Gold Price Forecast: XAU/USD remains on the backfoot below $1780 amid risk-off mood

- Gold prices have eased off a touch at the start of the week.

- The bulls are holding the fort leaving prospects of a firmer correction in the coming sessions.

- Read: Gold Weekly Forecast: Sellers look to retain control following uninspiring rebound

Update: Gold price is consolidating Monday’s negative momentum, trading below $1780 amid renewed US dollar demand, as risk-off mood prevails so far this Tuesday. Investors remain unnerved by the growing cases of Delta covid strain in the APAC region and stricter restrictions in Australia. Meanwhile, mixed messages from the Fed policymakers on inflation and monetary policy keep gold traders from placing any aggressive bets. The downbeat mood in gold price comes even though the US Treasury yields dropped sharply a day before. Gold price now awaits the critical US NFP data due on Friday for fresh hints on the economy and the Fed’s next policy move. In the meantime, the US CB Consumer Confidence data and Fedspeak will likely remain the main market drivers.

At the time of writing, XAU/USD is trading at $1,778.63, down -0.17% after sliding from a high of $1,785.83 to a low of $1,770.78.

The dust has begun to settle in the currency and precious metals markets after the shock that stemmed from the Fed’s hawkish tilt on June 16. This has made for a quiet start to the week.

However, the focus in the open was on the build-up of concerns in both Europe and now Asia over the spread of the coronavirus which made for a slightly risk-off tone.

For instance, Australia's most populous city, Sydney, went into lockdown and Indonesia is also battling record-high cases. Lockdowns in Malaysia are set to be extended and Thailand has also announced new restrictions in Bangkok and other provinces.

The market had been positioned for an accelerated post covid world over-optimism regarding the global vaccine rollouts. However, the forecasts that the delta variant of Covid could spread through Europe during the summer months could also now be undermining investor sentiment.

The US dollar has traditionally outperformed pertaining to such risk aversion which could hamper the prospects of a correction in the precious metals that have been falling in the wake of the Fed's hawkish hold.

Markets are in a state of flux as investors weigh the mixed messages from Federal Reserve speakers, US data and prospects of a slower than anticipated rate of global economic recovery.

With that being said, last week's news of optimism about a bipartisan US infrastructure agreement helped risk appetite and marginally dented the US dollar, giving precious metals a lift. The infrastructure plan is valued at $1.2 trillion over eight years, of which $579 billion in new spending.

This week's Nonfarm Payrolls will be an important data event for the precious metals markets as it may bring fresh impetus for the greenback.

''Payrolls probably surged again in June, with the pace up from the +559k in May,'' analysts at TD Securities said.

''Some acceleration in the private sector is suggested by the Homebase data, while government payrolls probably benefited from fewer than usual end-of-school-year layoffs. Our forecast implies a still-sizeable 6.8mn net decline in payrolls from the pre-COVID level.''

With all that being said, volatility is low as markets are aligned to the Fed's thinking that data is expected to reflect a strong bounce back in economic activity pertaining to the recovery from the covid crisis.

Some analysts doubt that the NFP print will set off any fireworks unless the headline is closer to the 1 million marks. Moreover, the US has a public holiday on July 5th to celebrate Independence Day, so investors could be less inclined to positing directly around the data.

''The potential for a stronger jobs report this week could also inhibit positive flows into gold for now,'' analysts at TD Securities said.

''In this context, gold is not completely out of the woods just yet, with another leg lower toward the $1730/oz region opening the door to another round of CTA selling,'' analysts at TD Securities argued.

Gold technical analysis

As per the start of the week's analysis, Chart of the Week: Gold meets critical landmark, the price is indeed holding at an important area on the charts.

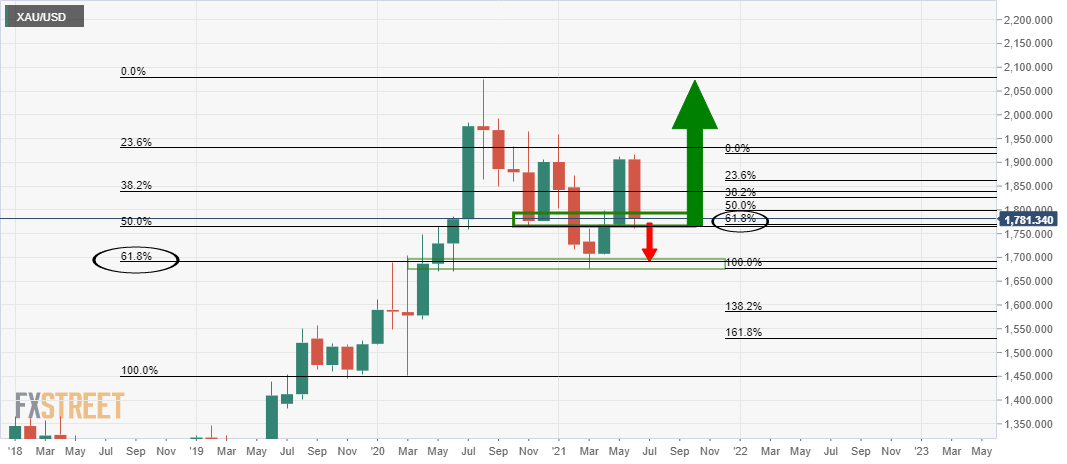

Monthly chart

The price is at a crossroads marked by the 61.8% Fibonacci of the prior bullish impulse, May and June months, and the 61.8% Fibo of the major bullish impulse that started back in March 2020.

In the meantime, a deeper correction on the daily chart could be in order as bears run out of momentum, at least for now.

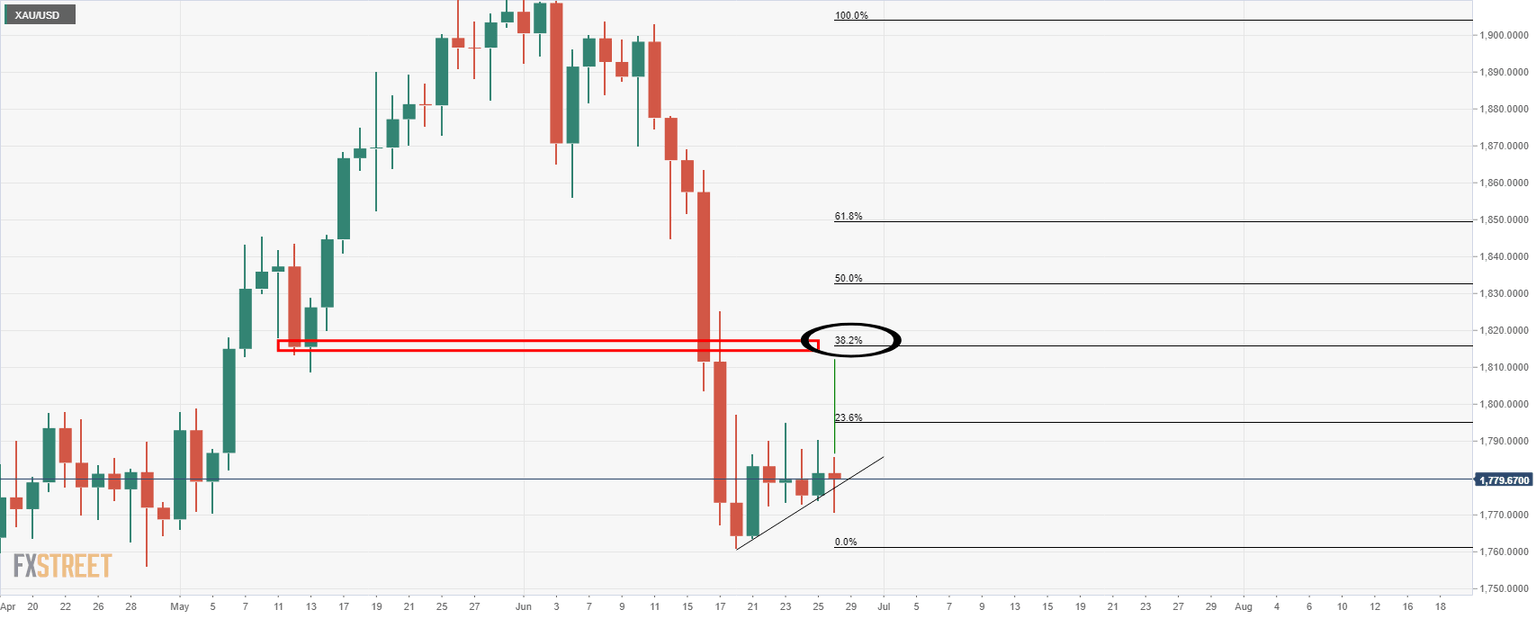

$1,815 could be on the cards if the bears cannot break the consolidation to the downside. This is where the 38.2% Fibo of the prior bearish impulse meets the May lows as a level of confluence.

Previous update

Update: Gold (XAU/USD) refreshes intraday low to $1,776, down 0.14% on a day, amid Tuesday’s Asian session. In doing so, gold sellers dominate for the second consecutive day amid downbeat market sentiment. The S&P 500 Futures drop 0.11% by the press time, after following the Wall Street benchmark refreshed the record top on Monday. The risk barometer pulls back amid the coronavirus (COVID-19) concerns in Asia-Pacific as well as the market’s indecision ahead of Friday’s US Nonfarm Payrolls (NFP).

It’s worth noting that the Fed policymakers’ rejection of the reflation fears fails to restore the market’s confidence, as US data contrasts the arguments, adding extra downside pressure on the sentiment. The same could be witnessed in the US 10-year Treasury yield that dropped the most in over a week the previous day.

Moving on, gold traders will keep their eyes on the Fedspeak and covid updates, except for surprises, for fresh impulse.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.