criteria met for a move lower to $1,890 and then $1,880:

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.